In this episode, Rob and Josef talk about of-coast investing, and the strategy behind Revolution’s Rise of the Rest Seed Fund and its founder, Steve Case.

Anna Mason, Partner at Revolution, joins, and Rob talks about how they met, and about doing deals for the past 5 years. Anna shares how she went from Wall Street, with a front-row seat to the housing crisis and the Great Recession.

She also speaks to the importance of investing in under-capitalized regions, and in being intentional about inclusivity, especially in the wake of COVID where some metrics reveal a backslide in DEI progress.

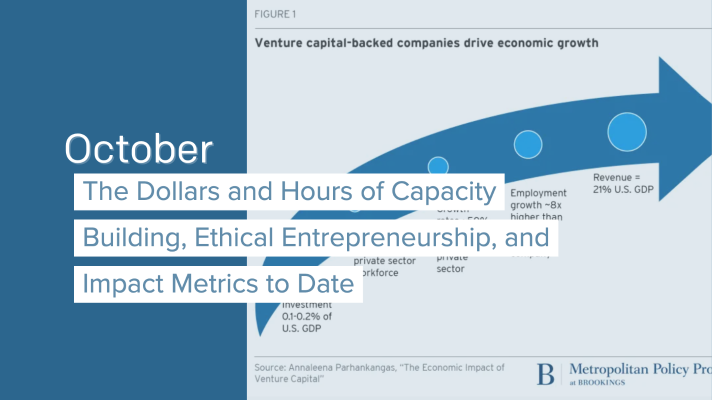

“We see opportunity first, through the lens of geography. The drive-it-home statistic that we have long focused on is that while the industry has grown as an asset class from $10B up to north of $150B a year, 75% of the capital invested every year still goes to three places: California, New York, and Massachusetts. “

Anna talks about the bus tours with Steve Case, which is an iconic exercise for the fund, and how people react to their arrival.

Spoiler alert: Steve does not drive the bus.

Who does Anna Mason see executing? Founder Rathna Sharad and Flavor Cloud, and recycling startup Recyclops.

Full Transcript Below:

00:09

Welcome to the execution is king Podcast, where we talk to successful startup founders, investors and ecosystem builders to uncover insights and best practices for the next generation of great global startups. I’m your host, Joseph Siebert. Joining me today is co host, Rob Weber partner Great North ventures. Our guest is Ana Mason, managing partner at revolutions Rise of the rest Seed Fund, Rise of the rest invest in promising companies at the seed stage. Were outside of Silicon Valley, New York City and Boston.

00:42

On a it’s great to have you on today. The first question I wanted to start with was this Have you briefly described your path into venture capital. And also, if you could go a little bit deeper on your thesis with Rise of the rest? Maybe any more specifics as to the focus of your role within Rise of the rest?

01:01

Sure. Thanks, Rob. It’s it’s great to connect in this more public forum. I know we spend a lot of time chatting with each other about deals and I’m excited, really excited for you guys in launch this podcast. My name is automation. I’m a proud washington dc transplant. I’ve lived in the district for about six years, I like to say I have my two favorite startups are my little girls who are two and a half and five and a half. They’re fifth generation Washingtonians. And the responsible family life choice that led us to raise our kids in DC is very much so the reason why I’m there. But along the way pretty early and I got connected with Steve and revolution team. And it’s been a real privilege and an honor to just work alongside him and my other partner, a managing partner, David hall to really grow rise the rest. It’s my path into venture I think like many is an interesting one. And part of what I love about our industry, but I also think can be a little bit challenging is that there is no one clear check the box path into the industry. So I like to say that I have a bit of an eclectic portfolio of professional experiences that brought me into venture. I grew up professionally on Wall Street, I was a distressed and high yield bond and bank debt trader and also dabbled in a bit of post retired private equity. Over the years. Long story short, I had a very, very front row seat to the financial crisis in the Great Recession. coming right out of school, I landed in a job that I thought was like the greatest thing since sliced bread working at Lehman Brothers on their distress desk, which has a strong reputation. Little did I know that shortly after, you know, a couple years after I joined, I would be trading our own bonds and bank debt on that desk through one of the largest corporate bankruptcies in history. What I would say briefly just about that experience, and how I think it tracks to my path into venture is that I find myself very frequently thinking and somewhat frequently saying that venture is very much so like the other side of the coin, from distressed from the distressed investing world, you’re making big bets that typically have very binary outcomes. But the fundamental difference, and what I really love about our industry, and about our work, it rides the rest specifically is that in venture, you’re really fundamentally betting on the bright side of the coin. And you’re just, you’re working with partnering with funding and backing entrepreneurs who are really functionally optimists, I think reimagining the future, which is a wildly different universe from working in a subset of the financial markets that are focused on trading in the securities of companies who have missed the mark, they’ve missed the innovation or have some measure of corporate malpractice that is that has taken their securities into a more distressed stage. So I learned a tremendous amount in the earliest days of my career, both from the standpoint of the nature of the work we did and I did on the distressed side, but also in having gone through a major corporate bankruptcy upheaval, and merger thereafter. And that merger experience going from Lehman to Barclays taught me a tremendous amount about corporate culture. And it’s a lot of what I try to apply from an investor lens standpoint, into how we think about team construction and team values. Because at the end of the day, whether you’re a seed stage startup with five employees, or you’re a major conglomerate with 25,000, employees or anything in between, at the end of the day, your organization is the sum of its people. And so really kind of having a feel for the good, the bad and the ugly there from some personal experiences early in my career certainly guided that experience. Wall Street was beloved and have to leave it experience. So just kind of fast tracking here a little bit. My Wall Street recovery program took me to Southern California, and I lived In LA and got involved in the awesome guests years ago, still somewhat nascent startup community, they’re co founded health tech startup called burness. We originally started in the boutique fitness booking space. Like so many we pivoted early in the lifecycle of our company, when we realized we productize the wrong value proposition, happy to talk more about that later. And that pivot led us into an opportunity where we really doubled down on community and the social psychology of fitness. And so it’s been fascinating for me to see sort of the emergence and the 2.0 of a lot of social, like vertically focused social, social commerce company is kind of coming up in the market, because we were very much so playing in that space. Back in 2012 2013, my co founder and I both got pregnant. And we were in a great place with our business, traction wise, but hadn’t fully landed on our business model. So we had an awesome opportunity to soft land, our company into a major, major private company in the space called Beachbody, which was a great home for some of our engineers and the technology and the platform itself. And I moved to DC for my responsible family life choice, which takes me close to present day. So I’ve been a revolution for five years. And it’s been a real privilege to work on scaling rise the rest.

06:24

So can you tell us a little bit about the thesis behind Rise of the rest?

06:28

Yeah, at its core, I would sum up the thesis of rise the rest by saying we see opportunity, first through the lens of geography. What that means in practice, is that the guiding light and the sort of drive at home statistic that we have long focused on is that while the venture industry as a whole has grown tremendously as an asset class, from, you know, $10 billion invested a year up to now, I think north of $150 billion a year 75% of the capital invested every year still goes to three places, California, New York and Massachusetts. And so we believe very deeply and are delighted to put our money where our mouth is that brilliant entrepreneurs can have and continue to build transformative companies anywhere in the country. But the tip of the spear in activating those opportunities is early stage seed capital. And so our model is what we call a catalytic co investment model where we are high volume early stage investors. And while we do invest across industry, over the years, we’ve sharpened our pencils to increasingly focus on opportunities that sit at the intersection of, of a handful of themes and those four themes for us, our infrastructure, resilience, digital transformation, and sustainability. And so that can take us into FinTech it can take us into healthcare, may can take us into hard infrastructure. I’m pretty sure I have a small child, my little startup who somehow broke the lock and snuck in here. But that’s the thesis for rise the rest in a nutshell.

