In this episode, Rob and Josef talk about of-coast investing, and the strategy behind Revolution’s Rise of the Rest Seed Fund and its founder, Steve Case.

Anna Mason, Partner at Revolution, joins, and Rob talks about how they met, and about doing deals for the past 5 years. Anna shares how she went from Wall Street, with a front-row seat to the housing crisis and the Great Recession.

She also speaks to the importance of investing in under-capitalized regions, and in being intentional about inclusivity, especially in the wake of COVID where some metrics reveal a backslide in DEI progress.

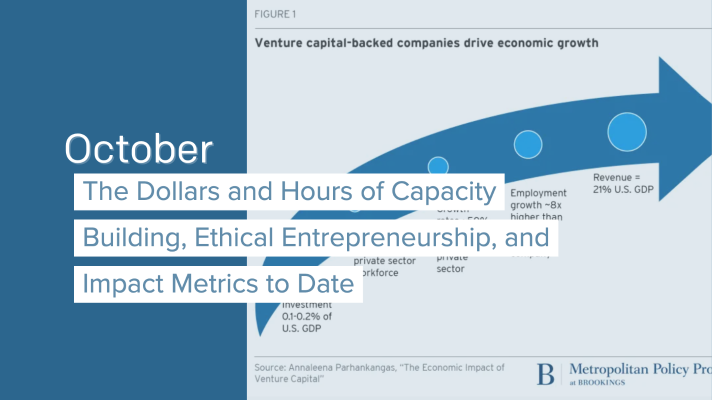

“We see opportunity first, through the lens of geography. The drive-it-home statistic that we have long focused on is that while the industry has grown as an asset class from $10B up to north of $150B a year, 75% of the capital invested every year still goes to three places: California, New York, and Massachusetts. “

Anna talks about the bus tours with Steve Case, which is an iconic exercise for the fund, and how people react to their arrival.

Spoiler alert: Steve does not drive the bus.

Who does Anna Mason see executing? Founder Rathna Sharad and Flavor Cloud, and recycling startup Recyclops.

Full Transcript Below:

00:09

Welcome to the execution is king Podcast, where we talk to successful startup founders, investors and ecosystem builders to uncover insights and best practices for the next generation of great global startups. I’m your host, Joseph Siebert. Joining me today is co host, Rob Weber partner Great North ventures. Our guest is Ana Mason, managing partner at revolutions Rise of the rest Seed Fund, Rise of the rest invest in promising companies at the seed stage. Were outside of Silicon Valley, New York City and Boston.

00:42

On a it’s great to have you on today. The first question I wanted to start with was this Have you briefly described your path into venture capital. And also, if you could go a little bit deeper on your thesis with Rise of the rest? Maybe any more specifics as to the focus of your role within Rise of the rest?

