We are thrilled to announce that our portfolio company, Micruity, has successfully closed a $5 million funding round. This latest funding round was led by industry giants Prudential, TIAA, and State Street, with additional support from Pacific Life and Western & Southern Financial Group. This $5 million investment underscores the confidence these major players have in Micruity’s mission and technological capabilities. We first invested in Micruity in January 2022.

About Micruity

Micruity is at the forefront of developing scalable retirement income solutions. Their platform, the Micruity Advanced Routing System (MARS), creates a seamless data flow across the defined contribution plan ecosystem, breaking down traditional barriers within the financial services industry. By fostering an open architecture, Micruity enables better integration of income planning features into 401(k)s, 403(b)s, and other retirement plans.

Looking Ahead

“The new funding enables Micruity to rapidly build out infrastructure not just for retirees in the drawdown phase of their retirement journey but also provide critical support for younger Americans still saving for retirement. Successive financial crises have eroded the retirement savings of many Americans who now face the prospect of outliving their savings. By building the infrastructure necessary to enhance the user experience of both guaranteed and non-guaranteed income products, Micruity, along with our partners, can help close this gap and deliver a safe and secure retirement.” – Trevor Gary, Founder and CEO of Micruity.

We are proud to support Micruity as they continue to innovate and transform the retirement landscape. Stay tuned for more updates on their journey and the exciting developments ahead.

For more information on Micruity’s transformative approach to retirement income, visit Micruity.

The Q1 2024 NVCA-Pitchbook Venture Monitor reveals activity levels similar to those in Q1 2023. Investors have already poured $36.6 billion into 3,925 deals. Although 38% of venture capitalists withdrew from deal-making in 2023, they still control over $300 billion in uninvested funds. This situation creates an intriguing dynamic with abundant capital but few investments.

What does this mean for startups?

While deal counts have remained consistent, the median pre-money valuation for funded startups slightly increased in Q1 2024. This shows that quality companies are still getting funded. What does “quality” mean in this funding environment? Venture capitalists now advise startups to prioritize profitability over the traditional growth-at-all-costs strategy.

The “Goal Posts” Have Moved

In 2021, the market saw a surge in investments where startups were funded at high valuations despite having relatively low key performance indicators (KPIs). The period has been followed by a correction, where the multiples for valuations have dropped. As a result, startups now face more stringent requirements to attract investors. To secure funding in this new era, companies must demonstrate stronger KPIs, showcasing solid traction, revenue growth, and sustainable business models.

Conclusion

This shift encourages a more disciplined approach to growth, where startups are not just chasing valuation but are building long-term value. I am optimistic about funding levels as startups and VCs respond to the correction in the market.

Source: NVCA-Pitchbook Venture Monitor

Stay up to date with Great North Ventures here!

What’s New

Capital-efficient startups often emerge in regions that venture capital has historically overlooked. These startups must achieve more with less to grow, making them perfectly suited for the current economic environment. We recently invested in two such companies: HLRBO in the Midwest and Mangxo in Latin America.

Great North Ventures led a $1M Seed round along with partners Comeback Capital, Gopher Angels & others into Brainerd, MN-based HLRBO. HLRBO helps landowners lease their land to hunters. Founder & CEO Heath Schubert & team have done an incredible job developing and growing HLRBO to date. Rob will be joining the board along with Jeff Peterson.

Great North Ventures has invested in Mangxo, a company set to revolutionize the way construction material suppliers extend credit terms to subcontractors in Latin America

Fund and Portfolio News

WithMe

WithMe, Inc. Appoints Jeff Lail Chief Operations Officer. With a two-decade career in the consumer services industry, Lail brings a proven track record of operational excellence to WithMe.

Nested Knowledge

Navidence and Nested Knowledge Partner to Standardize Real World Evidence Computable Operational Definitions

Yardstik

The employment screening tech startup has signed a multi-year lease for a sixth-floor office in the 100 Washington Square building.

