Ryan and Josef talk about the Weber brothers’ long history, with Ryan tracking Mynul since they took classes together in college.

He talks about his journey as a first-generation immigrant who came from Bangladesh to St. Cloud, MN.

His biggest lesson for founders? “Never run out of cash.”

He shares how his “hobby” turned from Plan B into the only plan, and the importance of going all-in. Mynul is heads-down, and shares some great advice about maintaining and creating capability while discussing people, systems, and processes with Ryan.

Full Transcript Below:

00:00

Well, welcome, everyone. For those of you who don’t know me, I’m Bonnie spear McGrath. So thanks for joining me today. As an entrepreneur, there are few things I enjoy in life as much as hearing the story of other entrepreneurs. And today, I’m super excited because we’ve got two entrepreneurs in the house lined up for this session. Both are graduates of St. Cloud University. So I want to put in a big plug for St. Cloud University, because there’s a lot of social pressure on all those Ivy League colleges. And that’s not necessary. So and they’re both highly successful entrepreneurs, I first I’m going to introduce Ryan Weber, I met Ryan and his twin brother, Rob A few years ago, and I love their story. They’re both from St. Cloud, went to a cloud University, started their own kind of bootstrapped ad tech company, that they later grew to $70 million in sales and made a lot of money for their investors, which is always a good thing to do. And after doing that, they decided they wanted to start helping other entrepreneurs. And they they did a little bit of on their own. And then strat started Great North labs, which is where I met them and became an advisor and investor. And I’m super impressed with them, and their integrity and authenticity. So big plug for Great North labs. And one of the people that they helped early on was my new old con. So I’m super excited to invite my new look here. As I said, he did study at St. Cloud University, but he’s not from St. Cloud. He’s originally from Bangladesh, and came all the way here to study computer science, and later decided to stay and start field nation, his company that he founded any CEO of in 2008. And field nation matches company projects with freelance technicians. And that might sound very simple. And it’s a simple idea, but it’s a super successful private company in Minnesota in which we can be so proud of, they now have over 200 employees and offices in Minneapolis and Bangladesh. So that’s pretty cool. And I always say it’s good to hear the behind the scenes story about how something happened in terms of idea, and especially in terms of financing. So the conversation today between Ryan and Mike Newell will be very interesting, including any secret insights that they want to share that maybe Rob Weber, who’s also on the call doesn’t know yet. So welcome, gentlemen, thank you so much for being here today. Thanks for having us, Bonnie.

03:09

Yes, thanks, Bonnie. So my name is Ryan Weber here. We’ve known each other for over 20 years now. It’s it’s over half our adult over half of our life, not just our adult life, pretty much our entire adult life. But I’m really excited, longtime friend, and then a great classmate and advisor to current projects that were involved in, but maybe manual for the audience, you could start off by telling us a little bit about field nation and what you do.

03:36

So So fuel nation is the simplest way to explain it’s, it’s like Uber for Field Services, right? What we do is we connect businesses that need field service work done with with the technicians and engineers in the field, who have that skill set to get that work done. So think about, you know, all these retail stores, they need point of sales, to cabling to networking, all sorts of technology is getting deployed in retail, banking, QSR, quick serve restaurants, offices, and, you know, how do you how do you find this technicians? How do you deploy them? How do you know that they’re qualified? How do you manage the project, all of this is built into the Philadelphian platform, you know, we help businesses connect with the right technician in the right place, and help them manage the whole project from the start of the planning all the way to payment, back office management, all that kind of stuff. And when did you start field nation? I started field nation in 2008. That was March of 2008.

04:44

You know, I I think that people would love to hear a little bit about your background, being a you know, from Bangladesh originally and coming to St. Cloud State University to study. Could you talk a little bit about, you know, your background prior to field nation?

04:57

Yeah, so I’m originally from Bangladesh. I came here for college for my bachelor’s degree, I went to St. Cloud state. Usually when people hear that Bangladesh to St. Cloud, they immediately the follow up question is how you ended up in St. Cloud? And the answer is, when I was looking for colleges in the US, I learned that there is only one state that was at that time was at least offering in state tuition to foreign students from day one. So the taxpayers were, you know, graciously paying for part of the tuition for the foreign students. So as you can imagine, when you are Bangladesh’s, literally the other side of the of the of us, it’s literally 12 hours time difference. Growing up, I knew, you know, Hollywood and New York and LA, and never heard about St. Cloud, probably not even Minnesota, growing up, right. But then, as I was doing my research into what college, you know, and everything is expensive, you know, especially when you come from the other side of the world, a developing country. It’s like, okay, I can’t afford to go other places. And St. Cloud gives a great deal. And that was really the primary reason to come to St. Cloud sent out state. But very quickly, I just, I just loved everything. I just loved the school, the teachers, the community, the friendship, that right that I built, you know, my plan, or a general plan was, I’ll just do, you know, two semesters of, you know, general education courses and then go somewhere else. But then, you know, that never happened, I just really love this place and love the community love the school and decided to stay here. So right after college, what actually do you know, in the last semester of my college, I had the opportunity to do an internship with a startup called Ebro in St. Cloud. And, you know, I think I was probably the I don’t know, you know, fourth or fifth employee, you know, at a bureau. And that’s kind of where I really saw got the sense of, you know, what it takes to build and the fun of, you know, building and taking something to the market, the uncertainty. And I remember, the first day I went to Ebro, they were in this big, you know, quest building, there was no desks, chairs and stuff like that, you know, a couple of people are building product and stuff like that, I just love that. And so I never grew up thinking that I would have, you know, I would start my own business, but I just loved the whole process there. And, and then I started the first company, back in 2004, called technician marketplace. It’s really first version of field nation. I started that in 2004. And that company also grew fairly quickly. But I ran into cashflow problem, and had to shut it down. It took a year off, got married and promised my wife not to start another company, and that lasted a year. But of course, with our blessing started field nation in 2008. So that’s that’s the whole story, Ryan, all the way from Bangladesh to Phil nation.