08:14

So I’m a big fan of Rise of the rest. And I know one of the things that it’s known for our it’s bus tours all around America. I know that’s been challenging to pull off during COVID. But I wonder if you could share with us a story or two, in terms of the most unique or interesting startup ecosystems you’ve come across in your travels with Rise of the rest.

08:38

Your thanks, Rob, I’m excited to get you back out on the bus with us again, whenever it is safe for us all to convene in that way again. So I’ve actually personally been to 47 cities and counting in the five years since I’ve been at rise the rest. And so these are always the hardest questions, because picking just one or even two is tough. I thought I chat briefly about to startup communities that might surprise people, even as I’m so heartened and pleased to see how much momentum the broader thesis and interest level investing outside the coasts, has become over the last couple of years. And so one, one community that I’m wildly bullish on is Tampa, the Tampa Bay Community in Florida. I think it’s most interesting to me, and I think is worth noting, because Miami, you know, sort of just across the state has been getting so much fanfare and attention and opportunity. And frankly, I think rightfully so I’m long Miami in so far as that debate rages. But I think Tampa long before COVID and in particular through COVID has had the opportunity to really kind of double down on the ecosystem that’s developing there. So some fun facts about the Tampa Bay region, average age. I don’t know if you want to wager a guess, Rob average age in Tampa Bay? What do you think?

10:09

I would I would think it’s all I think of Florida as being retirement oriented. So I’m gonna say like you say, 42.

10:16

Yeah, it’s like 34. It’s crazy. It’s 34. We learned that when we went there a couple years ago, you actually came in lower that I that I might have thought otherwise. But there’s, you know, when we visited there a couple years ago, pre COVID. We got to see firsthand what Jeff fenech and Lakshmi Shenoy and the team at embark collective or building in the Tampa community. And what’s super interesting about this, I think of it as what what we call the work live play model in our 2019 rise, the rest ecosystem playbook. There’s a major real estate development underway there, called the Water Street project, the Tampa Bay Water Street projects, it’s like multi billion dollar, really like city renovation, if you think about it. And what I love so much about what was developed there with so much thought and intentionality is that as you redevelop different areas of a city, you have to have entrepreneurship, top of mine in front and center. And that’s where you had this really this like gem in this toolbox of embark collective, which was not only startup hub and community space, but it was really a collective to bring together leaders, mentors, investors to support this emerging generation of startups in the Tampa Bay Community. And through that, they really become this like magnet or beacon. That gives people a landing place, not only for startups who are maybe relocating, or maybe are homegrown in the region, but also for so much of the talent that’s moving to Tampa, from the Bay Area and otherwise, and either wants to pay it forward, wants to find that next opportunity wants to mentor wants to invest wants to join a startup. And now there’s a space for it. And I think creating that type of network density and concentration with intention can make all the difference in a startup community. So that’s incredibly exciting to see. And I will also say, I don’t think they’ve all been announced yet. But we have four investments in Tampa, up from zero, like two years ago. So it’s really cool to see what’s happening in that market.

12:24

That’s really interesting to hear. I’ve actually been thinking about buying a place in Florida as I as I get older, the Minnesota winters are starting to, you know, catch up to me, but I was thinking more of more like southern Florida, not necessarily Tampa. So before I buy a place in the next couple of years, I will have to spend time in Tampa and see what it’s all about. Yeah, you gotta check it out. As a entrepreneur and investor, you know, so much of success, you see really comes from having a strong team and developing a team and talent. And I know with the rise of the rest, you recently completed a nationwide career fair on clubhouse, targeting all kinds of different local talent markets, such as the Twin Cities which I participated in and others, I saw you this quote that you tweeted from Brian chesky, the Airbnb co founder, who also participated, he said, You’ll never be in one place quite like you used to be, the place to be will be the internet. So see a lot more small and medium cities rising up. I could really relate to that being I’m kind of I’m not super nomadic, but I, you know, I spent a lot of time in the Twin Cities or rural like Lake town in Minnesota, and then also Chicago, you know, but I, I don’t like to be bogged down or tied down. And I think that really resonated with me Brian’s quote, but when you think about advice, you know, as you’re counseling founders through investments that the rise of the west or otherwise, what advice would you give to founders with respect to recruiting top talent? And, you know, what do you think is working best right now? And I guess, what do you think is not working?

14:02

So I love this question about place, obviously, in a, you know, in our intro discussion, I highlighted that place really sits at the foundation of our investment thesis or programmatic work, just everything we do, centers around this idea and this philosophy, its mantra, really the only place matters. And so as we moved into this space, where the realities of COVID created, I think, what some people call zoom land, like, you know, you’re sort of in nowhere USA everywhere USA. The question about, like, What does place mean, almost, at the risk of sounding hyperbolic, you know, sort of felt like it was taking on his like existential thread, about how we should all be thinking about place and one of the conclusions I’ve personally reached, in part informed by this intentional work we did through our tech talent Tour, which as you noted, Brian chesky and co headline but it was really intended to be a virtual Career Fair that could bring together active job seekers from all across the country with these startups who are in our portfolio, we had actually over 1000 open jobs across the entire portfolio. So I think a couple things on on this front. One is that I’ve, I’ve personally come to the conclusion that we’re in this moment that I’m calling like, the great unbundling of place, where when you think about it, even from a venture investor standpoint, we’re constantly chomping at the bit and looking for opportunities, like, Oh, is this industry being unbundled? And what does that mean for opportunity? And where does value get unlocked and who can really, you know, go after and chase this opportunity? I think we’re seeing the same thing happened with place where fundamentally the value proposition of place, right, which is usually where you work, and where you live, are inextricably linked, is now unlocking and unbundling. And so just like when we think about industries that are being unbundled and value creation is happening for startups, who are sort of jumping into that moment, with a very specific product offering that really just focuses on sort of like one element of the previous bundle, I think you’re kind of seeing the same thing happen, where cities can really focus on the value prop of why you should live there. And companies can really focus on the value prop of like, why you should work for us. For this to fully work, I think for cities, and for companies, and startups headquartered in Rise of the rest cities, they’re probably actually needs to be some sort of partnership that happens between the city or the economic development authorities, or the Chamber of Commerce, and startups, who often don’t get as much attention as some of the later stage companies. So that’s something I’m actually personally spending a bunch of time thinking about what could come next there that helps not only companies in our portfolios, but helps any startup in any emerging city across the country. And so all that’s to say, while there’s tremendous opportunity, because you’re seeing so many people move for individual startups, and I know all of our companies are feeling this on the front line. It’s actually also challenging, because now you’re not just competing for talent in your own backyard. We heard this from one of our startups headquartered in Nebraska, where he’s like, I used to be the best game in town, for everyone, for all these engineers, but now suddenly, they have remote opportunities in other places, too. And so I think, for companies to really put their best foot forward as they’re trying to attract top talent, and what is becoming very quickly, like an increasingly competitive market. Is that you, I think, you really have to kind of let your personality shine. I think we’re, we’ve certainly entered this age from a consumer standpoint, and I think we’re seeing this from an employee standpoint, to where values really matter a lot. And frankly, I think that culture and values people operations is something that early stage startups may didn’t always have the luxury of thinking about. But I’ve noticed, at least across our portfolio and a new companies we talked to, it’s becoming increasingly important and prominent. So two last quick things that that I think came out of actually this talent toward the first is

