In this episode, we talk about early-stage scaling. What it looks like, how to think about it, and what it takes to generate growth.

We are joined by Eric Martell, Founder of Pear Commerce. Eric is a former founder of EatStreet, and a former Managing Director and Venture Partner at gener8tor.

With a background as a founder and as an investor and startup mentor, Eric has a lot of perspective on early-stage growth. He talks about what it takes to succeed: being obsessed with solving a problem (not with the solution), getting traction by creative means, and good old-fashioned hustle.

He also shares how to land VC money: by demonstrating the aforementioned traction, hustle, and creativity; being willing to swing for the fences by taking risks; and understanding that the math that drives VCs means your business needs to be capable of reaching a tremendous valuation.

Who does Eric see executing? Adam Choe, a former Managing Director at Gener8tor, current VC, and professor at University of St. Thomas.

Transcript:

Execution is King Podcast (with Eric Martell) Edit Round 1

Tue, 5/17 3:42PM • 35:06

SUMMARY KEYWORDS

founders, company, investors, building, startup, people, customers, big, problem, rob, crazy, work, vc, retailers, generator, turkey burger, eric, diners, restaurants, scale

00:09

Welcome to the execution is King podcast where we talk to successful startup founders, investors and ecosystem builders to uncover insights and best practices for the next generation of great global startups. My name is Joseph Siebert. Today, my co host is Rob Weber, managing partner at Great North ventures. Hey, Rob, how you doing today?

00:30

I’m doing well excited about our guest today. Yeah, me too. You

00:34

know, this is a topic near and dear to our heart. I can’t imagine a topic near or Dear actually, we’re going to be talking about early stage scaling, right about how to generate growth, what to look for in like founders, what it really takes to be able to scale at an early stage, you’ve got a lot of experience with this, Rob, you must be excited, hey,

01:00

I think that people who haven’t founded a company or a startup, the thing that that often goes unrecognized is just how dedicated you have to be. And this is why I feel like you probably shouldn’t start accompany if you’re not visibly enthusiastic about that idea. And that problem set that you’re solving, because the amount of energy, you know, hours and time it needs, it really is all consuming for most of the founders. And when it’s all consuming like that, and working crazy hours. And sometimes that’s when you’re working when you’re not even working. You’re just you’re constantly thinking about scaling the business and growth. And you know, those first couple years are often so physically draining. I think this is why you often see founders, you know, they don’t just like they don’t go from startup to startup to startup, they take a break, because of just how draining, you know, you get some gray hair my case I started probably lost my hair a little faster than I otherwise would have. You know, it almost just because of how consuming being a founder can be in those early years. It’s I think it’s like a positive stress most of the time, like, but it’s still stress. And, you know, I think it’s why people get off the hamster wheel after they have an exit for a while, they usually come back to it because they’ll miss it. But you know, it’s often nice to get a breather after you’ve been on it for a while.

02:19

Well, our guest today is someone who can definitely obsess over a problem in a by obsess, I mean in a very good way and who has all the hustle and the ability to do this as a serial founder. This week. Our guest is Eric Martel, founder of pair commerce. How’re you doing today,

02:35

Eric? Oh, I can’t complain. Thanks for having me on, guys.

02:39

So Eric, we’ve known each other for a few years now. I met you when you first moved to Minnesota from Wisconsin. And you’ve had a pretty diverse background as a founder and then organizing the accelerator now founder again, can you kind of provide a little bit of background on kind of your journey to what you’re doing now?

02:57

Absolutely. So yeah, Rob, I think we met each other back in 2016. When I moved here from Madison, I don’t consider myself a Vikings fan. I’m a Packers fan. But in every other way I consider myself to be a true Minnesotan at this point.

03:13

Oh, that sorry. Sorry to interrupt, but the podcast is now over. Thanks for coming.

03:21

I think the first Packer fan we’ve had on the podcast, but you know, you did move years. So you know, we let that we let it slide.

03:27

Yeah, absolutely. Forgive me my faults, and I’ll forgive yours. But yeah, so I’ve been in the entrepreneurial Universe since 2009. Myself and two of my college friends started a company called Eat Street. The summer between our sophomore and junior year at the University of Wisconsin Madison eat street powers the online ordering of 15,000 restaurants nationwide, primarily in college towns of 100,000 to a million residents. I like telling folks even here in the Twin Cities, we don’t have much of our presence, the city is too big for us. But if you ordered some celebratory pizza in Lawrence, Kansas after the NCAA championship, there’s like a 95% chance that that food was delivered from my old company. So I was there from 2009 until 2016. That was the point when I decided that Madison wasn’t cold enough for me. So I moved up here to the Twin Cities and joined generator the startup accelerator As Rob mentioned, I had been a participant to the generator accelerator with my first company eat street, love the team love the vision, and was really honored to help open up the first office here in the Twin Cities along with a guy named Mark McGwire. I was there for two years, but I knew that at the end of the day, I was going to have the entrepreneurial bug again, I was really inspired by working with all these founders, so I decided I had to do it again. And I’ve been with pear commerce ever since. So that’s like the I don’t know maybe 62nd overview of you know, the last 13 years of my life I’ve and I’ve worn a lot of hats. I’ve been both an investor and investee, and I love every second of, you know, building companies. And

05:09

so tell us more about pair commerce. What was your inspiration? And, you know, how has that evolved since focusing on launching peer commerce?