08:31

In during this these early years, what were some of the biggest challenges you faced with starting a business?

08:37

You know, that for me, you know, the biggest challenge was that I didn’t have a network, right? Do you need a you need, you need to know people to start a business like, you know, people who can advise you people that you can actually hot, you know, not even higher, but say, Hey, would you work with me on this project. So my network coming from monitors, my network is really, really small. So that was, you know, that that was one of the biggest challenge, me being an immigrant had its own unique challenge, because I couldn’t just leave my full time job and do do this thing, because that’s that non meal wouldn’t be legal. So I always have to have a full time job, I would, you know, you know, do my eight to five, job. And then in my business, my entrepreneurship would be up part time after hour and weekend thing. So those are those are, you know, a few few challenges that I had to face. But, you know, I was I was very fortunate that the small network that I had, was very, very, very, very effective. You know, people like you, Ryan, I reached out to you when I first started my business, Phil nation, Rob and a small network of people that that I I grew up, you know, and the university was part of the company from the beginning.

10:06

Well, thanks for sharing a bit about the background. You know, I remember that those early years very well, a few years there later, I think we obviously we connected, interacted a little bit in computer science, I think a lot of computer science students do. I think at the time, we were very analytical, and kind of not a lot of social, social, not a lot of partying even though thing club seats sometimes gets that reputation. We were kind of the Nerds working in the labs. And so I think we got to know each other a lot more as we started to do business together. So flash forward to, you know, the beginning of field nation and the early years, what was different? What, what did you learn from your first experience? And how did you go about supporting and scaling the early years of field nation?

10:54

So so the, the biggest learning from the first one is that never run out of cash? Cash is really important. And that’s one area that I know, finance. And accounting is one area that I, I, I enjoy all parts of the business, finance and accounting was always a drag for me. And I always kind of wanted to avoid debt. And, and the biggest lesson is that, you know, cash is the lifeblood, and you run into that you’re dead. It was literally dead. And so that was the biggest lesson there. Scaling up, you know, starting field nation. I’ll tell you another another good lesson for me. When I had my first job, I never had the confidence to go all in with my business. It was, you know, partially, you know, I never saw people are on me to do do successful. I mean, of course, I saw you guys, but not in my family. Growing up, business wasn’t a thing that you do. It’s the the people who cannot have a job. Go start their own business. And so I grew up thinking, you know, you go for good, good employment. Something something safe. So, so starting the business was always like, it’s it’s sort of my hobby. My friends and family would tease as it’s my hobby, I mean, old doesn’t have anything else to do. So after hours and weekends, I just, you know, like you said, No, no partying, no, no life, no social life. And so what do you do you just go do your second job. But what happened in 2008, I was laid off from Ebro. And I remember that long path, long drive back from St. Cloud to Plymouth. I was living in Plymouth at that time. And I just felt rather than being scared, I was scared. But I felt more free. I felt like, great, there is no plan B anymore. It’s just plan A The only plan that just make filmnation happen. And it was just absolutely freeing experience. Because I was always trying to juggle the ball. And, you know, if, you know business, if it doesn’t work, it’s fine. I got another job. But the job that I have, that’s really important. Don’t screw it up. I’m going to need that. And when I when I got laid off, it was like, No, there’s, there’s a plan B, there’s just one plan. Let’s go go all in and make it happen. That was That was really good. That worked for me.

13:37

It’s really interesting. You talk about the kind of the culture a little bit of starting a business and going all in you know, we both were classmates in the Department of Computer Science at St. Cloud state and not I remember being called into the office by the department chair one day Sarnoff, that who you know, Dr. ramnath. And, you know, he asked, he asked me about my business, I thought he was calling in to reprimand me about something and then all of a sudden, I just decided, you know, I’m, I’m opening up, you know, I was going to talk about my my work, you know, in class and with faculty and everything changed, you know, at that point in it. And I remember when we met you were talking about we had been just a few years ahead of you and in building what was freeze calm and became native x. And, you know, it was those relationships. You know, in St. Cloud, we connected with a lecturer at Rob’s entrepreneurship class, Brian schoenborn who connected us with with somebody that had a lake home on his Lake, maybe you can share a little bit about the background. I guess, you know, I joined field nation a year before this gentleman as an advisor, you know, when you reached out to me, we hadn’t talked in a while. I didn’t really know what you were working on, but it was similar, like, maybe similar experience when I had with Sarnoff. You know, when you reached out to me, I was very interested and I was very much wanting to get involved in but until you opened up and kind of reached out I never knew you know really what you were up to and And even though I wasn’t invested in eat Bureau, you know that you talked about that. Maybe you could talk a little bit about that getting, you know, our angel investment and advising round together along with this gentleman and how that impacted your early years.