01:01

Sure. Thanks, Rob. It’s it’s great to connect in this more public forum. I know we spend a lot of time chatting with each other about deals and I’m excited, really excited for you guys in launch this podcast. My name is automation. I’m a proud washington dc transplant. I’ve lived in the district for about six years, I like to say I have my two favorite startups are my little girls who are two and a half and five and a half. They’re fifth generation Washingtonians. And the responsible family life choice that led us to raise our kids in DC is very much so the reason why I’m there. But along the way pretty early and I got connected with Steve and revolution team. And it’s been a real privilege and an honor to just work alongside him and my other partner, a managing partner, David hall to really grow rise the rest. It’s my path into venture I think like many is an interesting one. And part of what I love about our industry, but I also think can be a little bit challenging is that there is no one clear check the box path into the industry. So I like to say that I have a bit of an eclectic portfolio of professional experiences that brought me into venture. I grew up professionally on Wall Street, I was a distressed and high yield bond and bank debt trader and also dabbled in a bit of post retired private equity. Over the years. Long story short, I had a very, very front row seat to the financial crisis in the Great Recession. coming right out of school, I landed in a job that I thought was like the greatest thing since sliced bread working at Lehman Brothers on their distress desk, which has a strong reputation. Little did I know that shortly after, you know, a couple years after I joined, I would be trading our own bonds and bank debt on that desk through one of the largest corporate bankruptcies in history. What I would say briefly just about that experience, and how I think it tracks to my path into venture is that I find myself very frequently thinking and somewhat frequently saying that venture is very much so like the other side of the coin, from distressed from the distressed investing world, you’re making big bets that typically have very binary outcomes. But the fundamental difference, and what I really love about our industry, and about our work, it rides the rest specifically is that in venture, you’re really fundamentally betting on the bright side of the coin. And you’re just, you’re working with partnering with funding and backing entrepreneurs who are really functionally optimists, I think reimagining the future, which is a wildly different universe from working in a subset of the financial markets that are focused on trading in the securities of companies who have missed the mark, they’ve missed the innovation or have some measure of corporate malpractice that is that has taken their securities into a more distressed stage. So I learned a tremendous amount in the earliest days of my career, both from the standpoint of the nature of the work we did and I did on the distressed side, but also in having gone through a major corporate bankruptcy upheaval, and merger thereafter. And that merger experience going from Lehman to Barclays taught me a tremendous amount about corporate culture. And it’s a lot of what I try to apply from an investor lens standpoint, into how we think about team construction and team values. Because at the end of the day, whether you’re a seed stage startup with five employees, or you’re a major conglomerate with 25,000, employees or anything in between, at the end of the day, your organization is the sum of its people. And so really kind of having a feel for the good, the bad and the ugly there from some personal experiences early in my career certainly guided that experience. Wall Street was beloved and have to leave it experience. So just kind of fast tracking here a little bit. My Wall Street recovery program took me to Southern California, and I lived In LA and got involved in the awesome guests years ago, still somewhat nascent startup community, they’re co founded health tech startup called burness. We originally started in the boutique fitness booking space. Like so many we pivoted early in the lifecycle of our company, when we realized we productize the wrong value proposition, happy to talk more about that later. And that pivot led us into an opportunity where we really doubled down on community and the social psychology of fitness. And so it’s been fascinating for me to see sort of the emergence and the 2.0 of a lot of social, like vertically focused social, social commerce company is kind of coming up in the market, because we were very much so playing in that space. Back in 2012 2013, my co founder and I both got pregnant. And we were in a great place with our business, traction wise, but hadn’t fully landed on our business model. So we had an awesome opportunity to soft land, our company into a major, major private company in the space called Beachbody, which was a great home for some of our engineers and the technology and the platform itself. And I moved to DC for my responsible family life choice, which takes me close to present day. So I’ve been a revolution for five years. And it’s been a real privilege to work on scaling rise the rest.

06:24

So can you tell us a little bit about the thesis behind Rise of the rest?

06:28

Yeah, at its core, I would sum up the thesis of rise the rest by saying we see opportunity, first through the lens of geography. What that means in practice, is that the guiding light and the sort of drive at home statistic that we have long focused on is that while the venture industry as a whole has grown tremendously as an asset class, from, you know, $10 billion invested a year up to now, I think north of $150 billion a year 75% of the capital invested every year still goes to three places, California, New York and Massachusetts. And so we believe very deeply and are delighted to put our money where our mouth is that brilliant entrepreneurs can have and continue to build transformative companies anywhere in the country. But the tip of the spear in activating those opportunities is early stage seed capital. And so our model is what we call a catalytic co investment model where we are high volume early stage investors. And while we do invest across industry, over the years, we’ve sharpened our pencils to increasingly focus on opportunities that sit at the intersection of, of a handful of themes and those four themes for us, our infrastructure, resilience, digital transformation, and sustainability. And so that can take us into FinTech it can take us into healthcare, may can take us into hard infrastructure. I’m pretty sure I have a small child, my little startup who somehow broke the lock and snuck in here. But that’s the thesis for rise the rest in a nutshell.

08:14

So I’m a big fan of Rise of the rest. And I know one of the things that it’s known for our it’s bus tours all around America. I know that’s been challenging to pull off during COVID. But I wonder if you could share with us a story or two, in terms of the most unique or interesting startup ecosystems you’ve come across in your travels with Rise of the rest.

08:38

Your thanks, Rob, I’m excited to get you back out on the bus with us again, whenever it is safe for us all to convene in that way again. So I’ve actually personally been to 47 cities and counting in the five years since I’ve been at rise the rest. And so these are always the hardest questions, because picking just one or even two is tough. I thought I chat briefly about to startup communities that might surprise people, even as I’m so heartened and pleased to see how much momentum the broader thesis and interest level investing outside the coasts, has become over the last couple of years. And so one, one community that I’m wildly bullish on is Tampa, the Tampa Bay Community in Florida. I think it’s most interesting to me, and I think is worth noting, because Miami, you know, sort of just across the state has been getting so much fanfare and attention and opportunity. And frankly, I think rightfully so I’m long Miami in so far as that debate rages. But I think Tampa long before COVID and in particular through COVID has had the opportunity to really kind of double down on the ecosystem that’s developing there. So some fun facts about the Tampa Bay region, average age. I don’t know if you want to wager a guess, Rob average age in Tampa Bay? What do you think?

