Great North Ventures Investment Themes

Great North Ventures is a network-driven, generalist early-stage fund that prioritizes exceptional execution. Founded by founders, for founders – we back repeat founders, we back strong first-time founders, and we form founder teams in our venture studio.

Our innovator network and team’s connections drive our value-add to startups, and our network density is greatest in Minnesota and the Upper Midwest. While we are a generalist fund, we invest in three themes: “Solving Labor Problems”, “Digital transformation Through AI”, and “Community-Driven Applications”.

Community-Driven Applications

There is a global trend towards network-driven software expanding into every industry, for both consumers, and for businesses. And while much of the world is buzzing about Web3, we believe we are still in the early innings of Web 2.0, as these software platforms continue their expansion.

There is a strong investment reason to invest in network-driven startups: they outperform! Why? Network-driven apps have lower customer acquisition costs than their single-user counterparts. This is because of strong viral effects that make use of growth loops, which compound user acquisition. When these network effects cause customers to engage with other customers retention rates also increase.

Founders building software today can leverage the behavioral design patterns that dominated horizontal online communications (Facebook, Instagram, Snap, YouTube) and gaming (Roblox, Fortnite, Zynga, etc). These same Web 2.0 patterns can be applied in any category where end users benefit through collaboration.

Web3 startups will also take advantage of these network effects. The winners in the crypto and metaverse spaces will take on a mobile-first approach (“Start With a Mobile App, Not a Website”) and will adopt best-in-category community features. Regardless of which internet paradigm a startup is part of, the apps with the highest engagement of their end-users will win in most categories and capture most of that category’s profits.

Starting and scaling a network can be challenging due to what is commonly referred to as the cold start problem. In addition to having a strong product, successful startups usually find the smallest network that can stand on their own (“atomic network”) and focus on building a leadership position there before expanding to other networks while eventually eroding the market share of the incumbent network.

In practice, we have seen other strategies work as well. Andrew Chen details four of them in his book “The Cold Start Problem”:

1. Invite Only refers to allowing users to join only if they are invited to use the app by other users. This ensures a stronger network effect from those that get invited as they already know other users on the service.

2. Come for the Tool, Stay for the Network refers to providing a single-player mode that allows a user to get value from the service even before it has a strong network. Instagram had photo filters, for example.

3. Paying for Launch refers to paying to grow the network, after the initial atomic network has been figured out, as a way to accelerate growth until the tipping point is reached where the network grows rapidly due to compounding atomic networks strengthening each other. This tends to be expensive and is not usually a tactic taken in the early stages of a startup that is resource-constrained.

4. Flintstoning refers to manually helping to keep the network strong while still early in developing automated capabilities that can exist at scale through the stronger network and product.

Tactically, we see many of the same tools and techniques work effectively across social apps. We’ve had startups scale based on strong network effects in both consumer and enterprise businesses. Usually, incumbents lack the creativity and know-how to thwart a well executed attack. Utilize a new technology, or market trend, to uncover a unique and valuable tool or focus on a specific network whose needs are only partially being satisfied and you may have the next big community app.

What We are Looking For

Vertical Social and Passion Marketplaces

The Web 1.0 marketplace winners like Craigslist and eBay were largely horizontal in nature. Since the early 2000s, nearly every category of e-commerce has had multiple successful marketplaces targeting it. But most categories have not fully embraced Web 2.0.

We have multiple examples of these marketplaces in our portfolio, including NextGem, Mustard, Omnia Fishing, and TeamGenius.

Consumerization of Enterprise SAAS

Enterprises used to move slowly when it came to new tech adoption. Workers have accelerated and transformed that adoption as tools they elect to use garner enterprise sales. By getting enough workers to adopt the product first, businesses can’t say no to the enterprise products without risking productivity. As a result, now enterprise software is consumer grade: simple, easy to use, and mobile first.

Examples from our portfolio include Branch, FactoryFix, Dispatch, Flywheel, Mustard, Omnia Fishing, PartySlate, Pitchly, SkillIt, CoverLease, ClinicianNexus, and Structural.

Work with us

If you have a startup that is a community-driven application, submit here for feedback. We will provide pitch deck feedback to all startups who submit. Before you submit, get an inside look at our process first: “This is how to evaluate early-stage consumer app startups”

Welcome back to the Great North Ventures newsletter! (Sign up here!) This month we have some advice for founders as well as an open call for funding applications.

In the latest episode of “Execution is King” we talk with Jonathan Treble of PrintWithMe. Jonathan talks about his path from Wharton to Grubhub to CEO/founder, and shares advice for those starting out:

“Optimize for control over valuation” – when negotiating at early stages.

“Validate with the smallest team that you can” – because, really, more money means more problems.

For the full episode, including recommendations and resources on recruiting, find us wherever you get podcasts or on YouTube.

For the full episode, including recommendations and resources on recruiting, find us wherever you get podcasts or on YouTube.

As we move ahead with Fund II investing, our themes have coalesced. Here are descriptions along with examples from our portfolio.