15:14

Yeah, Ron, I don’t know if I, if I told you this story. So I started the business in 2008. And a few months into into the business, I realized that I need not only I need some investment, I need some people who knows, who can tell me what I’m what, what I don’t know. And there was, there was a lot of things that I didn’t know. And, and literally, I started searching my LinkedIn at that time, I’m like, you know, I gotta find people that I know. It is a very, very small network, right? I just all of a sudden, I remember like, I do have a rich friend it, Ryan and Rob, let’s, let’s see, that’s out. Let’s ping them and see if they’ll, if they want to meet with me, and you were very gracious to meet with me, I remember us having lunch. And I was telling you, you know what I’m doing and stuff like that, and you’re giving me advice. And then we decided to stay in touch, because I think you liked something that I was doing. And we decided to stay in touch. And we I think we and since our kind of the first meeting outside the school, we probably talked probably for few months, maybe six months. And then I said, Look, I’m now ready to take some angel investment. Although my company didn’t have a lot of overhead I was I was always very resourceful in terms of doing stuff. So, you know, company was was was generating income and stuff like that. But a company was growing. Without a balance sheet. There’s no no no money in the balance sheet. But the company know the revenue and all that stuff started to flow. And it just made me really uncomfortable. I keep the nightmare of cash flow. from my previous company kept coming back. I said, I need to, I need to get some cash in the in the bank. And so I reached out to you and and you’re interested and quickly, you introduced me with young son, and young, I think you’re talking to young les comment in St. John’s, and he got interested in Phil nation, and you both decided to invest. That was my first investment into the company that was probably back in 2009. And at and you guys invested. And also you decided to stay involved with the company and time to time I’ll just call you up and say, here’s what I’m thinking. And I need people in this key roles and you are very, you know, gracious to, you know, help me connect with a lot of people and a lot of people are still with Phil nation, the people that you introduced me holidays.

18:05

Yeah, for everyone listening that, you know, young stone was a early connection that we made. Through his wall tap home near St. John’s young, young was a CEO of a tech company called Old technologies and lived in the same neighborhood was Steve Jobs. But we just were very fortunate that somebody in the community Brian shone bar and introduced us early on and, and young served as a mentor to Robin my business freeze calm. And when we began our family office, angel investing, we tried to model our behavior of, of young and young brought his friend in Pradeep madonn, who’s the third partner in our current venture fund, Great North lab. So we tried to when we Angel invested, we tried to lean in and provided any support and guidance, we could just like we were receiving from our Silicon Valley friends, thanks to Brian. But you know, those years, I remember, everything is just flashing back in front of me as you talk about, you know, this time period, because at the time, you know, we didn’t have a lot of active angel investors in many funds in Minnesota, if any that were doing this seed stage or or pre seed stage investing. And, you know, I think we were so you know, we’ve always looked for people that can execute, you know, and we love to find entrepreneurs like Mike Newell, you were working on your business and clearly had some traction yet, you know, you had to learn, you know, you had some hard, hard times in the early years and had to recover. But maybe, can you talk about how and I also remember, when we gave you the money, I thought you were going to spend it but it seemed like it never left your bank account. So that was maybe that gave you more confidence with scaling. But I’m really interested to hear more about when did you feel like things were really starting to hum and what were some of the major milestones, as you began growing after the after that period.

19:51

I don’t know if I can tell you one major milestone two kind of breakthrough moment for us but Well, I do have one aha that I always like to share. Yeah, which is, I was so naive, when I started, I thought, you know, you build a product and you do some Google AdWords and stuff like that, and all of a sudden things gonna just everybody start to sign up. And I was so naive, and and I waited and waited, you know, for for few months, and there was literally nothing. And I don’t know if this was a problem with a business model or, or what. And then I think towards the end of 2008, we had one bot customer sign up, just all by there is no sales for somebody signed up, one company signed up and did 20 work orders on our platform, our our platform is mostly work order driven, like somebody create a work order, and then they find a technician and deploy the technician in the field. That’s kind of how the system works. And, you know, by end of 2008, I waited six months and then end up to those and eight, somebody signed up, created 20, work orders found 20, technician nation, you know, distributed all over the nation. And I got so excited. I thought this is it, this is the moment that tells me that I’m on the right path. Now, looking back now, you know, last year, we did a million workorder, you can see that the scale of the company is very different. But there is nothing more meaningful to me than that first 20 workers that just just that was the lifeline for me, that just gave me this desperate validation that I needed. in those early days that it is the right, I’m working on the right problem. And people find value through my, through my product. And that then it was a question of, you know, the How do I figure out the sales and, and distribution and all that kind of stuff, which is an ongoing process that never ends, that we still have the same same discussion that that we had 12 years ago. But that that 20 work order was so sweet memory in my mind, I still if anybody asked me, what’s a breakthrough, that was the breakthrough? I don’t know if that didn’t happen. And I didn’t see any worker coming for a few more months, I would just, you know, shut down and say this, it’s not worth doing. I don’t know, I don’t know, what would have happened. But that is really big.