18:15

we discovered, and it was an exciting discovery, that so many of our portfolio companies, even early stage ones, have heads of people, Chief people, officers, VP of talent, like not just an HR person, but someone who is looking at the whole picture of what’s our culture, what’s our recruiting process, what’s our training methodology? How do we really bring people into the fold. And I love the fact that that is front and center. And so I think that I’m thinking about how you build that function. And frankly, how that becomes not just the CEOs issue to think about, is an incredibly important tactical steps that startups can take at this early stage. And the second is, frankly, just to really transparently reassess your policies for your team. We surveyed our portfolio as part of this talent or effort. And we found that while fewer than 30% of our companies had remote work policies before COVID, more than 75% plan to have a policy, either already do now or plan to just have one for the foreseeable future. And on the flip side of the nearly 2000 active job seekers who RSVP to join us during this virtual career fair 99% of them were interested in or open to remote work. There was like one person that wasn’t interested, and 67% were interested in or open to relocation. And so I just think like flexibility is the name of the game these days. And it’s a tricky terrain, I think, for startups to navigate, because it can be distracting from a focus standpoint. So again, empowering someone on your team early Who’s sort of thinking about the people function most fully, I think is really beneficial.

20:05

So along with this unbundling of work from from place, you know, as kind of education from place as well. When you think of the uvp of these different cities, a lot of it has to do at least nowadays, you know, with with education that you can attain there. But you’ve been traveling around to these cities, you’ve been investing in these early stage startups. And obviously, there is this unbundling of education happening. Right now, I don’t know how, how progressed, it’s been put, there’s all these things, I mean, Udemy, Coursera, the ones that immediately popped to mind, but then there’s things like lambda school as well, and all kinds of other opportunities to get the education you need to work specifically in, in like startup type careers that are really proliferating. But as far as like traction, that you’ve seen, you know, like at companies, have you seen people in leadership positions? Are these founders coming out of those kind of educational backgrounds? Have you seen any traction to that unbundling of place and education,

21:13

we’ve made some investments in that space in a couple different different directions and are excited to track the progress of those companies. I can’t think of specific examples of founders in our portfolio who have been graduates of those programs. But I know that there’s active hiring that happens out of those programs. And I can say, you know, I think one example of a company in that space is to you, it’s actually DC based, you know, in our backyard in DC, they’re a publicly traded company, which I think in and of itself speaks volumes to the potential of the industry and the potential for success and real traction and efficacy of that business model. Um, but we actually partnered with them as one of our core talent partners on this recent talent tour that we did. And they brought a tremendous number of candidates through the platform. And I think what’s interesting, and what you see in some of the nuances of these models, is you have many people who are actually also leaving their current career, like they’re leaving their jobs, sort of mid cycle, mid career professionals, I guess they there’s the terminology. And they’re inspired to be a part of positive change, which I think is fundamentally what our industry is all about. And while I don’t have the specific stats for you on founders, you know, something that a colleague of mine said a while back, that’s always stuck with me, is that you don’t need to be a founder to be an entrepreneur. And I think this, having this spirit of innovation and opportunity and possibility is something that bleeds through startup cultures, whether you’re the founder, your employee, number five, or number 50. And I think you see a lot of those folks coming out of these programs into job opportunities in the startup space.

23:03

Yeah, I think that’s right on, I think one of the values that I always tried to push really hard when I as an entrepreneur was just shared around accountability. And I think that’s one of the real benefits. So you know, most startups provide employee stock appreciation plans or stock options. And I think that really kind of aligns it, you really want your team to act as if they’re owners and to take accountability when you’re building a startup. And I think that really can support that kind of a culture where every, every employee is a founder, and I think it’s really important. I was gonna maybe to change gears a little bit I wanted to ask, so your partner is Steve Kay’s. He’s one of the true pioneers of the internet. I know when I was starting out in the late 90s, as a teenager hacking away at my first websites and ecommerce projects, AOL was just a force of really kind of bringing the internet to the masses across the country. What is it been like working with someone like Steve that, you know, is really one of the true pioneers of the internet? Really? How does that impact your day to day,

24:10

it’s incredibly inspiring to work with Steve and it always has been from from day one, you know, it’s, it’s funny part of my role over the years it rise, the rest and in addition to the, you know, investment per view, and has been overseeing sort of strategy and execution, for our Rise of the rest, road trips, these bus tours that we do and that I think we’ve become pretty well known for. And it’s funny, I usually get three questions, and they’ve sort of followed me and us all through the years and through all the tours coming up on our ninth one. And, you know, the first two questions are is Steve really on the bus? And the second question is, like, is Steve running for president? You know, sort of learned, you know, my quick one two punch is like Steve is really on the bus. And and he’s no, he’s to the best of my knowledge. He’s not running for president. But I think there’s, you know, that first point It’s really like literal, like when I say like Steve’s on the bus and sort of both literal and figurative. He is, you know, front and center and present in all the work that we do. And I think his dedication has been a constant source of inspiration to our partnership to our team, to the cities that we visit, it’s always been fun in a delight to see the way that people react to and interact with him and to have the opportunity and the privilege to sort of be on the inside track of that has always been a lot of fun. And there’s also a tremendous amount of learning. You know, I think most people are not strangers to sort of the brilliant marketing behind the rise of AOL. And, you know, the CDs, everyone always talks about, but I think I’ve seen and I’ve learned a lot of that kind of shine through in the way that he’s, you know, conceived of and, and, you know, we’ve expanded Rise of the rest over the years, there’s a very specific, very deliberate, high level message that I’ve always found so impressive and inspiring in terms of how Steve always delivers it. Most people who know of our work in the space know that 75% of venture capital goes to three places. And all of the work that we do all of the investment, all the partnership, all of the focus on economic development, is inspired by that one single fact. And it’s been just tremendous learning, I think around that. The final quick thing I’ll say is, the Steve is also a great storyteller. And I think one of the first times I heard him, you know, when we were out on the road on a tour, tell the story about you know, one person, you know, when he started AOL in the early days, I don’t know if I’ll get this exactly right. But I think the story goes, like only 1% of the US was online, and it was only for like three hours a day or a week I forget exactly what that last part is. But I remember the first time I heard him talk about that, and link in his mind, the connection between sort of leaning into and creating the future with AOL, and, and drawing parallels for himself and the work that he and we are trying to do with rise. The rest was just, you know, kind of one of those that gave me chills moments, and it continues to be a source of inspiration, I think, in all the work that we do.

27:13

Here’s what I want to know, though, does Steve ever drive the bus? Like maybe it goes and sits up there he hangs a couple AOL CDs from the rearview mirror. So they’re spinning,

27:23

we do have a professional bus drivers. It’s a pretty big tour bus. We’re, he is on it. I have never seen him actually drive.