10:09

I would I would think it’s all I think of Florida as being retirement oriented. So I’m gonna say like you say, 42.

10:16

Yeah, it’s like 34. It’s crazy. It’s 34. We learned that when we went there a couple years ago, you actually came in lower that I that I might have thought otherwise. But there’s, you know, when we visited there a couple years ago, pre COVID. We got to see firsthand what Jeff fenech and Lakshmi Shenoy and the team at embark collective or building in the Tampa community. And what’s super interesting about this, I think of it as what what we call the work live play model in our 2019 rise, the rest ecosystem playbook. There’s a major real estate development underway there, called the Water Street project, the Tampa Bay Water Street projects, it’s like multi billion dollar, really like city renovation, if you think about it. And what I love so much about what was developed there with so much thought and intentionality is that as you redevelop different areas of a city, you have to have entrepreneurship, top of mine in front and center. And that’s where you had this really this like gem in this toolbox of embark collective, which was not only startup hub and community space, but it was really a collective to bring together leaders, mentors, investors to support this emerging generation of startups in the Tampa Bay Community. And through that, they really become this like magnet or beacon. That gives people a landing place, not only for startups who are maybe relocating, or maybe are homegrown in the region, but also for so much of the talent that’s moving to Tampa, from the Bay Area and otherwise, and either wants to pay it forward, wants to find that next opportunity wants to mentor wants to invest wants to join a startup. And now there’s a space for it. And I think creating that type of network density and concentration with intention can make all the difference in a startup community. So that’s incredibly exciting to see. And I will also say, I don’t think they’ve all been announced yet. But we have four investments in Tampa, up from zero, like two years ago. So it’s really cool to see what’s happening in that market.

12:24

That’s really interesting to hear. I’ve actually been thinking about buying a place in Florida as I as I get older, the Minnesota winters are starting to, you know, catch up to me, but I was thinking more of more like southern Florida, not necessarily Tampa. So before I buy a place in the next couple of years, I will have to spend time in Tampa and see what it’s all about. Yeah, you gotta check it out. As a entrepreneur and investor, you know, so much of success, you see really comes from having a strong team and developing a team and talent. And I know with the rise of the rest, you recently completed a nationwide career fair on clubhouse, targeting all kinds of different local talent markets, such as the Twin Cities which I participated in and others, I saw you this quote that you tweeted from Brian chesky, the Airbnb co founder, who also participated, he said, You’ll never be in one place quite like you used to be, the place to be will be the internet. So see a lot more small and medium cities rising up. I could really relate to that being I’m kind of I’m not super nomadic, but I, you know, I spent a lot of time in the Twin Cities or rural like Lake town in Minnesota, and then also Chicago, you know, but I, I don’t like to be bogged down or tied down. And I think that really resonated with me Brian’s quote, but when you think about advice, you know, as you’re counseling founders through investments that the rise of the west or otherwise, what advice would you give to founders with respect to recruiting top talent? And, you know, what do you think is working best right now? And I guess, what do you think is not working?

