There is a history of successful tech companies in Minnesota founded during recessions. These resilient startups didn’t just survive- they proliferated under pressure. Jamf, which recently raised $468M in an IPO, is the largest, latest, and highest-profile example. Jamf was founded in 2002 out of UW-Eau Claire, and is headquartered in Minneapolis. Jamf is now valued at $4.7B.

Looking into startups that were founded during recessions, you wouldn’t expect to find a list of successes. But by digging into public data on Crunchbase and in local publications, a surprising number of successful companies emerged that were started up in during the dot-com bust (2000-01), or the Great Recession (2007-2009).

Here are examples of startups founded during recessions in Minnesota, that found success.

| Company Name | Description | Year Founded, Names of Founders | Exit/Valuation/Funding Raised* |

| ProtoLabs | Automated quoting and manufacturing systems to produce commercial-grade plastic, metal, and liquid silicone rubber parts | 1999 (significant growth in 2000-2001), Larry Lukis | Successful ~$70M IPO in Feb 2012 with a current Market cap of $3.2B |

| Modern Survey | Provider of employee survey services. The company provides employee survey and talent analytics service that enables companies to understand their workforce and drive business performance by creating an aggregated, holistic view of the employee lifecycle— from the candidate experience, new employee onboarding to engagement, and exit interviews. | 1999 (significant growth in 2000-2001), Don MacPherson and Patrick Riley | Acquired by Aon Hewitt in Feb 2016. Terms were not disclosed. |

| NativeX (aka W3i and Freeze.com) | PC publishing platform and mobile content and app delivery | 2000, Ryan and Rob Weber | We peaked in 2012 at $70 million in revenue and $10 million in EBITDA, with 170+ total employees. |

| Inbox Dollars | Online rewards club that pays members cash for their online and mobile activities. They reward members for their everyday activities such as reading emails, taking surveys, playing games, and signing up for offers. | 2000, Daren Cotter | Acquired by Prodege in May 2019 for an undisclosed amount |

| Ability Network | Connecting thousands of hospitals, skilled nursing facilities, home health agencies, clinics, and tens of thousands of physicians across the country with each other, and with the nation’s largest payer: Medicare. | 2000, Amy Coulter | ABILITY Network was acquired by Inovalon for $1.2B on Mar 7, 2018 |

| GovDelivery | As the number one referrer of traffic to hundreds of government websites, GovDelivery enables public sector organizations to connect with more people and to get those people to take action. | 2000, Scott Burns | GovDelivery was sold to Vista Equity Partners in a $153 million deal in Oct 2016 |

| Code42 | Code42 provides data loss protection, visibility, and recovery solutions. | 2001, Brian Bispala, Matthew Dornquast, Mitch Coopet | Code42 has raised $138M total, through their Series B round in October of 2015 |

| CVRX | Medical device company that develops implantable technology for the treatment of high blood pressure | 2001, Robert Kieval | $340.6M total raised in 8 rounds Most recently raised $93M in a Series G in 2019 |

| Jamf | World leader in macOS and iOS management with offices around the world. They deliver, support and service the solution for Apple management needs in education and business. | 2002, Zach Halmstad | Raised $468M in 2020 IPO. Current Market cap of $4.7B |

| Compellent | Develops and provides enterprise storage software and hardware solutions that automate the movement and management of data | 2002, Phil Soran | Acquired by Dell in 2010 for $820M cash |

| DoApp | Mobile ad network and consumer and business app developer for websites, desktops and mobile devices | 2007, Joe Sriver | Acquired by Newscycle Solutions (Now Naviga) in 2016 for undisclosed amount |

| ZipNosis | Hospital and healthcare company that specializes in online diagnosis and triage, telehealth, and virtual care | 2008, Jon Pearce | Zipnosis has raised $25M in funding total through a Series B round |

| Calabrio | Delivers workforce optimization (WFO) and analytics solutions that elevate the customer experience and drive strategic business growth | 2008, Brett Shockley | Calabrio was acquired by Kohlberg Kravis Roberts (KKR) in 2016 for $200M |

| SportsEngine | The leading provider of web software and mobile applications for youth, amateur and professional sports | 2008, Carson Kipfer, Greg Blasko, Justin Kaufenberg | Acquired by NBC Sports in 2016 for an undisclosed amount |

| Field Nation | World’s most active Freelancer Management System (FMS) ensuring successful collaborations in today’s rapidly changing world of work. Field Nation enables companies to find, hire and pay contractors anywhere and easily manage their workforce. | 2008, Mynul Khan | Raised a total of $30.2M |

| HomeSpotter (aka Mobile Realty Apps) | Helps brokerages, agents, and MLSs build relationships amongst one another and with clients. Allow agents to collaborate with ease, work on the go, and increase their productivity. Brokerages and MLSs are better equipped to support and retain agents and help grow their businesses. | 2009, Aaron Kardell | HomeSpotter has raised $3.9M in funding |