27:35

So I was gonna skip to my last question. I think the tech industry at large, but especially the venture capital market, has really struggled with diversity, equity and inclusion over the years, and I no Rise Of The rest is really at the forefront of kind of embracing diversity, equity and inclusion, from a VC point of view. So I just wanted to ask, how is the progress been? The last? I guess you’ve been with revolution for five years? How do you think the VC industry is doing in terms of embracing? You know, Dei,

28:10

my sense, in my experience, is that we’re making progress. I see it in the now much more regular announcements of you know, many of our colleagues who are women or, you know, GPS of color, or launching funds for the first time raising second or third funds with, you know, much larger numbers and a un behind them. It looks like we’re as an industry starting to do a better job. I think you see some of that too. On the, you know, the funder side in terms of what the composition of founders who are getting funded. But those anecdotes like those anecdotal insights aside, I think when we still see the headline data come through year after year, the numbers are just still so incredibly sobering. You know, from a female founder standpoint, we went backwards during COVID pretty dramatically. And the numbers were not all that impressive to begin with. And so I think we are living in an age more broadly, of increased intentionality and focus, frankly, because we all sort of live and operate in the public eye in some capacity. And I think there’s a more there’s the potential for a more virtuous circle between what your customers and what your investors and what your team sort of demands that can hopefully create more momentum and more positive change on this front. You know, one of the things I’ve been reflecting on, both with respect to geography and with an end diversity more broadly, is that I think we’re in maybe in a moment where it’s helpful to dig deeper Behind the headline numbers, because we do also have a tremendous amount of momentum in the asset class. And there are, you know, an increasing number of later stage funds. And I say this with all the warmth in my heart who are like weaponizing capital, and, you know, doing these very quick, later stage rounds that sort of inflates the overall numbers, I think of invested capital in the space, both in the fund world and in the startup world. So, you know, coming back to geography just for a minute, as we close, the headline numbers haven’t changed from the standpoint of 75% of venture capital still go into three places, but svv put out a report a couple weeks ago, where there were some really exciting data, I think, from our standpoint, it rise the rest, which is that the percentage of early stage funding, early stage specifically funding going to Bay Area startups, has actually declined 15% in the last 10 years. And what’s even more interesting to me, and I think to us, is that half of that decline has come in the last 15 months. So when you think about everything that COVID is accelerating, I think in certain ways, I think some of these shifts, you’re starting to see more acceleration and more momentum. And so that even that, just that one fact, that made me really want to double click on that, and understand, like, Where is that capital going? And what does that look like? And so there’s a lot more work to do. That’s like really the short answer behind my longer winded answer. But I’m encouraged to see more people around the table. And I’m also encouraged by the seriousness and the size of check increasingly being committed in the public forum by institutional LPs, and by the corporate community. I think, in particular, like the corporate LP community can start to make a pretty big difference when it comes to funding both startups and fund managers from a founder of color or female founder perspective.

31:56

So one last question, before you go on, we try to ask this of all our guests, sticking with the theme of the podcast, nice book into it, who is someone, or maybe it’s a team or a startup that is really executing. Or maybe it’s flying under the radar that nobody hasn’t heard of, that we should be paying attention to.

32:18

I have two companies in our portfolio. just picking up on that last thread one is led by an extraordinary female founder, the company is based in Seattle. It’s called flavor cloud. And the business is a cross border. Ecommerce enablement tool that really helps to empower every retailer to go global rathna recently closed a $6 million dollar series a round, and she’s just flying. And she’s one of the most capital efficient, sort of nose to the grindstone execution oriented founders I’ve ever met in our portfolio, and the numbers don’t lie. And so she’s already I think, come close to doubling monthly revenue, since she closed that a. So I’m really excited for the prospects of that business and think she’s writing a real wave of momentum in the e commerce enablement, and sort of supply chain resilience sectors. And the second is a newer company in our portfolio out of Salt Lake City, it’s called recite clops. And the company started as a consumer oriented like recycling as a service business that focused on rural and smaller MSA communities that didn’t have recycling services provided by their municipalities, in large part due to some changes from the International sort of regulatory landscape. And what I what I love so much about what’s happened. And they’re also just heads down executing so so efficiently is that their business has, I think, very quickly evolved not only into that consumer facing recycling as a service play, but actually now they’re sort of leaning into this reverse logistics company that singularly focuses on sustainability and the opportunities that come from that. And that’s created some really explosive b2b opportunities for them that I think are already and will continue to prove to be a short cut from a market based expansion standpoint, that helped to take them from a regional to a national player pretty quickly. So super excited about them. And they also the founder, there’s actually the younger brother of another founder in our portfolio who’s who was one of our first investments back when we launched rise the rest a couple years ago. So I love love seeing that connection come through for so many reasons.

34:37

Second generation of investees That’s great. Yeah, so listeners check out flavor cloud and recite clops. And if you google recyclates, and see a picture of Dwight schrute in a samurai outfit, that is the wrong recite claps.

34:53

It is not thank you guys so much for having me on congrats on the new podcast and I can’t wait to see Tune in to all your future episodes. Thanks, Ana.

35:02

Thanks so much on it’s been great to have you on today and looking forward to keeping the conversations going in the years to come. We’re really proud of all the good work. You’re doing it rise of the rest. Thanks, Rob.

Ryan and Josef talk about the Weber brothers’ long history, with Ryan tracking Mynul since they took classes together in college.

He talks about his journey as a first-generation immigrant who came from Bangladesh to St. Cloud, MN.

His biggest lesson for founders? “Never run out of cash.”

He shares how his “hobby” turned from Plan B into the only plan, and the importance of going all-in. Mynul is heads-down, and shares some great advice about maintaining and creating capability while discussing people, systems, and processes with Ryan.

Full Transcript Below:

00:00

Well, welcome, everyone. For those of you who don’t know me, I’m Bonnie spear McGrath. So thanks for joining me today. As an entrepreneur, there are few things I enjoy in life as much as hearing the story of other entrepreneurs. And today, I’m super excited because we’ve got two entrepreneurs in the house lined up for this session. Both are graduates of St. Cloud University. So I want to put in a big plug for St. Cloud University, because there’s a lot of social pressure on all those Ivy League colleges. And that’s not necessary. So and they’re both highly successful entrepreneurs, I first I’m going to introduce Ryan Weber, I met Ryan and his twin brother, Rob A few years ago, and I love their story. They’re both from St. Cloud, went to a cloud University, started their own kind of bootstrapped ad tech company, that they later grew to $70 million in sales and made a lot of money for their investors, which is always a good thing to do. And after doing that, they decided they wanted to start helping other entrepreneurs. And they they did a little bit of on their own. And then strat started Great North labs, which is where I met them and became an advisor and investor. And I’m super impressed with them, and their integrity and authenticity. So big plug for Great North labs. And one of the people that they helped early on was my new old con. So I’m super excited to invite my new look here. As I said, he did study at St. Cloud University, but he’s not from St. Cloud. He’s originally from Bangladesh, and came all the way here to study computer science, and later decided to stay and start field nation, his company that he founded any CEO of in 2008. And field nation matches company projects with freelance technicians. And that might sound very simple. And it’s a simple idea, but it’s a super successful private company in Minnesota in which we can be so proud of, they now have over 200 employees and offices in Minneapolis and Bangladesh. So that’s pretty cool. And I always say it’s good to hear the behind the scenes story about how something happened in terms of idea, and especially in terms of financing. So the conversation today between Ryan and Mike Newell will be very interesting, including any secret insights that they want to share that maybe Rob Weber, who’s also on the call doesn’t know yet. So welcome, gentlemen, thank you so much for being here today. Thanks for having us, Bonnie.

03:09

Yes, thanks, Bonnie. So my name is Ryan Weber here. We’ve known each other for over 20 years now. It’s it’s over half our adult over half of our life, not just our adult life, pretty much our entire adult life. But I’m really excited, longtime friend, and then a great classmate and advisor to current projects that were involved in, but maybe manual for the audience, you could start off by telling us a little bit about field nation and what you do.