Digital Transformation through AI – We are looking for technology-driven startups that are innovating analog industries using artificial intelligence. Examples include Dispatch and Flywheel.

Community-Driven Applications – We are looking for consumer or enterprise startups which are connecting people through software, especially in the areas of media consumption or commerce. Examples include NextGem and PartySlate (and our new investment, Mustard!).

Solving Labor Problems – We are looking for startups with market-driven solutions for workplaces and labor. Examples include FactoryFix and Skillit.

If you are a founder who fits a theme and our investment criteria, apply for funding on our website!

Portfolio Updates

Mustard is new to the portfolio! Mustard is a video-based food discovery and ordering app. Users view and share videos of restaurant dishes, discovering food from restaurants nearby, and can even order or reserve a table right from the app. The app is live in LA and free on the App Store.

Patrick O’Rahilly, CEO of FactoryFix Talks Jobs in Manufacturing with Tim Heston of The Fabricator

Allergy Amulet Research Secures Second Peer-Reviewed Publication

NoiseAware Introduces AutoResolve To Solve Vacation-Rental Noise Problems Automatically Any Time Of Day Or Night

Breezeway and NoiseAware announce integration

Open Positions

See open positions on the Great North Ventures careers page

Dispatch is hiring for 58 positions

FactoryFix is hiring for 8 positions

2ndKitchen is hiring for 5 positions

PrintWithMe is hiring for 22 positions

Parallax is hiring for 2 positions

Branch is hiring for 14 positions

Inhabitr is hiring for 6 positions

NoiseAware is hiring for 1 position

PartySlate is hiring for 1 position

Flywheel is hiring for 3 positions

April Newsletter

June Newsletter

Demystifying Startup HR

Head of Finance & Fund Administration- Venture Capital Firm (Remote)

Demystifying Startup HR

3 Portfolio Companies Make Inc. 5000 + Quicklly & Instacart Expand

iraLogix closes $22M + Branch expands with Uber

iraLogix closes $22M Series C

Flywheel lands Gates Foundation grant

Venture Capital Analyst

Orazio Buzza, Founder and CEO of Fooda – on Episode 13, “Execution is King”

$40M Fund II Raised!

Eric Martell, Founder of Pear Commerce: Episode 13, Execution is King

Great North Ventures Raises $40 Million Fund II

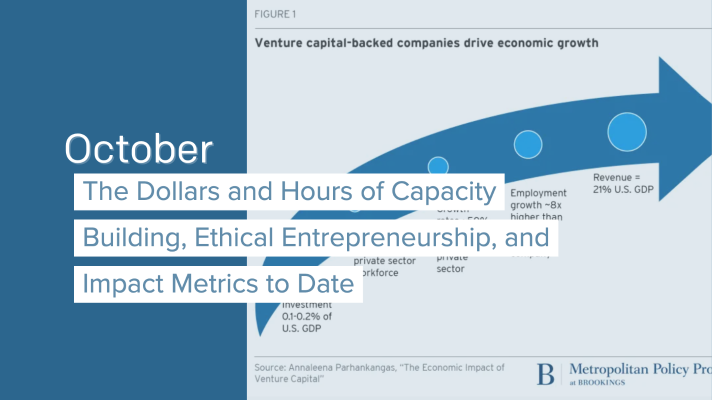

Investment Thesis: Fund II Strategy

Investment Theme: Community-Driven Applications

Investment Theme: Digital Transformation Through AI

Investment Theme: Solving Labor Problems

Trends in the Gig Economy + Work in the Metaverse

Portfolio raises $125M + talking fundraising with Branch CEO

Omnia Fishing closes $4M round, joins Great North portfolio!

Atif Siddiqi, Founder/CEO of Branch: Episode 11, Execution is King

Michael Martocci, CEO and Founder of SwagUp: Episode 10, Execution is King

Yardstik new to portfolio, closes $8M Series A

First venture studio startup comes out of stealth!

Insights for founders from a data guru, + FactoryFix raises a Series A!

Una Fox: Episode 9, Execution is King

Start With a Mobile App, Not a Website

2ndKitchen acquired by SoftBank-backed REEF + advice from an early Googler

Joe Sriver, 4giving: Episode 8, Execution is King

2ndKitchen Acquired by REEF

Venture studio startup jobs + advice for founders from founders

Best Advice from the Great North Annual Event: Episode 7, Execution is King

Newsletter: Do you fit our investing themes?

Jonathan Treble, PrintWithMe: Episode 6, Execution is King

Anna Mason, Revolution: Episode 5, Execution is King

Mynul Khan, FieldNation: Episode 4, Execution is King

Nick Moran, New Stack Ventures: Episode 3, Execution is King

Molly Pyle, Center on Rural Innovation (CORI): Episode 2, Execution is King

Justin Kaufenberg, Rally Ventures: Execution is King Episode 1

Newsletter: “Podcast Launched: Execution is King!”

“Execution is King” – the Great North Ventures Podcast

Newsletter: Fund II is open for business!

Unlocking the Potential of Anonymized Commercial Real Estate (CRE) Data

Fund II is open for Business!