You can see that I’m on this list with my brother, Ryan Weber, with our former company NativeX. Several other founders from this list are people we have recruited as operating partners for Great North Labs, such as Joe Sriver, Carson Kipfer, Mitch Coopet, Brian Bispala, Patrick Riley, and Daren Cotter.

Capital Efficiency and Resilience

Resilient startups and founders find ways to adapt, persist, and succeed in spite of the challenges they face. The startups on this list found success coming out of challenging times with limited capital availability.

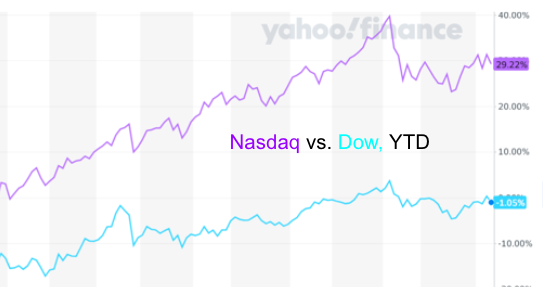

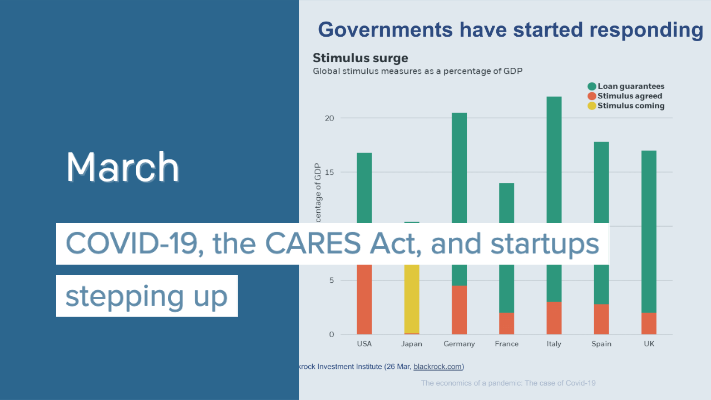

Across the entire Midwest, both the quantity and value of early-stage deals went down during the past two recessions. You can see in the chart below that the dot-com bust in the late 90s led funding to drop off a cliff, with a long climb back up hindered by the Great Recession in 2008-2009.

We live in a region where startups have to be capital efficient. We simply don’t have the amount of early-stage capital other regions get. This leads to more competition for capital, and to higher capital-efficiency among startups.

“This is good news for investors, as the returns in the Midwest are more favorable for investors compared to investing in VC in other regions.”

While that means the Midwest’s 10% of VC-backed startups receive under 5% of funding, it also means that the Midwest startups that make it to exit return the highest median multiple on investment (5.17x). This is good news for investors, as the returns in the Midwest are more favorable for investors compared to investing in VC in other regions. But, it puts greater demands on early-stage startup operators, who need to operate in a way where they can maximize their chances of success with the capital available.

How do you Scale Resilience?

Great North Labs’s approach to early-stage investing includes cultivating resilience in the regional startup ecosystem, identifying it in opportunities, and developing it into our portfolio startups.

We cultivate resilience in the startup ecosystem by supporting important organizations with our Founder’s Pledge, and teaching disciplined startup methods through our startup school initiative.

When identifying opportunities and developing resilience in portfolio companies, in addition to our own experience, we include resilient founders with startup success in Minnesota and the Upper Midwest as operating partners. We believe that successful founders and operators make the best early stage investors because they’ve had to scale an emerging technology company before. We also believe that the best way for founders to grow is to learn from the experience of others who have been in their shoes.

By having startup operators who have not only been there before with a startup, but have found a way to thrive coming out of tough times, and have done it all in our region, facing the same regional capital availability issues that persist today, are invaluable when it comes to providing guidance for other early-stage founders in Minnesota and the Upper Midwest.