03:36

So So fuel nation is the simplest way to explain it’s, it’s like Uber for Field Services, right? What we do is we connect businesses that need field service work done with with the technicians and engineers in the field, who have that skill set to get that work done. So think about, you know, all these retail stores, they need point of sales, to cabling to networking, all sorts of technology is getting deployed in retail, banking, QSR, quick serve restaurants, offices, and, you know, how do you how do you find this technicians? How do you deploy them? How do you know that they’re qualified? How do you manage the project, all of this is built into the Philadelphian platform, you know, we help businesses connect with the right technician in the right place, and help them manage the whole project from the start of the planning all the way to payment, back office management, all that kind of stuff. And when did you start field nation? I started field nation in 2008. That was March of 2008.

04:44

You know, I I think that people would love to hear a little bit about your background, being a you know, from Bangladesh originally and coming to St. Cloud State University to study. Could you talk a little bit about, you know, your background prior to field nation?

04:57

Yeah, so I’m originally from Bangladesh. I came here for college for my bachelor’s degree, I went to St. Cloud state. Usually when people hear that Bangladesh to St. Cloud, they immediately the follow up question is how you ended up in St. Cloud? And the answer is, when I was looking for colleges in the US, I learned that there is only one state that was at that time was at least offering in state tuition to foreign students from day one. So the taxpayers were, you know, graciously paying for part of the tuition for the foreign students. So as you can imagine, when you are Bangladesh’s, literally the other side of the of the of us, it’s literally 12 hours time difference. Growing up, I knew, you know, Hollywood and New York and LA, and never heard about St. Cloud, probably not even Minnesota, growing up, right. But then, as I was doing my research into what college, you know, and everything is expensive, you know, especially when you come from the other side of the world, a developing country. It’s like, okay, I can’t afford to go other places. And St. Cloud gives a great deal. And that was really the primary reason to come to St. Cloud sent out state. But very quickly, I just, I just loved everything. I just loved the school, the teachers, the community, the friendship, that right that I built, you know, my plan, or a general plan was, I’ll just do, you know, two semesters of, you know, general education courses and then go somewhere else. But then, you know, that never happened, I just really love this place and love the community love the school and decided to stay here. So right after college, what actually do you know, in the last semester of my college, I had the opportunity to do an internship with a startup called Ebro in St. Cloud. And, you know, I think I was probably the I don’t know, you know, fourth or fifth employee, you know, at a bureau. And that’s kind of where I really saw got the sense of, you know, what it takes to build and the fun of, you know, building and taking something to the market, the uncertainty. And I remember, the first day I went to Ebro, they were in this big, you know, quest building, there was no desks, chairs and stuff like that, you know, a couple of people are building product and stuff like that, I just love that. And so I never grew up thinking that I would have, you know, I would start my own business, but I just loved the whole process there. And, and then I started the first company, back in 2004, called technician marketplace. It’s really first version of field nation. I started that in 2004. And that company also grew fairly quickly. But I ran into cashflow problem, and had to shut it down. It took a year off, got married and promised my wife not to start another company, and that lasted a year. But of course, with our blessing started field nation in 2008. So that’s that’s the whole story, Ryan, all the way from Bangladesh to Phil nation.

08:31

In during this these early years, what were some of the biggest challenges you faced with starting a business?

08:37

You know, that for me, you know, the biggest challenge was that I didn’t have a network, right? Do you need a you need, you need to know people to start a business like, you know, people who can advise you people that you can actually hot, you know, not even higher, but say, Hey, would you work with me on this project. So my network coming from monitors, my network is really, really small. So that was, you know, that that was one of the biggest challenge, me being an immigrant had its own unique challenge, because I couldn’t just leave my full time job and do do this thing, because that’s that non meal wouldn’t be legal. So I always have to have a full time job, I would, you know, you know, do my eight to five, job. And then in my business, my entrepreneurship would be up part time after hour and weekend thing. So those are those are, you know, a few few challenges that I had to face. But, you know, I was I was very fortunate that the small network that I had, was very, very, very, very effective. You know, people like you, Ryan, I reached out to you when I first started my business, Phil nation, Rob and a small network of people that that I I grew up, you know, and the university was part of the company from the beginning.

10:06

Well, thanks for sharing a bit about the background. You know, I remember that those early years very well, a few years there later, I think we obviously we connected, interacted a little bit in computer science, I think a lot of computer science students do. I think at the time, we were very analytical, and kind of not a lot of social, social, not a lot of partying even though thing club seats sometimes gets that reputation. We were kind of the Nerds working in the labs. And so I think we got to know each other a lot more as we started to do business together. So flash forward to, you know, the beginning of field nation and the early years, what was different? What, what did you learn from your first experience? And how did you go about supporting and scaling the early years of field nation?

10:54

So so the, the biggest learning from the first one is that never run out of cash? Cash is really important. And that’s one area that I know, finance. And accounting is one area that I, I, I enjoy all parts of the business, finance and accounting was always a drag for me. And I always kind of wanted to avoid debt. And, and the biggest lesson is that, you know, cash is the lifeblood, and you run into that you’re dead. It was literally dead. And so that was the biggest lesson there. Scaling up, you know, starting field nation. I’ll tell you another another good lesson for me. When I had my first job, I never had the confidence to go all in with my business. It was, you know, partially, you know, I never saw people are on me to do do successful. I mean, of course, I saw you guys, but not in my family. Growing up, business wasn’t a thing that you do. It’s the the people who cannot have a job. Go start their own business. And so I grew up thinking, you know, you go for good, good employment. Something something safe. So, so starting the business was always like, it’s it’s sort of my hobby. My friends and family would tease as it’s my hobby, I mean, old doesn’t have anything else to do. So after hours and weekends, I just, you know, like you said, No, no partying, no, no life, no social life. And so what do you do you just go do your second job. But what happened in 2008, I was laid off from Ebro. And I remember that long path, long drive back from St. Cloud to Plymouth. I was living in Plymouth at that time. And I just felt rather than being scared, I was scared. But I felt more free. I felt like, great, there is no plan B anymore. It’s just plan A The only plan that just make filmnation happen. And it was just absolutely freeing experience. Because I was always trying to juggle the ball. And, you know, if, you know business, if it doesn’t work, it’s fine. I got another job. But the job that I have, that’s really important. Don’t screw it up. I’m going to need that. And when I when I got laid off, it was like, No, there’s, there’s a plan B, there’s just one plan. Let’s go go all in and make it happen. That was That was really good. That worked for me.

13:37

It’s really interesting. You talk about the kind of the culture a little bit of starting a business and going all in you know, we both were classmates in the Department of Computer Science at St. Cloud state and not I remember being called into the office by the department chair one day Sarnoff, that who you know, Dr. ramnath. And, you know, he asked, he asked me about my business, I thought he was calling in to reprimand me about something and then all of a sudden, I just decided, you know, I’m, I’m opening up, you know, I was going to talk about my my work, you know, in class and with faculty and everything changed, you know, at that point in it. And I remember when we met you were talking about we had been just a few years ahead of you and in building what was freeze calm and became native x. And, you know, it was those relationships. You know, in St. Cloud, we connected with a lecturer at Rob’s entrepreneurship class, Brian schoenborn who connected us with with somebody that had a lake home on his Lake, maybe you can share a little bit about the background. I guess, you know, I joined field nation a year before this gentleman as an advisor, you know, when you reached out to me, we hadn’t talked in a while. I didn’t really know what you were working on, but it was similar, like, maybe similar experience when I had with Sarnoff. You know, when you reached out to me, I was very interested and I was very much wanting to get involved in but until you opened up and kind of reached out I never knew you know really what you were up to and And even though I wasn’t invested in eat Bureau, you know that you talked about that. Maybe you could talk a little bit about that getting, you know, our angel investment and advising round together along with this gentleman and how that impacted your early years.