22:33

Yeah, it seemed like, you know, I just remember observing in it seemed like, you know, you had some very large enterprise customer interests. And in part of the, I think getting, building that confidence, you’d see it, you know, with every order almost in every meeting we had, and, you know, during the scale up, and it just seemed like the conversations, you know, the types of companies and the traction, you were seeing continued to increase as your confidence built, and kind of, I think more and more people believed in field nation, and it was a competitive space it you know, what, while you were starting, wasn’t it my No,

23:06

it was a competitive space, we had a, you know, very well funded competitors. And we did things very differently and not having money, I sometimes I say, you know, one of the one of the best thing is that don’t start with too much money. I mean, you need some money, so you’re not running out of cash, that’s a, that’s a different problem. But too much money could be the same problem. It could be, you know, a bigger problem, because you’re wasting someone else’s money without knowing whether you have the right product, or you have the right distribution, what not, and I’ve seen some of my competitors made that mistake of raising too much, I mean, the promise of a, you know, Uber, like model, and right now, you see everything is becoming Uber eyes, right. It’s the Uber of this and Uber of that delivery, and, you know, hotels, and everything is overpriced. And when we started in 2008, this idea of you know, getting on demand workers to go do something was new people would, investors are very bullish back then, as they are now. And so a lot of a lot of my competitors got raised a lot of money and they try to scale quickly without figuring out the you know, the market maturity and, and all that kind of stuff. And, and wasn’t wasn’t very successful. But you know, one thing I would say, the timing matters, right? So when we started people would compare us, Phil nation as the Craig’s Craigslist, they would say, oh, you’re like Craigslist. We are not we, you know, ABC Company. We’re enterprise. We don’t deal with Craigslist, right? And now it changed so much. It seems like everybody is more comfortable staying at Airbnb and riding an Uber. It’s the new normal, like, of course, you know, you get something on demand, that’s the way it was. It’s whether it’s a cloud on demand, or whether it’s a technician on demand on a driver on demand, it’s everything on demand.

25:21

That’s maybe a great kind of topic to follow a little bit, you know, we I know, you went a long time before raising, you know, any larger financing. And I remember working with young, young, young, young, everybody is now the Chief Strategy Officer at Samsung, he’s been there for six years. So quite, quite an amazing journey, you know, for the people involved in associated with that time, you know, going into that big financing. Do you want to talk about, you know, after you scaled for some time, you were in a position of strength, but how, what were you thinking about, you know, in terms of the next chapter, as you prepare for, you know, that your later financing, if you could share a little bit about that?

26:03

Yeah, you know, what, one thing we didn’t want it to do is raise a lot of money, too quickly. And because we were still, we were figuring it out at that time, like, what is the right market? What is the right customer? How do we scale them up? How do we scale our business and stuff like that, and there was, you know, we just didn’t want it to raise a lot of capital that comes with the, with the constraint of build it 100 people sales team and sell, sell, sell, you got to fight, you know, you know, you get to do that, you know, product market fit, you got to figure out the distribution channel and stuff like that. And so we waited, you know, we waited, and then we were adamant to find somebody who was genuinely passionate about the market we’re in and the problem that we’re trying to solve, and be patient, like we are, we know that it’s a slow maturing market. For us, it’s a slow maturing market, it is still taking a long time for us to, you know, see the market maturity, because we are working, we are working with enterprises and not consumers, it doesn’t turn, like the way you see GameStop it’s done. Yeah. enterprises move in a different pace. So we wanted to make sure that our investors are patient, they will stay with us and not not have that undue burden that, you know, do something because we got an exit, we got to figure out an exit in next, you know, next year or something like that. So when we raised our capital, that is, you know, end of 2015. By that time, we were on in 500, multiple times, fast 50. And so there was a lot of calls, we’re getting a lot of VC and private equities are coming from east and west coast. Unfortunately, there wasn’t any anybody from the, from the Midwest at that time. But I remember our CFO and I, we met 70, some VCs at that time, as part of the interview process. And then we finally found someone, a company private equity, called SAS corner growth equity. We immediately like those guys, because of their flexibility in the, in the capital and the life, the the time horizon, they have, they literally don’t have time horizon, if they’re like a business, they hold it, and they can have subsequent rounds, and stuff like that. And, and so we decided to raise capital at that time, you know, and up to those.

28:41

I remember always hearing you say that, you know, this is the startup you see yourself working on forever, you know, and it’s been, you know, I never thought you would, I never thought it would be come forever, but you still have the same excitement and patients it seems and continue to grow. And it’s been exciting, you know, following your journey, maybe we could kind of shift gears and talk a little bit more about the broader kind of gig economy, you know, and, you know, when when we started the fund, with experience investing in these gig like services quite a bit as angel investors, you know, we, you know, we’ve done SAS and marketplace, businesses, consumer and enterprise, as a fund. But, you know, we were excited to win starting the fund to get a group of operators as advisors of scaled tech companies, including yourself, so you know, having, you know, having then seeing in the portfolio, we start seeing a wide variety of, of people working on Uber like services for other markets and including one that you helped with diligence on early I remember, it was just so, so amazing to see this, this founder, Patrick O’Reilly at factory fix, you know, request a meeting with our fund and in his deck as he’s going through it. He says the comps he was highlighting was field nation as a major success. I was like Yeah, that’s my buddy, my Neil from college. He’s like, What? He’s like, yeah, I asked him if you mind if my noodle gets involved in reviewing this deal with us? And he said, Oh, sure, of course. But, you know, and that’s, you know, you know, your perspective as an operator, scaling a good leg service, and seeing different strategies play out has been invaluable, you know, in supporting our evaluation of such opportunities as factory fix. But do you want to talk a little bit about, you know, what you see as some of the different strategies and in, you know, that are working or not working with these types of services? With with kind of gig economy, kind of, yeah, what challenges and in what, what seems to be what are some of the key takeaways you see from people that have been successful and not successful in? How does it vary by market?