14:02

So I love this question about place, obviously, in a, you know, in our intro discussion, I highlighted that place really sits at the foundation of our investment thesis or programmatic work, just everything we do, centers around this idea and this philosophy, its mantra, really the only place matters. And so as we moved into this space, where the realities of COVID created, I think, what some people call zoom land, like, you know, you’re sort of in nowhere USA everywhere USA. The question about, like, What does place mean, almost, at the risk of sounding hyperbolic, you know, sort of felt like it was taking on his like existential thread, about how we should all be thinking about place and one of the conclusions I’ve personally reached, in part informed by this intentional work we did through our tech talent Tour, which as you noted, Brian chesky and co headline but it was really intended to be a virtual Career Fair that could bring together active job seekers from all across the country with these startups who are in our portfolio, we had actually over 1000 open jobs across the entire portfolio. So I think a couple things on on this front. One is that I’ve, I’ve personally come to the conclusion that we’re in this moment that I’m calling like, the great unbundling of place, where when you think about it, even from a venture investor standpoint, we’re constantly chomping at the bit and looking for opportunities, like, Oh, is this industry being unbundled? And what does that mean for opportunity? And where does value get unlocked and who can really, you know, go after and chase this opportunity? I think we’re seeing the same thing happened with place where fundamentally the value proposition of place, right, which is usually where you work, and where you live, are inextricably linked, is now unlocking and unbundling. And so just like when we think about industries that are being unbundled and value creation is happening for startups, who are sort of jumping into that moment, with a very specific product offering that really just focuses on sort of like one element of the previous bundle, I think you’re kind of seeing the same thing happen, where cities can really focus on the value prop of why you should live there. And companies can really focus on the value prop of like, why you should work for us. For this to fully work, I think for cities, and for companies, and startups headquartered in Rise of the rest cities, they’re probably actually needs to be some sort of partnership that happens between the city or the economic development authorities, or the Chamber of Commerce, and startups, who often don’t get as much attention as some of the later stage companies. So that’s something I’m actually personally spending a bunch of time thinking about what could come next there that helps not only companies in our portfolios, but helps any startup in any emerging city across the country. And so all that’s to say, while there’s tremendous opportunity, because you’re seeing so many people move for individual startups, and I know all of our companies are feeling this on the front line. It’s actually also challenging, because now you’re not just competing for talent in your own backyard. We heard this from one of our startups headquartered in Nebraska, where he’s like, I used to be the best game in town, for everyone, for all these engineers, but now suddenly, they have remote opportunities in other places, too. And so I think, for companies to really put their best foot forward as they’re trying to attract top talent, and what is becoming very quickly, like an increasingly competitive market. Is that you, I think, you really have to kind of let your personality shine. I think we’re, we’ve certainly entered this age from a consumer standpoint, and I think we’re seeing this from an employee standpoint, to where values really matter a lot. And frankly, I think that culture and values people operations is something that early stage startups may didn’t always have the luxury of thinking about. But I’ve noticed, at least across our portfolio and a new companies we talked to, it’s becoming increasingly important and prominent. So two last quick things that that I think came out of actually this talent toward the first is

18:15

we discovered, and it was an exciting discovery, that so many of our portfolio companies, even early stage ones, have heads of people, Chief people, officers, VP of talent, like not just an HR person, but someone who is looking at the whole picture of what’s our culture, what’s our recruiting process, what’s our training methodology? How do we really bring people into the fold. And I love the fact that that is front and center. And so I think that I’m thinking about how you build that function. And frankly, how that becomes not just the CEOs issue to think about, is an incredibly important tactical steps that startups can take at this early stage. And the second is, frankly, just to really transparently reassess your policies for your team. We surveyed our portfolio as part of this talent or effort. And we found that while fewer than 30% of our companies had remote work policies before COVID, more than 75% plan to have a policy, either already do now or plan to just have one for the foreseeable future. And on the flip side of the nearly 2000 active job seekers who RSVP to join us during this virtual career fair 99% of them were interested in or open to remote work. There was like one person that wasn’t interested, and 67% were interested in or open to relocation. And so I just think like flexibility is the name of the game these days. And it’s a tricky terrain, I think, for startups to navigate, because it can be distracting from a focus standpoint. So again, empowering someone on your team early Who’s sort of thinking about the people function most fully, I think is really beneficial.

20:05

So along with this unbundling of work from from place, you know, as kind of education from place as well. When you think of the uvp of these different cities, a lot of it has to do at least nowadays, you know, with with education that you can attain there. But you’ve been traveling around to these cities, you’ve been investing in these early stage startups. And obviously, there is this unbundling of education happening. Right now, I don’t know how, how progressed, it’s been put, there’s all these things, I mean, Udemy, Coursera, the ones that immediately popped to mind, but then there’s things like lambda school as well, and all kinds of other opportunities to get the education you need to work specifically in, in like startup type careers that are really proliferating. But as far as like traction, that you’ve seen, you know, like at companies, have you seen people in leadership positions? Are these founders coming out of those kind of educational backgrounds? Have you seen any traction to that unbundling of place and education,