15:14

Yeah, Ron, I don’t know if I, if I told you this story. So I started the business in 2008. And a few months into into the business, I realized that I need not only I need some investment, I need some people who knows, who can tell me what I’m what, what I don’t know. And there was, there was a lot of things that I didn’t know. And, and literally, I started searching my LinkedIn at that time, I’m like, you know, I gotta find people that I know. It is a very, very small network, right? I just all of a sudden, I remember like, I do have a rich friend it, Ryan and Rob, let’s, let’s see, that’s out. Let’s ping them and see if they’ll, if they want to meet with me, and you were very gracious to meet with me, I remember us having lunch. And I was telling you, you know what I’m doing and stuff like that, and you’re giving me advice. And then we decided to stay in touch, because I think you liked something that I was doing. And we decided to stay in touch. And we I think we and since our kind of the first meeting outside the school, we probably talked probably for few months, maybe six months. And then I said, Look, I’m now ready to take some angel investment. Although my company didn’t have a lot of overhead I was I was always very resourceful in terms of doing stuff. So, you know, company was was was generating income and stuff like that. But a company was growing. Without a balance sheet. There’s no no no money in the balance sheet. But the company know the revenue and all that stuff started to flow. And it just made me really uncomfortable. I keep the nightmare of cash flow. from my previous company kept coming back. I said, I need to, I need to get some cash in the in the bank. And so I reached out to you and and you’re interested and quickly, you introduced me with young son, and young, I think you’re talking to young les comment in St. John’s, and he got interested in Phil nation, and you both decided to invest. That was my first investment into the company that was probably back in 2009. And at and you guys invested. And also you decided to stay involved with the company and time to time I’ll just call you up and say, here’s what I’m thinking. And I need people in this key roles and you are very, you know, gracious to, you know, help me connect with a lot of people and a lot of people are still with Phil nation, the people that you introduced me holidays.

18:05

Yeah, for everyone listening that, you know, young stone was a early connection that we made. Through his wall tap home near St. John’s young, young was a CEO of a tech company called Old technologies and lived in the same neighborhood was Steve Jobs. But we just were very fortunate that somebody in the community Brian shone bar and introduced us early on and, and young served as a mentor to Robin my business freeze calm. And when we began our family office, angel investing, we tried to model our behavior of, of young and young brought his friend in Pradeep madonn, who’s the third partner in our current venture fund, Great North lab. So we tried to when we Angel invested, we tried to lean in and provided any support and guidance, we could just like we were receiving from our Silicon Valley friends, thanks to Brian. But you know, those years, I remember, everything is just flashing back in front of me as you talk about, you know, this time period, because at the time, you know, we didn’t have a lot of active angel investors in many funds in Minnesota, if any that were doing this seed stage or or pre seed stage investing. And, you know, I think we were so you know, we’ve always looked for people that can execute, you know, and we love to find entrepreneurs like Mike Newell, you were working on your business and clearly had some traction yet, you know, you had to learn, you know, you had some hard, hard times in the early years and had to recover. But maybe, can you talk about how and I also remember, when we gave you the money, I thought you were going to spend it but it seemed like it never left your bank account. So that was maybe that gave you more confidence with scaling. But I’m really interested to hear more about when did you feel like things were really starting to hum and what were some of the major milestones, as you began growing after the after that period.

19:51

I don’t know if I can tell you one major milestone two kind of breakthrough moment for us but Well, I do have one aha that I always like to share. Yeah, which is, I was so naive, when I started, I thought, you know, you build a product and you do some Google AdWords and stuff like that, and all of a sudden things gonna just everybody start to sign up. And I was so naive, and and I waited and waited, you know, for for few months, and there was literally nothing. And I don’t know if this was a problem with a business model or, or what. And then I think towards the end of 2008, we had one bot customer sign up, just all by there is no sales for somebody signed up, one company signed up and did 20 work orders on our platform, our our platform is mostly work order driven, like somebody create a work order, and then they find a technician and deploy the technician in the field. That’s kind of how the system works. And, you know, by end of 2008, I waited six months and then end up to those and eight, somebody signed up, created 20, work orders found 20, technician nation, you know, distributed all over the nation. And I got so excited. I thought this is it, this is the moment that tells me that I’m on the right path. Now, looking back now, you know, last year, we did a million workorder, you can see that the scale of the company is very different. But there is nothing more meaningful to me than that first 20 workers that just just that was the lifeline for me, that just gave me this desperate validation that I needed. in those early days that it is the right, I’m working on the right problem. And people find value through my, through my product. And that then it was a question of, you know, the How do I figure out the sales and, and distribution and all that kind of stuff, which is an ongoing process that never ends, that we still have the same same discussion that that we had 12 years ago. But that that 20 work order was so sweet memory in my mind, I still if anybody asked me, what’s a breakthrough, that was the breakthrough? I don’t know if that didn’t happen. And I didn’t see any worker coming for a few more months, I would just, you know, shut down and say this, it’s not worth doing. I don’t know, I don’t know, what would have happened. But that is really big.

22:33

Yeah, it seemed like, you know, I just remember observing in it seemed like, you know, you had some very large enterprise customer interests. And in part of the, I think getting, building that confidence, you’d see it, you know, with every order almost in every meeting we had, and, you know, during the scale up, and it just seemed like the conversations, you know, the types of companies and the traction, you were seeing continued to increase as your confidence built, and kind of, I think more and more people believed in field nation, and it was a competitive space it you know, what, while you were starting, wasn’t it my No,

23:06

it was a competitive space, we had a, you know, very well funded competitors. And we did things very differently and not having money, I sometimes I say, you know, one of the one of the best thing is that don’t start with too much money. I mean, you need some money, so you’re not running out of cash, that’s a, that’s a different problem. But too much money could be the same problem. It could be, you know, a bigger problem, because you’re wasting someone else’s money without knowing whether you have the right product, or you have the right distribution, what not, and I’ve seen some of my competitors made that mistake of raising too much, I mean, the promise of a, you know, Uber, like model, and right now, you see everything is becoming Uber eyes, right. It’s the Uber of this and Uber of that delivery, and, you know, hotels, and everything is overpriced. And when we started in 2008, this idea of you know, getting on demand workers to go do something was new people would, investors are very bullish back then, as they are now. And so a lot of a lot of my competitors got raised a lot of money and they try to scale quickly without figuring out the you know, the market maturity and, and all that kind of stuff. And, and wasn’t wasn’t very successful. But you know, one thing I would say, the timing matters, right? So when we started people would compare us, Phil nation as the Craig’s Craigslist, they would say, oh, you’re like Craigslist. We are not we, you know, ABC Company. We’re enterprise. We don’t deal with Craigslist, right? And now it changed so much. It seems like everybody is more comfortable staying at Airbnb and riding an Uber. It’s the new normal, like, of course, you know, you get something on demand, that’s the way it was. It’s whether it’s a cloud on demand, or whether it’s a technician on demand on a driver on demand, it’s everything on demand.