30:49

Yeah, I think the, on the consumer front gig platforms are really, really successful. I think the laggers are the enterprises. Unfortunately, we are in the, in that in that group, that enterprise will, but that’s, that’s catching up. Usually, that’s always the case, people in their personal life will experience something, and then they’ll they’ll think about, you know, how does it apply in their businesses and stuff like that? So, you know, there’s a lot of, you know, kind of consumer centric gig platforms from Uber and Airbnb to, you know, grub hub to everything else that you can you can think of, but the next frontier is that enterprises, the enterprise is thinking, you know, how can I reduce my capex and OPEX? and make it more variable? Right? I mean, and, you know, if you remember, Ryan 2008, was a great recession. Yeah, it was, it was good. I mean, it was good for us to start at that time, because everybody was thinking outside the box, like what, you know, any, any financial crisis kind of creates that sense of thinking outside the box, like, we got to change, right, the status quo is not good enough. So 2008, we saw a lot of, you know, SM B’s was whether, because of the need for survival or whatnot, they were thinking outside the box, and we saw great adoption, you know, since 2009, till, you know, many years. And what we are, we are we are seeing is that this crisis, the crisis we are in the pandemic crisis is shaking up the enterprises, and they’re thinking like, Okay, we got to think outside the box in terms of, you know, variable labor. And that’s the, that’s the next wave in the I’m talking more specifically about the labor platforms like Phil nation, and others. And, and they’re much more comfortable in their understanding of the labor model. It does has its its challenge, though, you know, you know, and the biggest challenge is that the worker classification in this country, there is literally to classification and none really fit well, with the gig workers, we have the W two model the full time employees, and you have the independent contractor model. And the challenge is that, you know, some states are trying to push gig workers to be classified as employees, you’ve probably heard, you know, Eb five, assembly bill five, buy from California, although, I think there is a proposition that that got passed last November that AV five didn’t go through ultimately, but if I would have made every gig worker, employee, but that’s not gig workers want, you know, they don’t want to be employees, they want the the number one thing that gig workers really enjoy is, is the flexibility and employment, you know, full time employment doesn’t give that. So there needs to be a new type of legislation to accommodate for this new class of, you know, workers, and they do need some safety, they need benefits, they need, you know, fair treatment. But but that’s the, you know, making everybody a full time w two is not the solution. So, I would say we think that we’ll see some legislative changes, you know, next, you know, few years, hopefully, will be a more common sense approach than say, you know, move everybody make them everybody don’t. Yeah, it’s not a solution.

34:52

Yeah, it seems that regulations are struggling to keep up with the pace of technology. And this is a shining example of that, but I think I think it’s really interesting what you said about the enterprise market and in today’s environment as well. I know, we’re running up against time here. And I just want to say thank you for, for your friendship and for sharing this journey together. It’s been amazing and appreciate you being one of our first guests on on the show. And I will turn it over to Joe to take us through the next section. Thanks.

35:26

Yeah, thanks so much. My new will in a second, I’ll open it up to everybody for q&a. But I just like to kick it off with the first question. We’ve been asking everybody who comes onto our podcast? Are there any founders or startups or like organizations, or people you see supporting founders and startups that are really executing? Maybe people here? Haven’t heard of them? Maybe they have heard of them? Maybe it’s someone where, you know, maybe it’s a branch or something that everybody’s heard of, but is there anyone in particular that you see that you think is really, really just killing it?

36:01

Joseph? that’s a that’s a great question. I can’t answer that with with a lot of firsthand experience. I do hear people, you know, join young presidents. I don’t know it is a club or some some Association there is, you know, people go and get advice and stuff like that. And, but in Twin Cities, I haven’t been part of anything that that, that I could say.

36:31

Well, thanks. Yeah, well, we’ll open it up to everybody here. If you guys have any questions, or just want to pop on your video, pop off your microphone and chat a little bit. Feel free to talk ask wave for any questions for my Newell and Ryan.

36:46

And one question, I was just gonna ask my Newell, you know, you went through a lot, you know, with the immigration process, you know, what do you think of the current kind of regulatory environment on immigration? And I guess, do you have any, you have a solution that you think would work better in terms of American immigration policy? You know, after having gone through the whole experience that you had?

37:10

Yeah, it’s also a very sensitive topic, isn’t it? Look, I think, I think we need to have a common sense approach to immigration. It’s people try to, you know, make it a binary problem. Nothing is a binary problem. It’s way more complicated than this, this right. And, look, I can tell you that a smarter approach would be looking at industry by industry and look at what kind of, you know, workers we need. This country needs, high skilled workers to notes, no skilled workers. I mean, it’s every everything in between. and but there is no, there is no systematic approach to address that problem. It gets a it becomes a very slogan type of approach. Rather than, you know, this dramatic market based I would make it a market based approach, you know, what is what is very difficult for me to get my head around is that think about some of my friends, we went to St. Cloud state we got institution because the taxpayers the Minnesota taxpayers paid for our some of our tuition right under there was a great help. Many couldn’t stay in this country, because of the complexity of immigration, guess what some of them went back to India and other parts of the world and working for, you know, Google and, and Microsoft sort of the world and paying taxes in those countries. So and so there is a vicious loop for us and a virtuous loop for other countries, meaning the US companies cannot find talent here. They’re gonna go wherever the talent is, whether it’s in other parts of the world, and that talented, they cannot stay here, guess what, they’re gonna go somewhere else, you know, and, and the companies will follow the talents and, and those talents will, you know, pay taxes and enrich their community and stuff like that. So, you know, market driven approach would be my, my approach my my recommendation.