Using this approach Great North Labs is:

- Building capacity in Minnesota for developing breakout startup opportunities

- Identifying and investing in breakout startups opportunities early on, in Minnesota and the Upper Midwest

- Guiding portfolio companies to success using our operating experience and networks, and the operating experience and networks of our operating partners

Our plan and hope is that after the current recessionary period, we will be able to look back over our portfolio companies and at other Minnesota startups fighting through these times, and add many more to this list of successes.

Sheryl Sandberg joined Facebook in 2008, when Facebook was very small. She was instrumental in its meteoric growth into the global giant it is today. Many people are trying to put blame on her and downplay her work now, but her role and contributions over the years should be celebrated. She was a successful ‘integrator’ at Facebook, working with Mark Zuckerberg.

The EOS (Entrepreneur Operating System) blog defines an integrator as “…the person who is the tie-breaker for the leadership team, is the glue for the organization, holds everything together, beats the drum (provides cadence), is accountable for the P&L results, executes the business plan, holds the Leadership Team accountable, and is the steady force in the organization. The Integrator also creates organizational clarity, communication, and consistency; typically (but not always) operates more on logic; drives results; forces resolution, focus, team unity, prioritization and follow-through; is the filter for all of the Visionary’s ideas; harmoniously integrates the Leadership Team; and helps to remove obstacles and barriers.”

There is a history of visionary founders combining forces with integrators in Silicon Valley at hugely successful companies like:

• Sergey Brin & Larry Page with Eric Schmidt at Google

• Steve Wozniak with Steve Jobs at Apple

• Gordon Moore and Bob Noyce with Andy Grove at Intel.

This is not just a Silicon Valley phenomenon. Local Minnesota examples include:

• Justin Kaufenberg with Brian Bell at SportsEngine

• Ben Cattor with Alex Ware at Foodsby

And I speak from my own experience. Ryan Weber and I co-founded NativeX, and brought Andy Johnson on board as integrator when we grew. It was a difficult decision, but the right one. You can read about in this article I wrote for Wired.

Integrators can be instrumental in carrying companies forward by collaborating with the founders at the right time. A company can be started by ‘singular’ founders, and carried forward beyond 50-100 employees by ‘integrators’. This is why singular CEOs of more mature companies often have integrator COOs beside them. The reverse order does not always work; as remarkable as integrators are, integrators may not be successful founders. Could Eric Schmidt have founded Google? Could Sheryl Sandberg have founded Facebook? You decide!

But don’t forget to also ask yourself, could Zuckerberg have grown Facebook into the global success it is today, without the talented integrator Sheryl Sandberg?

I came across this letter by Ray Allen which he wrote to his younger self, and I immediately started thinking about the letter I would write to myself. At age 37, having been a part of a few successful entrepreneurial journeys in both the driver’s seat as founder a few times and observing as an angel investor many times more, what would I write to my younger 20 year-old self? At age 20, we were just getting our team together to launch our first ‘serious’ startup complete with angel investors, actual employees, an office, etc and had many lessons yet to be learned. Here is what I came up with:

- ‘Entrepreneur’ Often Means ‘Into-Manure’

As my friend David Pomije, founder of FuncoLand recently shared with me, ‘entrepreneur’ often means ‘into-manure’. Entrepreneurship is very celebrated after it works, but if you ask any entrepreneur, they all have their own epic battle that had to triumph over to persevere with their new startup. Expect there to be difficult times, and understand that you are not alone. - Spend More Time Interviewing Customers and Thinking About Strategy Before Starting Being an entrepreneur is being in a race against time, a race to not run out of resources before getting your startup to viability. To get ahead in the initial race, spend more time before it starts validating your ideas with prospective customers. It is much cheaper, and more efficient, to validate your ideas before you start sprinting.After you start sprinting, you’ll quickly realize it isn’t a sprint at all, but a marathon. Don’t just hop into new startup opportunities without consideration to market size and defensibility. Some entrepreneurs may luck into a strong defensible business model that ends up lasting, but most will not. You only have so many ‘bullets’ in your life, make sure you make them count.