05:19

Yeah, at my first company eat street, it was a two sided marketplace, we had to have restaurants. And then of course, we had to have hungry people ordering food from us. And the hungry people side of it, the diners, we really built that customer base with digital advertising, Facebook, Google, tick tock, I mean, you name it, we’ve probably spent tons of money on that ad network. And the great thing about building that giant list of consumers was that everything was really transparent to the digital space. Like somebody would click on an ad, we would capture their information as they actually went and checked out and bought some pizza on our website or app. And that allowed us to do things like remarket back to these people say, Hey, are you hungry? Again? Do you want to buy more pizza, and really helped us learn who our customers were so that we could run more effective digital advertisements to acquire new diners? Pair commerce came about because my fiancee, who has worked in CPG, for the last half a decade, was actually at the time Head of Marketing for a turkey burger company called Mighty spark here in town, that company was running digital ads, but they didn’t actually sell turkey burgers on their website. So she was like coming back to me every day and saying, Oh, my God, you are so spoiled, because you’re able to actually like see what your digital ads do for you. Whereas for us, if somebody clicked on our ad for a turkey burger, where they’re going to take you to a blog post, that’s just information about a turkey burger, I mean, who the heck cares about that. Or we can send the traffic to a retailer that sells our product, but we get no confirmation of sales out on the other side, we have no idea how many people buy the products, we have no idea anything about the products. And she’s like, you know, it’s totally worthless restaurant digital ads. And I was like, totally worthless. I mean, that’s, that’s an upside down understanding of like, the value that I see in digital ads. So I set out to build a company that basically provides the same kind of transparency and benefits to digital ads that are for companies that sell through retail, as I myself had been, like, super spoiled with at eat street running ads that were more or less direct to consumer, where we were the ones both advertising and selling the product. So basically, pair Commerce has tried to be a company that provides the benefits of direct to consumer performance marketing advertising, to companies that sell their products, primarily through retail,

07:38

well, you’re making us look like bad husbands, Eric, I gotta say.

07:43

She’s like Beyonce at this point. So I don’t, I’m neither a good nor a bad husband. I’m just

07:51

as Eric knows, I spent 16 years in both consumer app world and then also building mobile ad tech where, you know, dealing with AD attribution, and building and developing digital performance advertising systems and technology. And so I know the there’s a lot underneath all of it to make it work. And to try to do that in a market that doesn’t have, you know, have that infrastructure yet. It’s, you know, it sounds like a mountain of a task, I imagine you have to probably work with online retailers as well as the brands Right? Or how does it all work?

08:28

That is the biggest crucial piece of what we’re trying to build is, we want a retailer to provide transparency into the purchase, if a CPG company sent the traffic to the retailer in the first place. It’s like a clean trade, like, we’re going to help you as a retailer, grow your business online. But what we need as a brand, you know, Hershey, us who’s spending millions of dollars on advertising, it’s sending this traffic to retailers, is a little bit of transparency into what’s actually happening with the retail. So of course, there’s a whole lot of complicated technology that goes into like, you know, capturing and exchanging this kind of information. But really, at its core, it’s more a human problem than a tech problem. It’s approaching retailers and aligning incentives so that they understand the value of receiving traffic from brands in exchange for more transparency. And I’ll tell you, I mean, we’ve been at this for like two and a half, three years now. And it’s not been until the last like six months, that we’ve really gotten massive buy in from retailers. But at this point, we work with three of the top six grocers. We work with the largest club store, we work with the largest electronics retailer, the largest alcohol delivery company, we’ve really been able to get them to see the value of exchanging a little bit of transparency to the products that they sell, and the companies that you know, make those products in exchange for receiving, you know, massive, massive amounts of traffic that helped them grow their own business. So it’s a tough problem, but it’s a human problem. And yeah, it’s probably taken a few years off my life and I’m finding my first gray hairs. Now, Rob,

10:03

welcome to The Club.

10:06

How would you go about validating the idea for pair? After you? So after you talked about the inspiration and recognizing that there’s an opportunity here, but I imagine you had to like, you know, there’s a little bit of iteration and formulation, when you’re trying to figure out exactly how to figure it out, especially with a two sided marketplace like that. How did you know that you had like, kind of hit on the winning formula?