39:29

I know. And Ryan, I have a question if I if I could, so I often hear people talking about entrepreneurs putting the flame on with their ashes. What I mean by that is, they hang in there they sit, they can start things very well. But growing something that’s already started, we spend a lot of time talking about startup enterprises and businesses and we all love that. But what’s the difference in skill sets and even growing as an entrepreneur from the startup mentality, to wait a second, I have a business and I want to grow it. Are there differences? Or is it the same skill set, shed some light on that for all of us?

40:06

Well, I think the differences are enormous, you know, when when you’re starting up a business, you are a missionary, you are an inventor, you are just kind of, you’re you’re hustling and you’re trying to get get the product out, you’re the sales guy, you’re doing everything that needs to be done to get going. Right? When the company starts to scale, that’s a different, that’s a lot of lot of management and leadership. And sometimes, and I can tell you, it’s true for me, sometimes hard to get, you know, not to be involved, but to lead and to manage and hold people accountable, find the right people, you know, think about the organizational design, rather than just the the solving than the specific customer problem. Beyond the every sales call, which I used to do, now, stepping back and say no, you know, we got to figure out how to scale the sales, I used to be in every product decision, but rather now, you know, how do you design an organization that the organization can design the product. So it goes from, you know, being, I still like to be missionary, but missionary in terms of the mission of the company, not, not in the ground. And and just like you said, just doing everything, and and as you do when you’re, you know, you know, startup founder in the very beginning stage of the company. So skills are very different. And I can also tell you, Brian, is that it may not be right for everybody, you know, what you like in the earliest stage is, as a competence, start to scale, those things are not there anymore in the company. And and you may not like the new company. And if you try to, you know, hold on to those old things, the things that you really enjoyed, you may be holding back the company to scale up. And that’s that that is not good for the founder, not good for the company.

42:19

Do we have any more questions? Anybody can feel free to jump in here. We got a few minutes left.

42:25

I’ll ask a question. Hi, my name. I’m Kristen Danna. Well, I’ve got a HubSpot implementation consulting company. So we help our clients implement HubSpot and use the software. And we’re kind of in that stage that you just spoke about. And so I was hearing like the choir sing behind me. But then in respect to like, when you get to stage when you’re scaling up, in terms of your advisors who are advising you and the people that you’re speaking to, I think that’s something you constantly do through the lifecycle of your business. But when you get to that point, when you’re ready to scale up, and you want to create, like an advisory board or something like that, and you’re not necessarily looking for investors yet. Can you talk to us about that process? Did you do that? Or do you recommend that?

43:16

Absolutely, absolutely. I think that advisory group could be very helpful. And some of the things to think about for from the advisory standpoint. You know, we have advisors that are more technical focus, because that’s one area, we wanted to make sure that we know how to scale the technology stack of our company we have, we have advisor that comes from the domain expertise from our, our industry. And I personally have a CEO coach, a couple years ago, I decided, you know, how do I know I read a lot to see, because I always feel every year, I feel like, I’m probably not ready to be the CEO of this new company. Because as the company grows, the complexity grows. And, and I never been there, I never been there in that new company, CEO, the new stage of the company. And so I read it, but then a few years ago, I realized that, you know, having a live, you know, conversation with somebody who been there done that. It’s an amazing, it’s an amazing thing. So I do have a CEO coach and his his awesome. And, and I think a lot of times you hear the comment that you know, the it’s very lonely at the top. And, and having somebody that can be a sounding board and you can just be all open up and vulnerable and tell everything, all the stupid questions. It can be very, very freeing experience and and especially if you can talk to somebody who had done that. They can guide you in the right direction and say the thing that you’re working Worried about that’s really not a thing you should be worried about. Worry here, you got to really think about this. I

45:05

think we have time for one last question here. If anybody has a question for Mike Newell, or maybe Ryan,

45:11

if I could jump in? I have a quick question. It’s Simon here. This is a partial question from an old but it’s also could be one for Ryan two, which is what keeps you awake at night? Like, if you think about this people systems and process of scaling your business and evolving your leadership that you’ve described? What What keeps you awake at night? What’s the thing? Is that one thing or several things that are sort of most on your mind when all that? And then I guess the related question to Ryan, which is, as you scale the fund, is that similar? You know, is it different kind of business growth challenge as other things that you kind of think about? A lot?

45:57

That’s a great question, Simon, you know, what keeps me awake at night? If he asked me that question, last April, that would have been a different different answer, because I was I was, I was really worried, you know, as everything started to shut down, you know, not knowing, you know, where the market is going in, in a shutdown economy. But we recovered pretty well from that crisis. And we’re off to a really good start for 2021. It’s a rhetorical question, but you know, I don’t, I sleep really well. But, you know, in 2021, one of our key goal, you know, scaling one part of our market segment. And in any given year, we pick one or two areas, in the last last year was, was, you know, we created five different product packages, that was transformative for our company, it actually took took us 24 months to get that get those packages out the door, and implement in a rolling, implement, and then roll it out. And that I was, that was one thing on always on top of my mind. So now that’s all done. That’s now part of our muscle, that’s, that’s, you know, and so every year, we pick one or two things that are kind of transformative for the company, for either the product or our market, or, you know, our organization as a whole how we do it. And I tried to focus my time, in those couple of areas that are kind of still new, where we are trying to build that capability, the muscle, because it does require a lot of lot of lot of focus and attention and, and a lot of nurturing maybe the right thing, because, you know, as a CEO, I want to make sure that the new stuff that’s not part of the company’s muscle or DNA yet, and I’m hoping that I’m helping in that area to build build it. Ryan, anything you want to add?