Mike Schulte Promoted to Venture Partner

New Name + New Venture Studio

Great North Launches Startup Studio

We Don’t Need No [full-time MBA] Education

How the University of Minnesota is Embracing Startup Culture

Top Stories of 2020, iraLogix, and LaunchMN Calls for Mentors

Building Capacity for Innovation

Seizing Opportunity in a Recession, Allergy Amulet, and Twin Cities Startup Week

Recessionary times, a record-setting IPO, and Minnesota’s Resilient Startups

Minnesota's Resilient Startups

July 4th, Equitable American Dream-ing, and Robots Diagnosing COVID

Jumpstart, the Startup School, and Branch Wins a Webby!

COVID-19 Trends, the Great North response, and our Founders Survey

Giving in the Time of Coronavirus

COVID-19 Resources for Startups, State-by-State

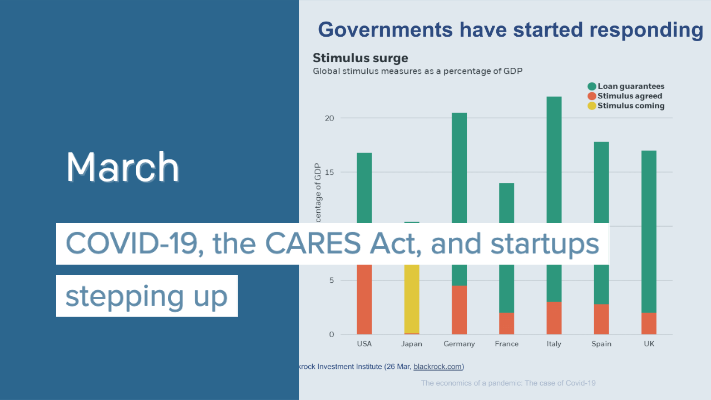

COVID-19, the CARES Act, and startups stepping up

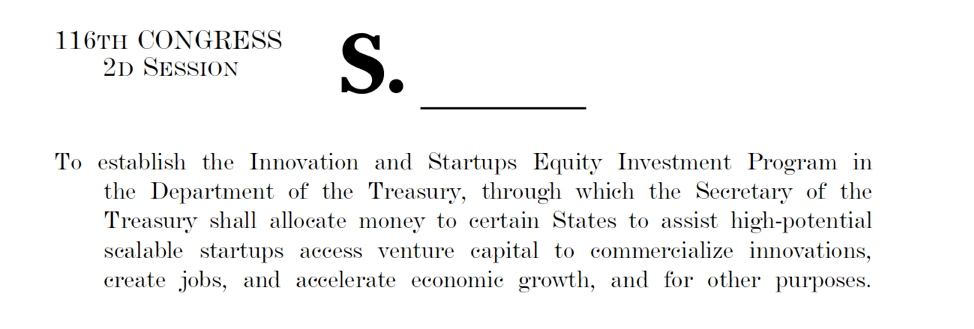

New Business Preservation Act

Digital Future Boardroom, PartySlate, and The Lean Startup School

Great North Labs’s Startup Summit 2020

Great North Labs's Startup Summit 2020

World Economic Forum, NoiseAware, and the Startup School reboot

Great North Labs at the World Economic Forum 2020 in Davos

Top 5 Stories of 2019

Taking the Founders Pledge, Inhabitr, and gBETA Pitch Night

Founders Pledge: Support the Organizations that Support You

BETA Showcase, Greater MN, and Launch MN comes to St. Cloud

7 Places to Spot Us at Startup Week

The Greater MN Meetup, Parallax, and Exponential Medicine

Greater MN at the big show, Neela Mollgaard heads Launch MN, and Misty’s roadtrip.

Talking VC, tech kids, and Forge North’s Horizon

June: Great North Labs’s first fund raised!

May: Innovation Ecosystems, SingularityU Kickoff, and PrintWithMe

April: Minnebar Recap, ZenLord Pro, and Supporting Entrepreneurs

MinneBar 14 Recap

Dispatch and 2ndKitchen claim Tech Madness titles

Minnesota Innovation Collaborative

March: Minnebar, Hockey + Hustlers, and Innovation Workshops

Great North Labs at CES

Dec.-Jan.: Top Posts from 2018, pepr, Glowe, and Misty Robotics

Carried Interest: Top Posts from 2018

Oct.-Nov.: Singularity University, Exponential Tech, and the State of Innovation

Digital Transformation Summit, July 25th in Minneapolis

June: Silicon Lakes, FactoryFix, and the Digital Transformation Summit

Putting the “Silicon” in Silicon Lakes

Digital Manufacturing and Logistics

May: Team Genius, IoT, and the Future of Everything

IoT 3.0

Healthcare Innovation

March: Exponential Tech, the “Goldilocks Zone”, and Minnebar 13

February: Team Expansion, Dispatch, and Startup School Events

Great North Labs Newsletter – December 2017

A Letter To My Younger Self

Great North Labs Newsletter

Great North Labs Featured on Tech.mn

Great North Labs Featured in St Cloud Times

Great North Labs – Featured on BizJournals.com