25:21

That’s maybe a great kind of topic to follow a little bit, you know, we I know, you went a long time before raising, you know, any larger financing. And I remember working with young, young, young, young, everybody is now the Chief Strategy Officer at Samsung, he’s been there for six years. So quite, quite an amazing journey, you know, for the people involved in associated with that time, you know, going into that big financing. Do you want to talk about, you know, after you scaled for some time, you were in a position of strength, but how, what were you thinking about, you know, in terms of the next chapter, as you prepare for, you know, that your later financing, if you could share a little bit about that?

26:03

Yeah, you know, what, one thing we didn’t want it to do is raise a lot of money, too quickly. And because we were still, we were figuring it out at that time, like, what is the right market? What is the right customer? How do we scale them up? How do we scale our business and stuff like that, and there was, you know, we just didn’t want it to raise a lot of capital that comes with the, with the constraint of build it 100 people sales team and sell, sell, sell, you got to fight, you know, you know, you get to do that, you know, product market fit, you got to figure out the distribution channel and stuff like that. And so we waited, you know, we waited, and then we were adamant to find somebody who was genuinely passionate about the market we’re in and the problem that we’re trying to solve, and be patient, like we are, we know that it’s a slow maturing market. For us, it’s a slow maturing market, it is still taking a long time for us to, you know, see the market maturity, because we are working, we are working with enterprises and not consumers, it doesn’t turn, like the way you see GameStop it’s done. Yeah. enterprises move in a different pace. So we wanted to make sure that our investors are patient, they will stay with us and not not have that undue burden that, you know, do something because we got an exit, we got to figure out an exit in next, you know, next year or something like that. So when we raised our capital, that is, you know, end of 2015. By that time, we were on in 500, multiple times, fast 50. And so there was a lot of calls, we’re getting a lot of VC and private equities are coming from east and west coast. Unfortunately, there wasn’t any anybody from the, from the Midwest at that time. But I remember our CFO and I, we met 70, some VCs at that time, as part of the interview process. And then we finally found someone, a company private equity, called SAS corner growth equity. We immediately like those guys, because of their flexibility in the, in the capital and the life, the the time horizon, they have, they literally don’t have time horizon, if they’re like a business, they hold it, and they can have subsequent rounds, and stuff like that. And, and so we decided to raise capital at that time, you know, and up to those.

28:41

I remember always hearing you say that, you know, this is the startup you see yourself working on forever, you know, and it’s been, you know, I never thought you would, I never thought it would be come forever, but you still have the same excitement and patients it seems and continue to grow. And it’s been exciting, you know, following your journey, maybe we could kind of shift gears and talk a little bit more about the broader kind of gig economy, you know, and, you know, when when we started the fund, with experience investing in these gig like services quite a bit as angel investors, you know, we, you know, we’ve done SAS and marketplace, businesses, consumer and enterprise, as a fund. But, you know, we were excited to win starting the fund to get a group of operators as advisors of scaled tech companies, including yourself, so you know, having, you know, having then seeing in the portfolio, we start seeing a wide variety of, of people working on Uber like services for other markets and including one that you helped with diligence on early I remember, it was just so, so amazing to see this, this founder, Patrick O’Reilly at factory fix, you know, request a meeting with our fund and in his deck as he’s going through it. He says the comps he was highlighting was field nation as a major success. I was like Yeah, that’s my buddy, my Neil from college. He’s like, What? He’s like, yeah, I asked him if you mind if my noodle gets involved in reviewing this deal with us? And he said, Oh, sure, of course. But, you know, and that’s, you know, you know, your perspective as an operator, scaling a good leg service, and seeing different strategies play out has been invaluable, you know, in supporting our evaluation of such opportunities as factory fix. But do you want to talk a little bit about, you know, what you see as some of the different strategies and in, you know, that are working or not working with these types of services? With with kind of gig economy, kind of, yeah, what challenges and in what, what seems to be what are some of the key takeaways you see from people that have been successful and not successful in? How does it vary by market?

30:49

Yeah, I think the, on the consumer front gig platforms are really, really successful. I think the laggers are the enterprises. Unfortunately, we are in the, in that in that group, that enterprise will, but that’s, that’s catching up. Usually, that’s always the case, people in their personal life will experience something, and then they’ll they’ll think about, you know, how does it apply in their businesses and stuff like that? So, you know, there’s a lot of, you know, kind of consumer centric gig platforms from Uber and Airbnb to, you know, grub hub to everything else that you can you can think of, but the next frontier is that enterprises, the enterprise is thinking, you know, how can I reduce my capex and OPEX? and make it more variable? Right? I mean, and, you know, if you remember, Ryan 2008, was a great recession. Yeah, it was, it was good. I mean, it was good for us to start at that time, because everybody was thinking outside the box, like what, you know, any, any financial crisis kind of creates that sense of thinking outside the box, like, we got to change, right, the status quo is not good enough. So 2008, we saw a lot of, you know, SM B’s was whether, because of the need for survival or whatnot, they were thinking outside the box, and we saw great adoption, you know, since 2009, till, you know, many years. And what we are, we are we are seeing is that this crisis, the crisis we are in the pandemic crisis is shaking up the enterprises, and they’re thinking like, Okay, we got to think outside the box in terms of, you know, variable labor. And that’s the, that’s the next wave in the I’m talking more specifically about the labor platforms like Phil nation, and others. And, and they’re much more comfortable in their understanding of the labor model. It does has its its challenge, though, you know, you know, and the biggest challenge is that the worker classification in this country, there is literally to classification and none really fit well, with the gig workers, we have the W two model the full time employees, and you have the independent contractor model. And the challenge is that, you know, some states are trying to push gig workers to be classified as employees, you’ve probably heard, you know, Eb five, assembly bill five, buy from California, although, I think there is a proposition that that got passed last November that AV five didn’t go through ultimately, but if I would have made every gig worker, employee, but that’s not gig workers want, you know, they don’t want to be employees, they want the the number one thing that gig workers really enjoy is, is the flexibility and employment, you know, full time employment doesn’t give that. So there needs to be a new type of legislation to accommodate for this new class of, you know, workers, and they do need some safety, they need benefits, they need, you know, fair treatment. But but that’s the, you know, making everybody a full time w two is not the solution. So, I would say we think that we’ll see some legislative changes, you know, next, you know, few years, hopefully, will be a more common sense approach than say, you know, move everybody make them everybody don’t. Yeah, it’s not a solution.

34:52

Yeah, it seems that regulations are struggling to keep up with the pace of technology. And this is a shining example of that, but I think I think it’s really interesting what you said about the enterprise market and in today’s environment as well. I know, we’re running up against time here. And I just want to say thank you for, for your friendship and for sharing this journey together. It’s been amazing and appreciate you being one of our first guests on on the show. And I will turn it over to Joe to take us through the next section. Thanks.

35:26

Yeah, thanks so much. My new will in a second, I’ll open it up to everybody for q&a. But I just like to kick it off with the first question. We’ve been asking everybody who comes onto our podcast? Are there any founders or startups or like organizations, or people you see supporting founders and startups that are really executing? Maybe people here? Haven’t heard of them? Maybe they have heard of them? Maybe it’s someone where, you know, maybe it’s a branch or something that everybody’s heard of, but is there anyone in particular that you see that you think is really, really just killing it?

36:01

Joseph? that’s a that’s a great question. I can’t answer that with with a lot of firsthand experience. I do hear people, you know, join young presidents. I don’t know it is a club or some some Association there is, you know, people go and get advice and stuff like that. And, but in Twin Cities, I haven’t been part of anything that that, that I could say.