10:29

Yeah, admittedly, we fell in love with the problem, because it sounded really complicated. And nobody else was like, really delivering value on that problem of like providing CPG companies that sell through retail, the transparency and performance marketing playbook of direct to consumer brands. And we loved how that sounded on paper. But we had no idea originally exactly how we were going to go about what we really did as immersed ourselves in a network of mentors and potential customers. And what I found is, you know, maybe even the easiest way to get sales is to come to somebody for advice in their perspective. And, you know, have them say this is a good idea, or this is never going to work. And if they think it’s a good idea, they might sign on as a pilot customer. So for us, I mean, I think that we could count no less than four iterations of the product. And I mean this in like, significant ways where, like, we totally reinvented our way of following through on this goal, and this problem statement that we had fallen in love with. But it took, like, you know, building an MVP, bringing it to customers and saying customers, you know, there’s somebody that I’ve been talking to in the CPG universe, who got all four of the pitches, and on the third one, he was like, Uh, you’re almost there, but like, it’s not quite going to be able to deliver the value that I’m looking for, I don’t think it’s gonna work retailers aren’t gonna say yes to it. But, you know, the proof is really kind of in the numbers. And what we did is eventually found a strategy, where we’ve aligned incentives correctly between the consumer packaged goods companies and the retailers, we built the necessary technology to, you know, facilitate that, you know, alignment of goals. And it’s been off to the races for us since that. And so we’ve been growing 30% month over month for the last nine months. But God, it took some patience and dozens, if not hundreds of customer conversations, and not being super in love with any individual solution to the big problem that we were trying to solve until we found that correct solution. And it’s almost like, you know, when you know, because then the business really took off.

12:31

Oh, that’s one of the things I’ve always enjoyed speaking with you, Eric, is you have the two characteristics that I think are most important, you know, if to be successful as a founder, and it’s, it’s really centered around creativity and being analytical. And it’s sort of like, I mean, if you can tackle, you know, the CPG industry, you know, the brands and these mega, you know, monolithic retailers, like it takes a certain amount level of just insanity to want to, you know, to go into that space, you know, but, but I mean, that is an all, you know, in the best ways, like, it’s not an easy, it’s not easy to get big companies to move. But I’ve just really enjoyed seeing this, you know, analyzing the problem falling in love with the problem, but then also kind of, you know, the creativity that goes into finding the right solution, right, like, like you said, you’re on your third iteration or whatever on, you know, on Pierre now, right?

13:21

Yeah, number four, actually, and thank you, blushing, and you’re probably giving me too much credit. But I mean, I also, you know, it would be worth calling out that, like, we’ve been very grateful to create north from, you know, day one for the support that you guys gave us, after we had a little bit of traction, we’re still kind of searching for our true north, and you guys believed in us as leaders, you know, we could not be in the position that we’re in right now. If it wasn’t for the support of, you know, our investors on our precede and our seed round. So, thank you guys for helping me pay my bills, as I’ve gone, you know, looking for the solution to this massive problem. And, you know, we’re pretty confident to this point that we’ve cracked it.

14:03

Yeah, let’s jump into that a little bit more in Thanks for the kind words, we appreciate it. But if you if you think about, you know, what are some of the lessons learned? So you raise quite a bit of capital while at each street, then you have been on the other side with generator and as an investor, and then back to being a founder again, what are some of the things that you’ve learned along the way for, you know, how to raise venture capital, and just, you know, things that maybe gaps that you see that maybe some founders struggle with? Is there anything that stands out to you?