48:05

Yeah, that’s really interesting. Simon people systems and process, I think about all three on a day to day basis, but probably the one that keeps me up at night is really people I think, you know, we’re a lot of these companies that we’re investing in, and they know, their business models, checkout, strategically, they look good, they’ve got some early wins and victories with customers, but you know, they, these organizations, the type of people in the in the way they need to evolve the people in that exists at the company and the people they need to bring on, it’s a biggest challenge. I think that all of these companies face more than a strategic or process challenge. I think that at different stages, if they if you don’t keep up with, you know, the system or the process, they’ll bite you. But usually, if you if you can get just a little bit of the right people in the in on the bus at the right stage, you can do it in, you know, I have seen, you know, there’s always outliers, right? Like, there’s a, there’s a portfolio company, we I won’t name any names or anything, but they, you know, sometimes the the process that the, like the board or advisors want to put in having not really been operators at different stages, they, they think about it, like, Oh, we need to operate like this is a 200 person company when two people, you know, in the way they’re conducting board meetings, I’m just scratch shaking my head, like, and I’m usually empathetic to the founder and trying to like, hold on, that’s that maybe this is a little much here, guys, let’s like, let’s give them what looks like, you know, like, push back, let’s like relax a little bit on the process. You know, let’s just, you know, take it one step at a time, but when I think people but I think it’s not just the the management teams, it is that advisory group, and that an extended network, it goes all the way around and I think, you know, it’s it’s really easy, you know, a lot of founders want to be, you know, or you know, want to succeed and have the drive in it. But if they don’t get the right, you know, advisors and team together, it’s just not going to happen

49:59

and I think that’s really well said my my own experiences, the hardest thing to do really well is what Manal described, which is because as an entrepreneur, you’re spinning a mini unplayed to index an enormous amount of energy to get something going. But what are the one or two things that really make a difference at that stage? Right, then if you can focus that enormous amount of energy, and leverage the people around you that you know, and be self aware enough to know where you can delegate and where you need to focus. That’s, that’s the key. Well said both of you.

50:38

Thanks, everybody, for coming here today. I did have one quick question. I wanted to ask my know, what do your family members say about your hobby now?

50:47

Oh, you know, life is more normal. Now. You know, I don’t have two jobs. So and we have two boys. And you know, we spent plenty of time just, you know, with the boys and it was fun. And I think he did a lot of energy and and the sooner in your life, you you have the energy and you get some of those crazy entrepreneurial start down in life is probably probably good. Good idea.

51:17

Great. Thanks so much. Thanks, Ryan. Thanks, everybody for asking questions. Thanks, Mike Newell, for coming on and having this conversation with us. And thanks so much to Bonnie spear McGrath for hosting this event.

51:29

Thanks everyone for coming and spending the time and asking good questions. And it was just as much fun as I was anticipating. So well done.

April Newsletter

June Newsletter

Demystifying Startup HR

Head of Finance & Fund Administration- Venture Capital Firm (Remote)

Demystifying Startup HR

3 Portfolio Companies Make Inc. 5000 + Quicklly & Instacart Expand

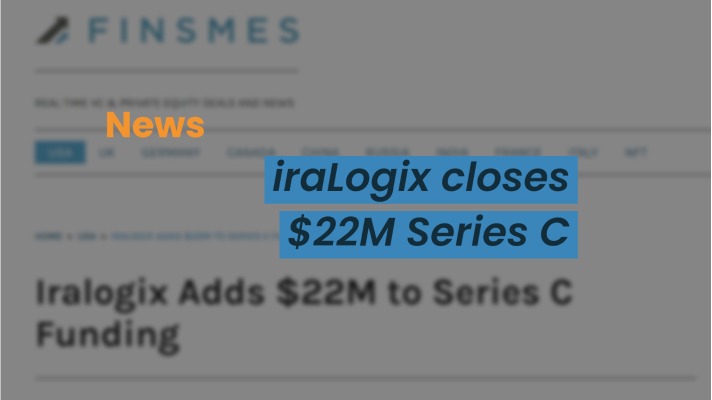

iraLogix closes $22M + Branch expands with Uber

iraLogix closes $22M Series C

Flywheel lands Gates Foundation grant

Venture Capital Analyst

Orazio Buzza, Founder and CEO of Fooda – on Episode 13, “Execution is King”

$40M Fund II Raised!

Eric Martell, Founder of Pear Commerce: Episode 13, Execution is King

Great North Ventures Raises $40 Million Fund II

Investment Thesis: Fund II Strategy

Investment Theme: Community-Driven Applications

Investment Theme: Digital Transformation Through AI

Investment Theme: Solving Labor Problems

Trends in the Gig Economy + Work in the Metaverse

Portfolio raises $125M + talking fundraising with Branch CEO

Omnia Fishing closes $4M round, joins Great North portfolio!