- Finding the Perfect Balance of Being Self-confident and Collaborative at the Same Time

This is a really tough one at times. I have yet to meet a single founder whom possesses all of the skills required to build a high growth startup. The most successful founders have self-confidence so they don’t get steamrolled by other’s ideas, but also are collaborative and are able to adapt based on feedback. Self-confidence overdone can come across as cocky and shut people out, and being too collaborative can water down your vision or slow you down. - Fail Upwards, Not Fast

Aydin Senkut from Felicis Venture passed on the angel rounds of Uber and AirB&B (https://www.youtube.com/watch?v=x9G-IS_Rykk) a mistake that cost him a gigantic fortune. Instead of just taking that as a failure, he turned it into a win realizing that these companies would be needing a big company to power global payments, which he found and invested in. - Build a Team as Motivated as You Are

After 5 years our early team, of primarily new college grads, reached around 50 employees and we started to realize that we didn’t like our culture. We were starting to have some employees who viewed our new business as a ‘just another job’.We decided to hire an outside CEO Andy Johnson to help bring additional management processes required to scale (see this Wired post here if you are thinking of hiring a CEO), and he shared with me one interview tactic that has always stuck with me…Only hire people visibly enthused about your business! If they aren’t excited about your business during your interview, they aren’t going to be after they join your organization. You want to build a team of different makers who have something to prove, and not a bunch of people going through the motions like your startup is just a job for them. - The Best Growth Companies Are Built by Companies Who Create a Culture of Professional Development

It is imperative to find ways to invest in your own professional growth and your employees’ professional growth. Your business is going to scale fast and the skills required by your team will also need to grow fast. The best growth companies which have the happiest employees invest in their own team’s professional development. - Make Sure You & Other Hiring Managers Always Hire People Better at Their Job Than the Person They Are Replacing

Don’t be intimidated by smart, hardworking people who can do a job better than you and definitely don’t let your hiring managers either. The best managers build the strongest teams by always finding people better than the job they are hired for then they could do themselves.

- Find Ways to Share Credit Where Credit is Due

As your company starts winning the race, media and others will associate your company’s success with you as the founder because you are very visible. Make sure you give proper credit to those who were a part of your early family. This is likely the most tight knit family you’ll ever experience, so compensate (highly recommend stock option plan) them fairly and provide recognition to them whenever you can.For me, those early contributors were-- Aaron Weber- Co-founder who was instrumental during those first 7 years leading operations but because he left early, got left out of the origin story most times in later years.

- Debby Manthei- In addition to running Marketing, she also took care of bookkeeping and gave us a reality check when we needed it most.

- Kyle Ohme- Our first head of IT who would have made MacGyver feel inadequate in putting things together.

- Patrick Carlson- Our first sales hire who showed others in our team how to build strong professional relationships outside of our four walls.

- Ting Huang- Our first head of architecture

- Joel Dahlin- One of our first developers who helped our team come together as a family by being a great listener and creating a fun work environment.

- Akash Sen- Our first head of HR who had the very challenging job of leading the human side of a startup with average employee age of about 25.

And many others who know who they are.

I will forever be indebted to all of you.

- Give Back Pledge

Strongly consider adopting Founder’s Pledge, or something similar, to help support the charities you believe in as startups need strong communities to flourish. When you are uber-successful, you’ll start to realize you can’t bring all that money with you when you die and you’ll start to realize your own mortality more. Make it known early that you care about the community, however you define community and build a legacy, not just a pile of cash. Pay it forward. It is easier to do when your stock is worth $0 then when you hit the jackpot.

~Rob Weber

Author: Rob Weber

Most colleges and universities are finding it very challenging to cultivate strong startup communities like those found at leading institutions like Stanford and Yale. But if we take a deeper look at these leading institutions, and how others are responding to this challenge, we can build a repeatable model to support the the rise of the rest.

Certainly one component to developing a strong collegiate startup culture is having a strong curriculum, jam packed with not just theory but applied learning activities which enable students to develop skills required for jobs in today’s workforce. A good example of this occurred two years ago with the creation of a Software Engineering Degree at St. Cloud StateUniversity. Many engineering programs have become dated in our region but SCSU’s Science and Engineering leadership are meeting regularly with industry leaders to identify the practical needs of employers and then developing new degrees in support of satisfying them.

Many companies are looking for strong software engineers. SCSU has long offered an ABET-accredited Computer Science Degree that is strong on fundamentals like Database, Computer Architecture and Operating Systems. Started in 2015, they offer a Software Engineering Degree which adds required courses on the Software Development Process. In addition they are also offering electives in Mobile Development, and Gaming and Visualization (useful for 3D software such as VR/AR programming).