14:33

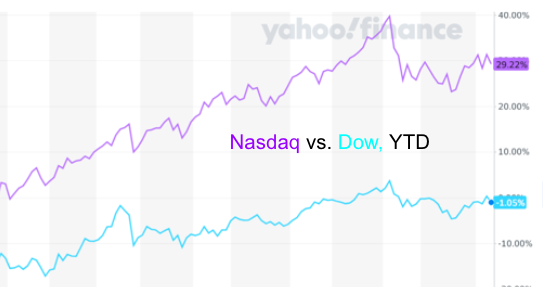

Yeah, well, the first one, and this is just something that we said repeatedly generator is that traction speaks the loudest, and at eat street, we were relatively significantly entrenched by the time that we went out to raise money. You know, we had paying diners. We had restaurants. You know, the concept was working on a pretty small scale at the time, but you You know, the concept was working? I mean, then the question just became like, how large can this go? and pair it was a little bit different because enterprise sales do take a long time, you know, what I think that we had going for us, in addition, of course, to a track record of being repeat founders, and was the fact that we were learning so much by the day, from these customer conversations that we’re having before they were even customers. So when I would talk to you guys, or when I would talk to other investors, you know, when we do our check ins, it’s like, you know, listen to like, you know, this new revelation, like how much closer we’re getting to solving the problem, you know, having people initially committing for pilots, you know, that was a pretty good proxy for, like pure revenue traction for us the first time around. But I think a lot of people think that like, you know, the extra 10%, that goes between, you know, being unsuccessful and successful and raising around is like, you know, the quality of the Photoshop of the deck, and like, what really speaks, you know, the loudest is probably like, you know, the progress that the company is making. And you don’t get that without rolling up your sleeves, and just putting in a tremendous amount of hard work. So I think that that’s the first thing that comes to mind. The other thing that I would say, that comes to mind, when it comes to fundraising is like, your investors are counting on you to be a big success, or at least they’re counting on some of the companies in their portfolio to be a big success, you know, they’re placing, you know, that’s with every single company that they invested to, but you need to justify that you can be a big enough success, that, you know, the fund math actually works out. I mean, if you imagine that an investor is investing out of a $50 million fund their investors because it’s not coming out of their own pockets, like they have people who invest into them, those investors are expecting, you know, at minimum, probably $150 million, coming back in 150 million is a staggering amount of money, when you consider that VCs are only taking tiny slivers of companies in terms of ownership of themselves. I mean, you know, great North labs does not own pair commerce, great North labs as a sliver of pair commerce, and realizing from the onset, that your company needs to exit for hundreds of millions, if not billions of dollars, is the only way that, you know, you can probably like position your story in such a way as to attract venture capital. And you have to be honest with yourself from day one as well. Because if you’re like I can’t make a justifiable statement that this company is probably going to be, you know, a $500 million company, why put yourself in a position where you accidentally successfully fundraise. And now you and your investors incentives are misaligned. So I would say, you know, dreaming big, having the justification to dream big, like going after an opportunity that’s big enough to necessitate, you know, venture capital dollars, it can make money for the VCs, coupled with some traction. I mean, those are like the dyed in the wool ways to go ahead and like raise some venture capital.

17:51

I couldn’t agree more, Eric, you know, you show this, this sort of lack of understanding from a founder as a VC, if I put on my VC hat when, you know, you kind of see in their pitch book, this sort of 10 year plan to get to like 3 million in ARR. And unless there’s some really special technology that, you know, that is going to cause the company to be valued more than beyond its revenue, like, that’s just not going to get to the returns, that a VC is going to need to have almost any size, it shows a lack of understanding, right? Like, that doesn’t mean you can fake it and say, Hey, we’re gonna get to 100 million in ARR. But there’s no underlying plan, you know, what you want to be able to understand, I think is, you know, it’s that sort of upside scenario, like, how does this look like a 50? Or 100 million run rate company, right? And what’s the path to get there? And what are your assumptions and be able to walk through, you know, rather than even go through a deck, if you can have that kind of a conversation? And there’s substance behind it? You know, like, kind of the way you’re describing it, I think you’re gonna have a much easier time raising money. Right?

18:54

And totally, and for founders, Eric, I mean, what kind of advice would you give to them? Or if there’s numbers aren’t saying that, you know, they’re venture backed ball? I mean, would you say, hey, figure something else out? bootstrap it? Or would you do more of the, you know, swinging for the fences? approach?

19:14

I think that totally depends on you know, what the founder kind of wants to get out of life, I made that sort of as a try to answer but look like, I think that the majority of us would probably be pretty happy 10 years down the road and Rob scenario, to be the sole owner of a company that’s making $3 million a year and maybe a million of that is profit, I mean, shoot, like, you know, I’d be paying myself a whole lot more. If I had a company that I owned 100% of I could put a million bucks in my pocket every single year. And I know a lot of investors you know, who, you know, built their businesses now. are leading the good life right now. I think, you know, in the case of me and Alex and the reason why we keep on doing this crazy venture capital like world, really is just because Like, we like solving massive problems with like, you know, tons of moving parts, because like, that’s just what gets us fired up. You know, I mean, some people get fired up, you know about their job because they enjoy like managing people, some people get fired up about their job, because they’re artists and you know, they’re creating art. For me and Alex, like, I just, I mean, I shouldn’t speak for him. But for me personally, like, I wouldn’t be happy if I wasn’t solving a problem at massive scale, because like, I like puzzles, and I like challenges and that kind of stuff. And you could still face big challenges and come up with creative solutions when you’re building a like smaller, you know, business that you own 100% of, but I think Alex and I like this idea of like changing industries and turning them upside down. And that’s why we’ve gone after like, such crazy problems are day wide. What do you look around

20:48

at, like Midwest startups? Do you see other founders doing that? Or do you see more of them slipping into that, like value protection? Versus like growing value growth, or creating value growth mode?