21:13

we’ve made some investments in that space in a couple different different directions and are excited to track the progress of those companies. I can’t think of specific examples of founders in our portfolio who have been graduates of those programs. But I know that there’s active hiring that happens out of those programs. And I can say, you know, I think one example of a company in that space is to you, it’s actually DC based, you know, in our backyard in DC, they’re a publicly traded company, which I think in and of itself speaks volumes to the potential of the industry and the potential for success and real traction and efficacy of that business model. Um, but we actually partnered with them as one of our core talent partners on this recent talent tour that we did. And they brought a tremendous number of candidates through the platform. And I think what’s interesting, and what you see in some of the nuances of these models, is you have many people who are actually also leaving their current career, like they’re leaving their jobs, sort of mid cycle, mid career professionals, I guess they there’s the terminology. And they’re inspired to be a part of positive change, which I think is fundamentally what our industry is all about. And while I don’t have the specific stats for you on founders, you know, something that a colleague of mine said a while back, that’s always stuck with me, is that you don’t need to be a founder to be an entrepreneur. And I think this, having this spirit of innovation and opportunity and possibility is something that bleeds through startup cultures, whether you’re the founder, your employee, number five, or number 50. And I think you see a lot of those folks coming out of these programs into job opportunities in the startup space.

23:03

Yeah, I think that’s right on, I think one of the values that I always tried to push really hard when I as an entrepreneur was just shared around accountability. And I think that’s one of the real benefits. So you know, most startups provide employee stock appreciation plans or stock options. And I think that really kind of aligns it, you really want your team to act as if they’re owners and to take accountability when you’re building a startup. And I think that really can support that kind of a culture where every, every employee is a founder, and I think it’s really important. I was gonna maybe to change gears a little bit I wanted to ask, so your partner is Steve Kay’s. He’s one of the true pioneers of the internet. I know when I was starting out in the late 90s, as a teenager hacking away at my first websites and ecommerce projects, AOL was just a force of really kind of bringing the internet to the masses across the country. What is it been like working with someone like Steve that, you know, is really one of the true pioneers of the internet? Really? How does that impact your day to day,

24:10

it’s incredibly inspiring to work with Steve and it always has been from from day one, you know, it’s, it’s funny part of my role over the years it rise, the rest and in addition to the, you know, investment per view, and has been overseeing sort of strategy and execution, for our Rise of the rest, road trips, these bus tours that we do and that I think we’ve become pretty well known for. And it’s funny, I usually get three questions, and they’ve sort of followed me and us all through the years and through all the tours coming up on our ninth one. And, you know, the first two questions are is Steve really on the bus? And the second question is, like, is Steve running for president? You know, sort of learned, you know, my quick one two punch is like Steve is really on the bus. And and he’s no, he’s to the best of my knowledge. He’s not running for president. But I think there’s, you know, that first point It’s really like literal, like when I say like Steve’s on the bus and sort of both literal and figurative. He is, you know, front and center and present in all the work that we do. And I think his dedication has been a constant source of inspiration to our partnership to our team, to the cities that we visit, it’s always been fun in a delight to see the way that people react to and interact with him and to have the opportunity and the privilege to sort of be on the inside track of that has always been a lot of fun. And there’s also a tremendous amount of learning. You know, I think most people are not strangers to sort of the brilliant marketing behind the rise of AOL. And, you know, the CDs, everyone always talks about, but I think I’ve seen and I’ve learned a lot of that kind of shine through in the way that he’s, you know, conceived of and, and, you know, we’ve expanded Rise of the rest over the years, there’s a very specific, very deliberate, high level message that I’ve always found so impressive and inspiring in terms of how Steve always delivers it. Most people who know of our work in the space know that 75% of venture capital goes to three places. And all of the work that we do all of the investment, all the partnership, all of the focus on economic development, is inspired by that one single fact. And it’s been just tremendous learning, I think around that. The final quick thing I’ll say is, the Steve is also a great storyteller. And I think one of the first times I heard him, you know, when we were out on the road on a tour, tell the story about you know, one person, you know, when he started AOL in the early days, I don’t know if I’ll get this exactly right. But I think the story goes, like only 1% of the US was online, and it was only for like three hours a day or a week I forget exactly what that last part is. But I remember the first time I heard him talk about that, and link in his mind, the connection between sort of leaning into and creating the future with AOL, and, and drawing parallels for himself and the work that he and we are trying to do with rise. The rest was just, you know, kind of one of those that gave me chills moments, and it continues to be a source of inspiration, I think, in all the work that we do.