Additionally, four years ago, SCSU opened a brand new 100,000 square foot ISELF facility where students can work with industry leaders on projects utilizing cutting edge technology like VR/AR, Robotics, Nanotech, 3D printers, etc. The vast majority of students today in Computer Science programs would rather be learning coding skills to build useful enterprise or consumer software instead of spending their college years learning how to build infrastructure they are not interested in building.

The ISELF building is not just a place for engineering SCSU students to gather either. The new facility is being utilized by students across a variety of fields from business to liberal arts in support of experiential learning. Let’s face it, many software engineers don’t make the most aesthetically pleasing software! It may go well beyond SCSU’s campus too. Recently, we held a meeting between SCSU and CSBSJU’s Director for Entrepreneurship, Margrette Newhouse, and both groups of academic leaders expressed an interest in teaming up to get more student-led businesses from CSBSJU to work collaboratively with SCSU’s experiential learning offering.

It has become table stakes for a university to invest in equipping labs with cutting edge, disruptive technology to give students access to equipment that they otherwise won’t have access to. Some of America’s greatest startup stories involved young founders taking full advantage of their school’s resources. Take the story of Google and how their founders waited at loading docks at Stanford for new computers to come so they could increase their network and computing capacity. It isn’t 2000 anymore and students still need access to an even greater number of tools. Ideally, universities should invest in labs that provide access to breakthrough AR/VR technology, robotics, drones, etc.

One often overlooked and easily corrected way to supercharge your university’s startup community is to encourage it to focus its investing activity on regional venture funds that align with the university’s mission, as pointed in Tim Schigel of Refinery Ventures recent post. In Tim’s post, he shares insights as to how universities like Yale are generating outsized returns for their endowment than they would otherwise get in the stock market by investing in venture funds which align with their school’s regional impact mission.

Today, most universities investing in the venture capital asset class send all of their funds outside of their region. This far-away distribution of venture capital creates a vicious cycle where the universities in other regions end up dramatically outperforming them, which causes the original university to be less competitive. If there are no venture funds in your region, universities should consider adopting a policy to take small amounts of their capital and deploy it to first-time fund managers who align with a regional investing strategy.

Startup competitions like the Minnesota Cup organized by the University of Minnesota bring awareness to many startups that otherwise would fly under the radar. Beautiful things happens when you bring awareness to startups in your region. The entrepreneurial community will start to rally behind them, bringing with them valuable business contacts, advice, capital, and more to ensure their success.

And then there is that all so important issue of connecting top employment opportunities to the most talented graduating students. The best startup communities provide organized apprentice programs such as Xtern by TechPoint in Indianapolis. Apprentice programs are critical to the success of new graduates so they can learn applied skills required for these new high demand jobs.

Finally, the university needs to identify regional founders who can lead this charge and support them with a bottom up approach by spreading the word throughout various student groups across different disciplines. Top down approaches don’t work. Entrepreneurs are best led by entrepreneurs as Brad Feld describes in his book Startup Communities.

April Newsletter

June Newsletter

Demystifying Startup HR

Head of Finance & Fund Administration- Venture Capital Firm (Remote)

Demystifying Startup HR

3 Portfolio Companies Make Inc. 5000 + Quicklly & Instacart Expand

iraLogix closes $22M + Branch expands with Uber

iraLogix closes $22M Series C

Flywheel lands Gates Foundation grant

Venture Capital Analyst

Orazio Buzza, Founder and CEO of Fooda – on Episode 13, “Execution is King”

$40M Fund II Raised!

Eric Martell, Founder of Pear Commerce: Episode 13, Execution is King

Great North Ventures Raises $40 Million Fund II

Investment Thesis: Fund II Strategy

Investment Theme: Community-Driven Applications

Investment Theme: Digital Transformation Through AI

Investment Theme: Solving Labor Problems

Trends in the Gig Economy + Work in the Metaverse

Portfolio raises $125M + talking fundraising with Branch CEO

Omnia Fishing closes $4M round, joins Great North portfolio!

Atif Siddiqi, Founder/CEO of Branch: Episode 11, Execution is King

Michael Martocci, CEO and Founder of SwagUp: Episode 10, Execution is King

Yardstik new to portfolio, closes $8M Series A

First venture studio startup comes out of stealth!