21:01

Yeah, that’s such a good question, Joseph. So I’ll speak from, you know, some degree of experience here. And I think we did a ton right at eat street and I eat street continues to thrive. But if you do the side by side comparison to a company that was founded two years after us DoorDash, which is now worth $40 billion, more than Target Corporation, I think the difference probably in certain chapters of our life is that we looked at things that DoorDash was doing, and we were like, that is crazy. Like, why would they ever do this? Like for instance, they were listing restaurants that they didn’t have a relationship with, and just collecting the orders, and then they would call in the order over the telephone. And they wouldn’t make any money on that. In fact, they lose tons of money. And eventually, they got sued by the In and Out Burger for like doing that. Well, you know what they did, they provided like a ridiculous amount of value back to their diners, because now all of a sudden diners could order In and Out Burger online for the first time ever. They worked it out with it at Burger eventually, where I think that they’re like back to being best friends forever. But the point was, would we would look at that, we would say, oh my gosh, this could put the entire business in jeopardy. What ended up actually happening is that, you know, DoorDash is like Elon Musk style, like a bet the house over and over again, it’s like, you know, we’re not big enough. So like, Let’s go big on something that sounds crazy, you know, eventually propelled them to be probably one of the top five startup successes like the last decade, this time around, you know, Alex and I are trying to take that mindset where it’s like, you know, $1 million in revenue, $10 million in revenue, $100 million of revenue, like, you always have to just be like striving so hard for like the next milestone, and doing things that might at first seemed like, they’re super crazy. Now, again, that’s not a knock on Easter, because he’s really created like a ridiculous amount of value for its investors for its shareholders. For the founders. I mean, it I owe everything that I have in life, probably to that like, you know, startup career launch opportunity. But in some degree of hindsight, you know, the venture capital universe is built on people taking big crazy, that’s just betting the house over and over again. And I have newfound admiration for my former competition. And I’m trying to learn like from what’s worked at eat street, and also from that mindset that some of those crazy aggressive Silicon Valley companies take to become like multibillion dollar businesses.

23:21

So Eric, that’s really interesting. You think about this sort of growth at all cost mentality, you don’t, I’ve gone through a couple of cycles, market cycles, you get the.com bust in my early 20s, that I lived through as a bootstrap founder. And then the financial crisis of 2008 is timeframe. Now we’re heading into this recessionary period. You know, I guess, in my past experience, it seemed like that grow at all costs, mindset was perhaps disadvantage more so in like recessionary times. And perhaps then the advantage can start to swing back to the more a little bit more of a lean approach versus the where they call it the Blitzscaling. But I think I think there is a role for Blitzscaling I think, I think sometimes it’s just situational, right? You got to know like, when’s the right time to blitzscale? And when is it not? And you also see these massive flame out companies that they blitzscale with a bad business model, that just never works. And they all they do is burn up a bunch of cash. And it’s very nuanced, right? It’s not like, it’s not like the default is always just blitzscale. It’s sort of like the economic period has affected a role. The business model and strategy has a role, even how competitive is the space you’re in, you know, has a role. So it’s kind of I find that always really tough to kind of try to gauge

24:38

I totally agree. And maybe I should even rephrase like my thinking on the previous point. My co founder, Alex, also used to work at Facebook, and their original slogan for their engineers was move fast and break things. And then they changed it eventually to move fast with stable infrastructure, which I think you know, is a good analogy for like the blitzscale laying, slash, like taking bold bets. What I was trying to kind of say is, you know, don’t ever write off an idea is a bad idea because it sounds crazy, like you owe yourself crazy ideas that can 10x your business. But it’s got to be done on top of like a solid business model. And like, you know, doing crazy things, does it always be like spending more cash like DoorDash, listing In and Out Burger as, you know, place that you can order from and then they just call in the order? I mean, they probably spent some money on that. But that wasn’t like a, you know, we need a billion dollars to listed up burger it was more like they took a first principles approach to like, is this going to add value to our diners? And the answer was yes. And on face value that might have seemed like kind of a crazy idea, but it actually wasn’t. And so my argument would be, never write off ideas as crazy. Give them the time of day because they can really help grow your business. And don’t at all try to blitzscale until you have product market fit because otherwise you will like giant piles of money on fire. Our approach is just like, you know, once we’re rolling, like we’re not planning on spending more money than we have. But what we are planning on doing is like really doubling down on crazy opportunities to grow the business even more quickly.

26:10

What are some of the things that you did to hack growth when you were at eat street? So you just talked about like, strategically, you know, this idea of swinging for the fences, right? Create that infrastructure? And then give yourself the opportunity to 10 acts by pursuing these these crazy things? What are the some of the things that you did just like a level down from that strategy, some of that tactical stuff when it comes to like creating growth? Yeah, straight?