27:13

Here’s what I want to know, though, does Steve ever drive the bus? Like maybe it goes and sits up there he hangs a couple AOL CDs from the rearview mirror. So they’re spinning,

27:23

we do have a professional bus drivers. It’s a pretty big tour bus. We’re, he is on it. I have never seen him actually drive.

27:35

So I was gonna skip to my last question. I think the tech industry at large, but especially the venture capital market, has really struggled with diversity, equity and inclusion over the years, and I no Rise Of The rest is really at the forefront of kind of embracing diversity, equity and inclusion, from a VC point of view. So I just wanted to ask, how is the progress been? The last? I guess you’ve been with revolution for five years? How do you think the VC industry is doing in terms of embracing? You know, Dei,

28:10

my sense, in my experience, is that we’re making progress. I see it in the now much more regular announcements of you know, many of our colleagues who are women or, you know, GPS of color, or launching funds for the first time raising second or third funds with, you know, much larger numbers and a un behind them. It looks like we’re as an industry starting to do a better job. I think you see some of that too. On the, you know, the funder side in terms of what the composition of founders who are getting funded. But those anecdotes like those anecdotal insights aside, I think when we still see the headline data come through year after year, the numbers are just still so incredibly sobering. You know, from a female founder standpoint, we went backwards during COVID pretty dramatically. And the numbers were not all that impressive to begin with. And so I think we are living in an age more broadly, of increased intentionality and focus, frankly, because we all sort of live and operate in the public eye in some capacity. And I think there’s a more there’s the potential for a more virtuous circle between what your customers and what your investors and what your team sort of demands that can hopefully create more momentum and more positive change on this front. You know, one of the things I’ve been reflecting on, both with respect to geography and with an end diversity more broadly, is that I think we’re in maybe in a moment where it’s helpful to dig deeper Behind the headline numbers, because we do also have a tremendous amount of momentum in the asset class. And there are, you know, an increasing number of later stage funds. And I say this with all the warmth in my heart who are like weaponizing capital, and, you know, doing these very quick, later stage rounds that sort of inflates the overall numbers, I think of invested capital in the space, both in the fund world and in the startup world. So, you know, coming back to geography just for a minute, as we close, the headline numbers haven’t changed from the standpoint of 75% of venture capital still go into three places, but svv put out a report a couple weeks ago, where there were some really exciting data, I think, from our standpoint, it rise the rest, which is that the percentage of early stage funding, early stage specifically funding going to Bay Area startups, has actually declined 15% in the last 10 years. And what’s even more interesting to me, and I think to us, is that half of that decline has come in the last 15 months. So when you think about everything that COVID is accelerating, I think in certain ways, I think some of these shifts, you’re starting to see more acceleration and more momentum. And so that even that, just that one fact, that made me really want to double click on that, and understand, like, Where is that capital going? And what does that look like? And so there’s a lot more work to do. That’s like really the short answer behind my longer winded answer. But I’m encouraged to see more people around the table. And I’m also encouraged by the seriousness and the size of check increasingly being committed in the public forum by institutional LPs, and by the corporate community. I think, in particular, like the corporate LP community can start to make a pretty big difference when it comes to funding both startups and fund managers from a founder of color or female founder perspective.

31:56

So one last question, before you go on, we try to ask this of all our guests, sticking with the theme of the podcast, nice book into it, who is someone, or maybe it’s a team or a startup that is really executing. Or maybe it’s flying under the radar that nobody hasn’t heard of, that we should be paying attention to.

32:18

I have two companies in our portfolio. just picking up on that last thread one is led by an extraordinary female founder, the company is based in Seattle. It’s called flavor cloud. And the business is a cross border. Ecommerce enablement tool that really helps to empower every retailer to go global rathna recently closed a $6 million dollar series a round, and she’s just flying. And she’s one of the most capital efficient, sort of nose to the grindstone execution oriented founders I’ve ever met in our portfolio, and the numbers don’t lie. And so she’s already I think, come close to doubling monthly revenue, since she closed that a. So I’m really excited for the prospects of that business and think she’s writing a real wave of momentum in the e commerce enablement, and sort of supply chain resilience sectors. And the second is a newer company in our portfolio out of Salt Lake City, it’s called recite clops. And the company started as a consumer oriented like recycling as a service business that focused on rural and smaller MSA communities that didn’t have recycling services provided by their municipalities, in large part due to some changes from the International sort of regulatory landscape. And what I what I love so much about what’s happened. And they’re also just heads down executing so so efficiently is that their business has, I think, very quickly evolved not only into that consumer facing recycling as a service play, but actually now they’re sort of leaning into this reverse logistics company that singularly focuses on sustainability and the opportunities that come from that. And that’s created some really explosive b2b opportunities for them that I think are already and will continue to prove to be a short cut from a market based expansion standpoint, that helped to take them from a regional to a national player pretty quickly. So super excited about them. And they also the founder, there’s actually the younger brother of another founder in our portfolio who’s who was one of our first investments back when we launched rise the rest a couple years ago. So I love love seeing that connection come through for so many reasons.