Insights for founders from a data guru, + FactoryFix raises a Series A!

Una Fox: Episode 9, Execution is King

Start With a Mobile App, Not a Website

2ndKitchen acquired by SoftBank-backed REEF + advice from an early Googler

Joe Sriver, 4giving: Episode 8, Execution is King

2ndKitchen Acquired by REEF

Venture studio startup jobs + advice for founders from founders

Best Advice from the Great North Annual Event: Episode 7, Execution is King

Newsletter: Do you fit our investing themes?

Jonathan Treble, PrintWithMe: Episode 6, Execution is King

Anna Mason, Revolution: Episode 5, Execution is King

Mynul Khan, FieldNation: Episode 4, Execution is King

Nick Moran, New Stack Ventures: Episode 3, Execution is King

Molly Pyle, Center on Rural Innovation (CORI): Episode 2, Execution is King

Justin Kaufenberg, Rally Ventures: Execution is King Episode 1

Newsletter: “Podcast Launched: Execution is King!”

“Execution is King” – the Great North Ventures Podcast

Newsletter: Fund II is open for business!

Unlocking the Potential of Anonymized Commercial Real Estate (CRE) Data

Fund II is open for Business!

Mike Schulte Promoted to Venture Partner

New Name + New Venture Studio

Great North Launches Startup Studio

We Don’t Need No [full-time MBA] Education

How the University of Minnesota is Embracing Startup Culture

Top Stories of 2020, iraLogix, and LaunchMN Calls for Mentors

Building Capacity for Innovation

Seizing Opportunity in a Recession, Allergy Amulet, and Twin Cities Startup Week

Recessionary times, a record-setting IPO, and Minnesota’s Resilient Startups

Minnesota's Resilient Startups

July 4th, Equitable American Dream-ing, and Robots Diagnosing COVID

Jumpstart, the Startup School, and Branch Wins a Webby!

COVID-19 Trends, the Great North response, and our Founders Survey

Giving in the Time of Coronavirus

COVID-19 Resources for Startups, State-by-State

COVID-19, the CARES Act, and startups stepping up

New Business Preservation Act

Digital Future Boardroom, PartySlate, and The Lean Startup School

Great North Labs’s Startup Summit 2020

Great North Labs's Startup Summit 2020

World Economic Forum, NoiseAware, and the Startup School reboot

Great North Labs at the World Economic Forum 2020 in Davos

Top 5 Stories of 2019

Taking the Founders Pledge, Inhabitr, and gBETA Pitch Night

Founders Pledge: Support the Organizations that Support You

BETA Showcase, Greater MN, and Launch MN comes to St. Cloud

7 Places to Spot Us at Startup Week

The Greater MN Meetup, Parallax, and Exponential Medicine

Greater MN at the big show, Neela Mollgaard heads Launch MN, and Misty’s roadtrip.

Talking VC, tech kids, and Forge North’s Horizon

June: Great North Labs’s first fund raised!

May: Innovation Ecosystems, SingularityU Kickoff, and PrintWithMe

April: Minnebar Recap, ZenLord Pro, and Supporting Entrepreneurs

MinneBar 14 Recap

Dispatch and 2ndKitchen claim Tech Madness titles

Minnesota Innovation Collaborative

March: Minnebar, Hockey + Hustlers, and Innovation Workshops

Great North Labs at CES

Dec.-Jan.: Top Posts from 2018, pepr, Glowe, and Misty Robotics

Carried Interest: Top Posts from 2018

Oct.-Nov.: Singularity University, Exponential Tech, and the State of Innovation

Digital Transformation Summit, July 25th in Minneapolis

June: Silicon Lakes, FactoryFix, and the Digital Transformation Summit

Putting the “Silicon” in Silicon Lakes

Digital Manufacturing and Logistics

May: Team Genius, IoT, and the Future of Everything

IoT 3.0

Healthcare Innovation

March: Exponential Tech, the “Goldilocks Zone”, and Minnebar 13

February: Team Expansion, Dispatch, and Startup School Events

Great North Labs Newsletter – December 2017

A Letter To My Younger Self

Great North Labs Newsletter

Great North Labs Featured on Tech.mn

Great North Labs Featured in St Cloud Times

Great North Labs – Featured on BizJournals.com