26:37

Well, you know, I mean, I think statute of limitations from 2009 is all up. So the complete transparent thing is that we like, we hustled our ass off, I mean, we, you know, I think put out over a quarter million flyers over the course of like, six months by actually, like, you know, working our way into student housing, like waiting for somebody to have the door open, like sliding a coupon code under everybody’s doors. I mean, we, you know, got a call from the massive police department at one point saying, Hey, you guys got a cool and otherwise, like, you know, the next time we see you, we’re gonna like pick you up off the streets. And we were always on the right side of ethical, but we were doing absolutely everything in our power to scale, in some ways very inefficiently at first, but like, You got to kickstart the flywheel your first customers are not going to be the same as the customers that you acquire after you’ve hit like some massive scale, you got to work your ass off for them. Thinking back to Madison, like we ran some very deeply discounted food deals to like get people to order from our website, where it was like, Hey, you can get $1 subs from like, you know, a Jimmy John’s style restaurant, but only if you order through us. And Matt, Alex and I were like working part time jobs at the time, like other part time jobs. And we were like funding that out of our own pocket. I mean, I remember my bank account went negative, because I bought so many sub sandwiches for other people. Well, that was what she had to do to, you know, again, get that initial spark that could turn into a giant fire, I would encourage founders, you know, especially in the early days of their company, like just like, work really, really hard. I mean, you don’t have to be so strategic about it. And then once you have some scale, then you have to start thinking, okay, how can I get 10 times 100 times bigger than this without just passing out 10 times, or 100 times more flyers that we’ve already passed out. But we just we were, we were wild. Back in the Madison days. I mean, we were skipping Saturday nights going out to the bars. And instead, we were, you know, passing out flyers, and that’s what it took to get our business off the ground.

28:33

So Eric, I think your description of of growing in the early days is really consistent with my own experiences, and that of what I’ve just observed, I mean, you have to do the things that don’t scale to get that spark going. And every behind every great startup is some kind of something that doesn’t scale or, or maybe it’s a creative, you know, method that doesn’t scale, or isn’t going to work forever, but it can at least work for a while. So you have like, you know, whether it’s Tinder and how they got started at, you know, certain like parties or you had like, it’s famous kind of how Airbnb got started by you know, like auto posting on Craigslist, or Pay Pal. You know, infiltrating eBay sellers. And just like the, the back and forth and, you know, there always seems to be these, like clever ways of, of sort of faking it till you make it right. I don’t know. So I, I it almost seems like more more of the exception. You know, I can’t even think of very many businesses that maybe maybe there’s some just vanilla like enterprise SAS kind of businesses where you could just, you know, but even then you still need to, you still need to get your first customer and you got to do whatever it takes, right.

29:46

Yeah, Rob, I couldn’t agree more. I think that the ultimate founder combination is a growth hacker and you know, somebody who thinks strategically and you know, sometimes they’re the same person and sometimes, you know, it’s a team of people. I’m really grateful to Matt, my co founder back at eat street and Alex, my co founder through both of my companies for help rounding out my strengths and weaknesses. And I think that together, you know, we’re able to check all those boxes. But honestly, the strategic thinking, like really plays its part once you hit a certain size, and then you’re like, oh, I need to think about how I can scale efficiently to be 10 times or 100 times bigger. But let’s be real, like 99% of startups don’t ever get quote unquote, big in the first place. You don’t have to overthink growth hacking, you just have to put in the time and the elbow grease, I mean, you know, you got to come up with some clever ways of connecting with your first customers, but a lot of the times, that’s just gonna be like, a whole ton of like, manual work and effort. So I would say to founders, you know, kind of getting their businesses off the ground. Like, don’t overthink this, you know, strategic, like, how do I scale to a billion dollars, like workouts scaling to your first $100,000? And do that in ways that don’t necessarily scale permanently? But like, usually, it’s just like, how many hours have you put on the clock, like trying to get those first customers and work relentlessly and you’ll get there. And then once you’re there, then you can start thinking, you know, a little bit more strategically about how to scale a general but like, I mean, you know, I guess if I had to summarize it, it’s just work your ass off of the early days, and you’ll be very, very happy with the result.

31:17

So from your time as an investor and working with early stage startups at generator, is that advice you would give? Or is that like a tool for screening that you would lean to? What do you ask them like about their first customers? And how many hours they’re putting into it? How did you filter like, I’m enamored by this idea that this is entirely required, that you have to be able to do this stuff? And I’m sure there are a few outlier examples where, you know, like, like Rob said, some of these b2b companies may be where they didn’t have to have this kind of hustle. But is that something that you saw across the board when you were working with early stage and something you would like filter for and encourage and startup founders?