36:31

Well, thanks. Yeah, well, we’ll open it up to everybody here. If you guys have any questions, or just want to pop on your video, pop off your microphone and chat a little bit. Feel free to talk ask wave for any questions for my Newell and Ryan.

36:46

And one question, I was just gonna ask my Newell, you know, you went through a lot, you know, with the immigration process, you know, what do you think of the current kind of regulatory environment on immigration? And I guess, do you have any, you have a solution that you think would work better in terms of American immigration policy? You know, after having gone through the whole experience that you had?

37:10

Yeah, it’s also a very sensitive topic, isn’t it? Look, I think, I think we need to have a common sense approach to immigration. It’s people try to, you know, make it a binary problem. Nothing is a binary problem. It’s way more complicated than this, this right. And, look, I can tell you that a smarter approach would be looking at industry by industry and look at what kind of, you know, workers we need. This country needs, high skilled workers to notes, no skilled workers. I mean, it’s every everything in between. and but there is no, there is no systematic approach to address that problem. It gets a it becomes a very slogan type of approach. Rather than, you know, this dramatic market based I would make it a market based approach, you know, what is what is very difficult for me to get my head around is that think about some of my friends, we went to St. Cloud state we got institution because the taxpayers the Minnesota taxpayers paid for our some of our tuition right under there was a great help. Many couldn’t stay in this country, because of the complexity of immigration, guess what some of them went back to India and other parts of the world and working for, you know, Google and, and Microsoft sort of the world and paying taxes in those countries. So and so there is a vicious loop for us and a virtuous loop for other countries, meaning the US companies cannot find talent here. They’re gonna go wherever the talent is, whether it’s in other parts of the world, and that talented, they cannot stay here, guess what, they’re gonna go somewhere else, you know, and, and the companies will follow the talents and, and those talents will, you know, pay taxes and enrich their community and stuff like that. So, you know, market driven approach would be my, my approach my my recommendation.

39:29

I know. And Ryan, I have a question if I if I could, so I often hear people talking about entrepreneurs putting the flame on with their ashes. What I mean by that is, they hang in there they sit, they can start things very well. But growing something that’s already started, we spend a lot of time talking about startup enterprises and businesses and we all love that. But what’s the difference in skill sets and even growing as an entrepreneur from the startup mentality, to wait a second, I have a business and I want to grow it. Are there differences? Or is it the same skill set, shed some light on that for all of us?

40:06

Well, I think the differences are enormous, you know, when when you’re starting up a business, you are a missionary, you are an inventor, you are just kind of, you’re you’re hustling and you’re trying to get get the product out, you’re the sales guy, you’re doing everything that needs to be done to get going. Right? When the company starts to scale, that’s a different, that’s a lot of lot of management and leadership. And sometimes, and I can tell you, it’s true for me, sometimes hard to get, you know, not to be involved, but to lead and to manage and hold people accountable, find the right people, you know, think about the organizational design, rather than just the the solving than the specific customer problem. Beyond the every sales call, which I used to do, now, stepping back and say no, you know, we got to figure out how to scale the sales, I used to be in every product decision, but rather now, you know, how do you design an organization that the organization can design the product. So it goes from, you know, being, I still like to be missionary, but missionary in terms of the mission of the company, not, not in the ground. And and just like you said, just doing everything, and and as you do when you’re, you know, you know, startup founder in the very beginning stage of the company. So skills are very different. And I can also tell you, Brian, is that it may not be right for everybody, you know, what you like in the earliest stage is, as a competence, start to scale, those things are not there anymore in the company. And and you may not like the new company. And if you try to, you know, hold on to those old things, the things that you really enjoyed, you may be holding back the company to scale up. And that’s that that is not good for the founder, not good for the company.

42:19

Do we have any more questions? Anybody can feel free to jump in here. We got a few minutes left.

42:25

I’ll ask a question. Hi, my name. I’m Kristen Danna. Well, I’ve got a HubSpot implementation consulting company. So we help our clients implement HubSpot and use the software. And we’re kind of in that stage that you just spoke about. And so I was hearing like the choir sing behind me. But then in respect to like, when you get to stage when you’re scaling up, in terms of your advisors who are advising you and the people that you’re speaking to, I think that’s something you constantly do through the lifecycle of your business. But when you get to that point, when you’re ready to scale up, and you want to create, like an advisory board or something like that, and you’re not necessarily looking for investors yet. Can you talk to us about that process? Did you do that? Or do you recommend that?

43:16

Absolutely, absolutely. I think that advisory group could be very helpful. And some of the things to think about for from the advisory standpoint. You know, we have advisors that are more technical focus, because that’s one area, we wanted to make sure that we know how to scale the technology stack of our company we have, we have advisor that comes from the domain expertise from our, our industry. And I personally have a CEO coach, a couple years ago, I decided, you know, how do I know I read a lot to see, because I always feel every year, I feel like, I’m probably not ready to be the CEO of this new company. Because as the company grows, the complexity grows. And, and I never been there, I never been there in that new company, CEO, the new stage of the company. And so I read it, but then a few years ago, I realized that, you know, having a live, you know, conversation with somebody who been there done that. It’s an amazing, it’s an amazing thing. So I do have a CEO coach and his his awesome. And, and I think a lot of times you hear the comment that you know, the it’s very lonely at the top. And, and having somebody that can be a sounding board and you can just be all open up and vulnerable and tell everything, all the stupid questions. It can be very, very freeing experience and and especially if you can talk to somebody who had done that. They can guide you in the right direction and say the thing that you’re working Worried about that’s really not a thing you should be worried about. Worry here, you got to really think about this. I

45:05

think we have time for one last question here. If anybody has a question for Mike Newell, or maybe Ryan,

45:11

if I could jump in? I have a quick question. It’s Simon here. This is a partial question from an old but it’s also could be one for Ryan two, which is what keeps you awake at night? Like, if you think about this people systems and process of scaling your business and evolving your leadership that you’ve described? What What keeps you awake at night? What’s the thing? Is that one thing or several things that are sort of most on your mind when all that? And then I guess the related question to Ryan, which is, as you scale the fund, is that similar? You know, is it different kind of business growth challenge as other things that you kind of think about? A lot?

45:57

That’s a great question, Simon, you know, what keeps me awake at night? If he asked me that question, last April, that would have been a different different answer, because I was I was, I was really worried, you know, as everything started to shut down, you know, not knowing, you know, where the market is going in, in a shutdown economy. But we recovered pretty well from that crisis. And we’re off to a really good start for 2021. It’s a rhetorical question, but you know, I don’t, I sleep really well. But, you know, in 2021, one of our key goal, you know, scaling one part of our market segment. And in any given year, we pick one or two areas, in the last last year was, was, you know, we created five different product packages, that was transformative for our company, it actually took took us 24 months to get that get those packages out the door, and implement in a rolling, implement, and then roll it out. And that I was, that was one thing on always on top of my mind. So now that’s all done. That’s now part of our muscle, that’s, that’s, you know, and so every year, we pick one or two things that are kind of transformative for the company, for either the product or our market, or, you know, our organization as a whole how we do it. And I tried to focus my time, in those couple of areas that are kind of still new, where we are trying to build that capability, the muscle, because it does require a lot of lot of lot of focus and attention and, and a lot of nurturing maybe the right thing, because, you know, as a CEO, I want to make sure that the new stuff that’s not part of the company’s muscle or DNA yet, and I’m hoping that I’m helping in that area to build build it. Ryan, anything you want to add?

48:05