34:37

Second generation of investees That’s great. Yeah, so listeners check out flavor cloud and recite clops. And if you google recyclates, and see a picture of Dwight schrute in a samurai outfit, that is the wrong recite claps.

34:53

It is not thank you guys so much for having me on congrats on the new podcast and I can’t wait to see Tune in to all your future episodes. Thanks, Ana.

35:02

Thanks so much on it’s been great to have you on today and looking forward to keeping the conversations going in the years to come. We’re really proud of all the good work. You’re doing it rise of the rest. Thanks, Rob.

April Newsletter

June Newsletter

Demystifying Startup HR

Head of Finance & Fund Administration- Venture Capital Firm (Remote)

Demystifying Startup HR

3 Portfolio Companies Make Inc. 5000 + Quicklly & Instacart Expand

iraLogix closes $22M + Branch expands with Uber

iraLogix closes $22M Series C

Flywheel lands Gates Foundation grant

Venture Capital Analyst

Orazio Buzza, Founder and CEO of Fooda – on Episode 13, “Execution is King”

$40M Fund II Raised!

Eric Martell, Founder of Pear Commerce: Episode 13, Execution is King

Great North Ventures Raises $40 Million Fund II

Investment Thesis: Fund II Strategy

Investment Theme: Community-Driven Applications

Investment Theme: Digital Transformation Through AI

Investment Theme: Solving Labor Problems

Trends in the Gig Economy + Work in the Metaverse

Portfolio raises $125M + talking fundraising with Branch CEO

Omnia Fishing closes $4M round, joins Great North portfolio!

Atif Siddiqi, Founder/CEO of Branch: Episode 11, Execution is King

Michael Martocci, CEO and Founder of SwagUp: Episode 10, Execution is King

Yardstik new to portfolio, closes $8M Series A

First venture studio startup comes out of stealth!

Insights for founders from a data guru, + FactoryFix raises a Series A!

Una Fox: Episode 9, Execution is King

Start With a Mobile App, Not a Website

2ndKitchen acquired by SoftBank-backed REEF + advice from an early Googler

Joe Sriver, 4giving: Episode 8, Execution is King

2ndKitchen Acquired by REEF

Venture studio startup jobs + advice for founders from founders

Best Advice from the Great North Annual Event: Episode 7, Execution is King

Newsletter: Do you fit our investing themes?

Jonathan Treble, PrintWithMe: Episode 6, Execution is King

Anna Mason, Revolution: Episode 5, Execution is King

Mynul Khan, FieldNation: Episode 4, Execution is King

Nick Moran, New Stack Ventures: Episode 3, Execution is King

Molly Pyle, Center on Rural Innovation (CORI): Episode 2, Execution is King

Justin Kaufenberg, Rally Ventures: Execution is King Episode 1

Newsletter: “Podcast Launched: Execution is King!”

“Execution is King” – the Great North Ventures Podcast

Newsletter: Fund II is open for business!

Unlocking the Potential of Anonymized Commercial Real Estate (CRE) Data

Fund II is open for Business!

Mike Schulte Promoted to Venture Partner

New Name + New Venture Studio

Great North Launches Startup Studio

We Don’t Need No [full-time MBA] Education

How the University of Minnesota is Embracing Startup Culture

Top Stories of 2020, iraLogix, and LaunchMN Calls for Mentors

Building Capacity for Innovation

Seizing Opportunity in a Recession, Allergy Amulet, and Twin Cities Startup Week

Recessionary times, a record-setting IPO, and Minnesota’s Resilient Startups

Minnesota's Resilient Startups

July 4th, Equitable American Dream-ing, and Robots Diagnosing COVID

Jumpstart, the Startup School, and Branch Wins a Webby!