32:03

Yeah, totally, you know, I’d say that hustle and early traction were like the number one things that we were screening for a generator, VC has a low hit rate, I mean, a generator probably has a lower hit rate than anybody, because we’re investing at the earliest stages, but like, a lot of the companies are not going to work out. And you just kind of have to build that into like, your understanding that not every company is going to necessarily be a home run right off the bat. But, you know, probably the strongest indicator that we would have in the future was just like sitting down with the person maybe even after the original interview, like getting drinks and asking them about how they got their first customers that if they told that awesome story right there, I mean, that’s gonna go extremely far, I would say in terms of like, probably getting you into generator, you know, something that I would recommend to anybody who’s like looking at those programs, or, more importantly, anybody who’s getting a business off the ground, you know, get creative and work super, super hard.

32:55

So for founders, hustle, swinging for the fences, right? And when you’re pitching your story to Vc, pitch them that dream, right? pitch them those big numbers, that a good synthesis.

33:08

I’d say you captured it all in probably 10,000 less words than I’ve gotten.

33:15

So when it comes to people who are successfully swinging for the fences, and who are able to hustle, who do you see executing right now? Maybe it’s a startup, maybe it’s an individual, maybe it’s someone everyone’s heard of, maybe it’s someone nobody’s heard of, who do you see executing right now?

33:33

Yeah, I’m gonna give the hat tip to my very good friend and former coworker, Adam Cho, who came up through generator with me, he was a managing director, as well as myself, we both worked at the Minnesota office, what impresses me so much about Adam is that he’s gotten like multiple lines in the water. I mean, I’ve never been able to have more than one line in the water personally. So I don’t know if he doesn’t sleep or what. But, you know, he’s actively working as a venture investment right now for tundra ventures, which is an upcoming VC in the Twin Cities. And he’s, you know, running basically like a community and working for an NFT community, you know, in the crypto space. And then, also, he’s teaching at St. Thomas. And what I what I love about Adam is that, in addition to building a lot of value himself, I believe is that if T project is going to be successful, I think that tundra is going to be successful. Adams, the kind of person who’s like lifting up the creating entrepreneurs of the ecosystem. You know, I think he’s inspiring students that say, Thomas to begin entrepreneurial careers. He’s very generous with his time for any founders looking to get something off the ground. And I just think that, you know, he’s kind of superhuman in his efforts and couldn’t say enough good things about it.

34:51

Well, thank you so much for joining us on the podcast, Eric.

34:55

Awesome. Well, thank you for having me, Joseph.

April Newsletter

June Newsletter

Demystifying Startup HR

Head of Finance & Fund Administration- Venture Capital Firm (Remote)

Demystifying Startup HR

3 Portfolio Companies Make Inc. 5000 + Quicklly & Instacart Expand

iraLogix closes $22M + Branch expands with Uber

iraLogix closes $22M Series C

Flywheel lands Gates Foundation grant

Venture Capital Analyst

Orazio Buzza, Founder and CEO of Fooda – on Episode 13, “Execution is King”

$40M Fund II Raised!

Eric Martell, Founder of Pear Commerce: Episode 13, Execution is King

Great North Ventures Raises $40 Million Fund II

Investment Thesis: Fund II Strategy

Investment Theme: Community-Driven Applications

Investment Theme: Digital Transformation Through AI

Investment Theme: Solving Labor Problems

Trends in the Gig Economy + Work in the Metaverse

Portfolio raises $125M + talking fundraising with Branch CEO

Omnia Fishing closes $4M round, joins Great North portfolio!

Atif Siddiqi, Founder/CEO of Branch: Episode 11, Execution is King

Michael Martocci, CEO and Founder of SwagUp: Episode 10, Execution is King

Yardstik new to portfolio, closes $8M Series A

First venture studio startup comes out of stealth!

Insights for founders from a data guru, + FactoryFix raises a Series A!

Una Fox: Episode 9, Execution is King

Start With a Mobile App, Not a Website

2ndKitchen acquired by SoftBank-backed REEF + advice from an early Googler

Joe Sriver, 4giving: Episode 8, Execution is King

2ndKitchen Acquired by REEF

Venture studio startup jobs + advice for founders from founders

Best Advice from the Great North Annual Event: Episode 7, Execution is King

Newsletter: Do you fit our investing themes?

Jonathan Treble, PrintWithMe: Episode 6, Execution is King

Anna Mason, Revolution: Episode 5, Execution is King

Mynul Khan, FieldNation: Episode 4, Execution is King

Nick Moran, New Stack Ventures: Episode 3, Execution is King

Molly Pyle, Center on Rural Innovation (CORI): Episode 2, Execution is King

Justin Kaufenberg, Rally Ventures: Execution is King Episode 1

Newsletter: “Podcast Launched: Execution is King!”

“Execution is King” – the Great North Ventures Podcast

Newsletter: Fund II is open for business!

Unlocking the Potential of Anonymized Commercial Real Estate (CRE) Data

Fund II is open for Business!