Atif Siddiqi, Founder/CEO of Branch: Episode 11, Execution is King

Michael Martocci, CEO and Founder of SwagUp: Episode 10, Execution is King

Yardstik new to portfolio, closes $8M Series A

First venture studio startup comes out of stealth!

Insights for founders from a data guru, + FactoryFix raises a Series A!

Una Fox: Episode 9, Execution is King

Start With a Mobile App, Not a Website

2ndKitchen acquired by SoftBank-backed REEF + advice from an early Googler

Joe Sriver, 4giving: Episode 8, Execution is King

2ndKitchen Acquired by REEF

Venture studio startup jobs + advice for founders from founders

Best Advice from the Great North Annual Event: Episode 7, Execution is King

Newsletter: Do you fit our investing themes?

Jonathan Treble, PrintWithMe: Episode 6, Execution is King

Anna Mason, Revolution: Episode 5, Execution is King

Mynul Khan, FieldNation: Episode 4, Execution is King

Nick Moran, New Stack Ventures: Episode 3, Execution is King

Molly Pyle, Center on Rural Innovation (CORI): Episode 2, Execution is King

Justin Kaufenberg, Rally Ventures: Execution is King Episode 1

Newsletter: “Podcast Launched: Execution is King!”

“Execution is King” – the Great North Ventures Podcast

Newsletter: Fund II is open for business!

Unlocking the Potential of Anonymized Commercial Real Estate (CRE) Data

Fund II is open for Business!

Mike Schulte Promoted to Venture Partner

New Name + New Venture Studio

Great North Launches Startup Studio

We Don’t Need No [full-time MBA] Education

How the University of Minnesota is Embracing Startup Culture

Top Stories of 2020, iraLogix, and LaunchMN Calls for Mentors

Building Capacity for Innovation

Seizing Opportunity in a Recession, Allergy Amulet, and Twin Cities Startup Week

Recessionary times, a record-setting IPO, and Minnesota’s Resilient Startups

Minnesota's Resilient Startups

July 4th, Equitable American Dream-ing, and Robots Diagnosing COVID

Jumpstart, the Startup School, and Branch Wins a Webby!

COVID-19 Trends, the Great North response, and our Founders Survey

Giving in the Time of Coronavirus

COVID-19 Resources for Startups, State-by-State

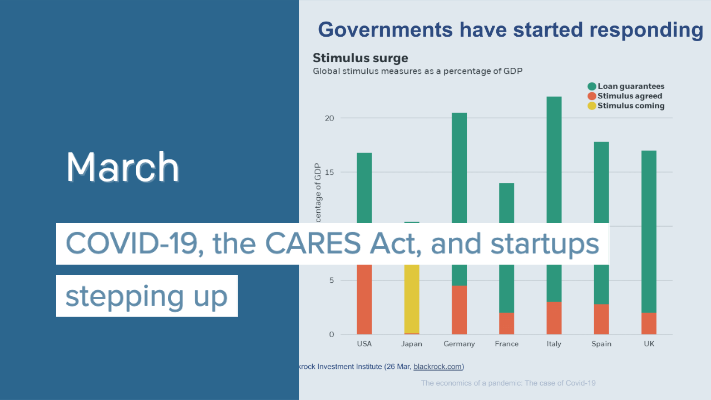

COVID-19, the CARES Act, and startups stepping up

New Business Preservation Act

Digital Future Boardroom, PartySlate, and The Lean Startup School

Great North Labs’s Startup Summit 2020

Great North Labs's Startup Summit 2020

World Economic Forum, NoiseAware, and the Startup School reboot

Great North Labs at the World Economic Forum 2020 in Davos

Top 5 Stories of 2019

Taking the Founders Pledge, Inhabitr, and gBETA Pitch Night

Founders Pledge: Support the Organizations that Support You

BETA Showcase, Greater MN, and Launch MN comes to St. Cloud

7 Places to Spot Us at Startup Week

The Greater MN Meetup, Parallax, and Exponential Medicine

Greater MN at the big show, Neela Mollgaard heads Launch MN, and Misty’s roadtrip.

Talking VC, tech kids, and Forge North’s Horizon

June: Great North Labs’s first fund raised!

May: Innovation Ecosystems, SingularityU Kickoff, and PrintWithMe

April: Minnebar Recap, ZenLord Pro, and Supporting Entrepreneurs

MinneBar 14 Recap

Dispatch and 2ndKitchen claim Tech Madness titles

Minnesota Innovation Collaborative

March: Minnebar, Hockey + Hustlers, and Innovation Workshops

Great North Labs at CES

Dec.-Jan.: Top Posts from 2018, pepr, Glowe, and Misty Robotics

Carried Interest: Top Posts from 2018

Oct.-Nov.: Singularity University, Exponential Tech, and the State of Innovation

Digital Transformation Summit, July 25th in Minneapolis

June: Silicon Lakes, FactoryFix, and the Digital Transformation Summit

Putting the “Silicon” in Silicon Lakes

Digital Manufacturing and Logistics

May: Team Genius, IoT, and the Future of Everything

IoT 3.0

Healthcare Innovation

March: Exponential Tech, the “Goldilocks Zone”, and Minnebar 13

February: Team Expansion, Dispatch, and Startup School Events

Great North Labs Newsletter – December 2017

A Letter To My Younger Self

Great North Labs Newsletter

Great North Labs Featured on Tech.mn

Great North Labs Featured in St Cloud Times

Great North Labs – Featured on BizJournals.com