COVID-19 Trends, the Great North response, and our Founders Survey

Giving in the Time of Coronavirus

COVID-19 Resources for Startups, State-by-State

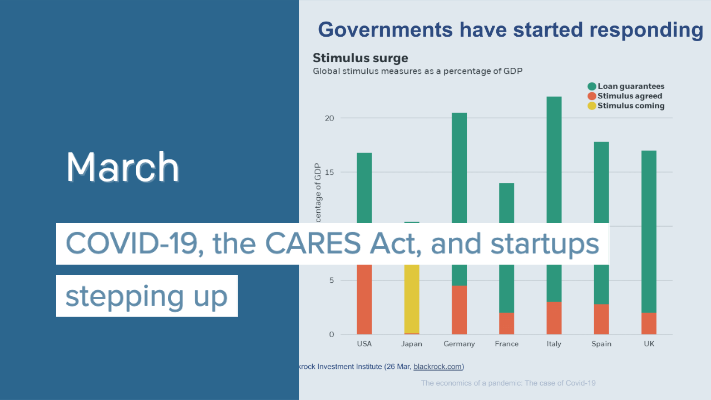

COVID-19, the CARES Act, and startups stepping up

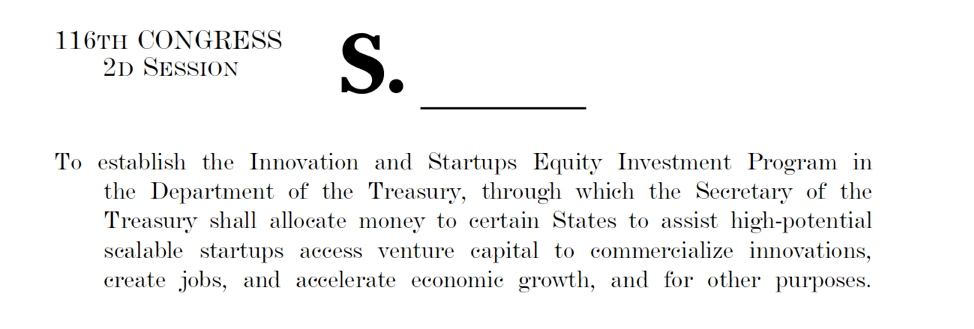

New Business Preservation Act

Digital Future Boardroom, PartySlate, and The Lean Startup School

Great North Labs’s Startup Summit 2020

Great North Labs's Startup Summit 2020

World Economic Forum, NoiseAware, and the Startup School reboot

Great North Labs at the World Economic Forum 2020 in Davos

Top 5 Stories of 2019

Taking the Founders Pledge, Inhabitr, and gBETA Pitch Night

Founders Pledge: Support the Organizations that Support You

BETA Showcase, Greater MN, and Launch MN comes to St. Cloud

7 Places to Spot Us at Startup Week

The Greater MN Meetup, Parallax, and Exponential Medicine

Greater MN at the big show, Neela Mollgaard heads Launch MN, and Misty’s roadtrip.

Talking VC, tech kids, and Forge North’s Horizon

June: Great North Labs’s first fund raised!

May: Innovation Ecosystems, SingularityU Kickoff, and PrintWithMe

April: Minnebar Recap, ZenLord Pro, and Supporting Entrepreneurs

MinneBar 14 Recap

Dispatch and 2ndKitchen claim Tech Madness titles

Minnesota Innovation Collaborative

March: Minnebar, Hockey + Hustlers, and Innovation Workshops

Great North Labs at CES

Dec.-Jan.: Top Posts from 2018, pepr, Glowe, and Misty Robotics

Carried Interest: Top Posts from 2018

Oct.-Nov.: Singularity University, Exponential Tech, and the State of Innovation

Digital Transformation Summit, July 25th in Minneapolis

June: Silicon Lakes, FactoryFix, and the Digital Transformation Summit

Putting the “Silicon” in Silicon Lakes

Digital Manufacturing and Logistics

May: Team Genius, IoT, and the Future of Everything

IoT 3.0

Healthcare Innovation

March: Exponential Tech, the “Goldilocks Zone”, and Minnebar 13

February: Team Expansion, Dispatch, and Startup School Events

Great North Labs Newsletter – December 2017

A Letter To My Younger Self

Great North Labs Newsletter

Great North Labs Featured on Tech.mn

Great North Labs Featured in St Cloud Times

Great North Labs – Featured on BizJournals.com