Mike Schulte Promoted to Venture Partner

New Name + New Venture Studio

Great North Launches Startup Studio

We Don’t Need No [full-time MBA] Education

How the University of Minnesota is Embracing Startup Culture

Top Stories of 2020, iraLogix, and LaunchMN Calls for Mentors

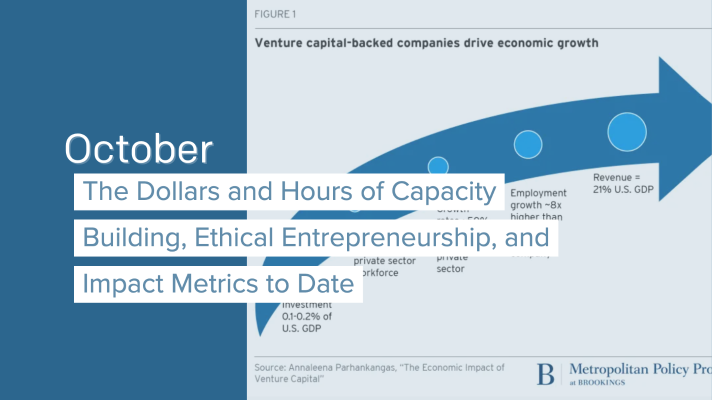

Building Capacity for Innovation

Seizing Opportunity in a Recession, Allergy Amulet, and Twin Cities Startup Week

Recessionary times, a record-setting IPO, and Minnesota’s Resilient Startups

Minnesota's Resilient Startups

July 4th, Equitable American Dream-ing, and Robots Diagnosing COVID

Jumpstart, the Startup School, and Branch Wins a Webby!

COVID-19 Trends, the Great North response, and our Founders Survey

Giving in the Time of Coronavirus

COVID-19 Resources for Startups, State-by-State

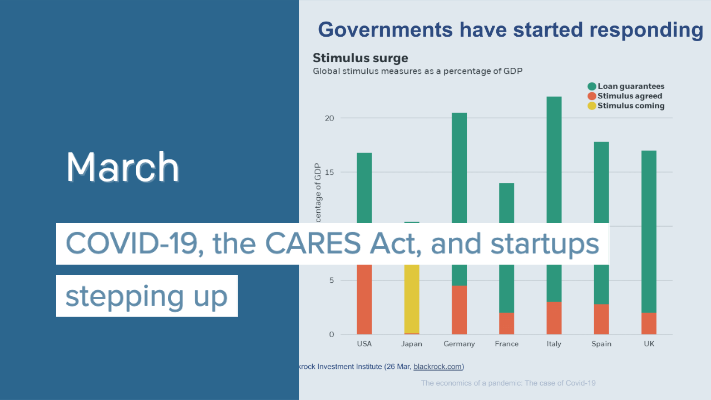

COVID-19, the CARES Act, and startups stepping up

New Business Preservation Act

Digital Future Boardroom, PartySlate, and The Lean Startup School

Great North Labs’s Startup Summit 2020

Great North Labs's Startup Summit 2020

World Economic Forum, NoiseAware, and the Startup School reboot

Great North Labs at the World Economic Forum 2020 in Davos

Top 5 Stories of 2019

Taking the Founders Pledge, Inhabitr, and gBETA Pitch Night

Founders Pledge: Support the Organizations that Support You

BETA Showcase, Greater MN, and Launch MN comes to St. Cloud

7 Places to Spot Us at Startup Week

The Greater MN Meetup, Parallax, and Exponential Medicine

Greater MN at the big show, Neela Mollgaard heads Launch MN, and Misty’s roadtrip.

Talking VC, tech kids, and Forge North’s Horizon

June: Great North Labs’s first fund raised!

May: Innovation Ecosystems, SingularityU Kickoff, and PrintWithMe

April: Minnebar Recap, ZenLord Pro, and Supporting Entrepreneurs

MinneBar 14 Recap

Dispatch and 2ndKitchen claim Tech Madness titles

Minnesota Innovation Collaborative

March: Minnebar, Hockey + Hustlers, and Innovation Workshops

Great North Labs at CES

Dec.-Jan.: Top Posts from 2018, pepr, Glowe, and Misty Robotics

Carried Interest: Top Posts from 2018

Oct.-Nov.: Singularity University, Exponential Tech, and the State of Innovation

Digital Transformation Summit, July 25th in Minneapolis

June: Silicon Lakes, FactoryFix, and the Digital Transformation Summit

Putting the “Silicon” in Silicon Lakes

Digital Manufacturing and Logistics

May: Team Genius, IoT, and the Future of Everything

IoT 3.0

Healthcare Innovation

March: Exponential Tech, the “Goldilocks Zone”, and Minnebar 13

February: Team Expansion, Dispatch, and Startup School Events

Great North Labs Newsletter – December 2017

A Letter To My Younger Self

Great North Labs Newsletter

Great North Labs Featured on Tech.mn

Great North Labs Featured in St Cloud Times

Great North Labs – Featured on BizJournals.com