Great North Ventures in the Community

Past and Future Events attended by GNV

- April MN Founders Happy Hour – Hosted by Ramsey Shaffer – April 17

- MinneAnalytics Startup Showcase – April 19

- e-Fest® – Home of The Schulze Entrepreneurship Challenge – April 20

- Minnebar 18 – Hosted by Minnestar – April 20

- Rally Ventures Annual Meeting – Palo Alto – April 30

- Angel Fest – Hosted by Groove Capital – May 2

- Code Launch Minneapolis – Hosted by CodeLaunch Accelerator – May 9

- Entrepreneurs’ Rally XII – Hosted by Entrepreneurs’ Organization – Minnesota – May 9

- Spring 2024 BETA Showcase – Hosted by BETA – May 15

- UWT 2024 – Hosted by United We Transform – May 21

- Enterprise Rising – Hosted by Casey Allen – May 22

Content on Execution

- WithMe: A Startup Growth Story Fueled by Profits

- This Week in Startups: Tomasz Tunguz and David Clark on how to invest in AI and Q1 2024 startup valuations | E1930

April Newsletter

June Newsletter

Demystifying Startup HR

Head of Finance & Fund Administration- Venture Capital Firm (Remote)

Demystifying Startup HR

3 Portfolio Companies Make Inc. 5000 + Quicklly & Instacart Expand

iraLogix closes $22M + Branch expands with Uber

iraLogix closes $22M Series C

Flywheel lands Gates Foundation grant

Venture Capital Analyst

Orazio Buzza, Founder and CEO of Fooda – on Episode 13, “Execution is King”

$40M Fund II Raised!

Eric Martell, Founder of Pear Commerce: Episode 13, Execution is King

Great North Ventures Raises $40 Million Fund II

Investment Thesis: Fund II Strategy

Investment Theme: Community-Driven Applications

Investment Theme: Digital Transformation Through AI

Investment Theme: Solving Labor Problems

Trends in the Gig Economy + Work in the Metaverse

Portfolio raises $125M + talking fundraising with Branch CEO

Omnia Fishing closes $4M round, joins Great North portfolio!

Atif Siddiqi, Founder/CEO of Branch: Episode 11, Execution is King

Michael Martocci, CEO and Founder of SwagUp: Episode 10, Execution is King

Yardstik new to portfolio, closes $8M Series A

First venture studio startup comes out of stealth!

Insights for founders from a data guru, + FactoryFix raises a Series A!

Una Fox: Episode 9, Execution is King

Start With a Mobile App, Not a Website

2ndKitchen acquired by SoftBank-backed REEF + advice from an early Googler

Joe Sriver, 4giving: Episode 8, Execution is King

2ndKitchen Acquired by REEF

Venture studio startup jobs + advice for founders from founders

Best Advice from the Great North Annual Event: Episode 7, Execution is King

Newsletter: Do you fit our investing themes?

Jonathan Treble, PrintWithMe: Episode 6, Execution is King

Anna Mason, Revolution: Episode 5, Execution is King

Mynul Khan, FieldNation: Episode 4, Execution is King

Nick Moran, New Stack Ventures: Episode 3, Execution is King

Molly Pyle, Center on Rural Innovation (CORI): Episode 2, Execution is King

Justin Kaufenberg, Rally Ventures: Execution is King Episode 1

Newsletter: “Podcast Launched: Execution is King!”

“Execution is King” – the Great North Ventures Podcast

Newsletter: Fund II is open for business!

Unlocking the Potential of Anonymized Commercial Real Estate (CRE) Data

Fund II is open for Business!

Mike Schulte Promoted to Venture Partner

New Name + New Venture Studio

Great North Launches Startup Studio

We Don’t Need No [full-time MBA] Education

How the University of Minnesota is Embracing Startup Culture

Top Stories of 2020, iraLogix, and LaunchMN Calls for Mentors

Building Capacity for Innovation

Seizing Opportunity in a Recession, Allergy Amulet, and Twin Cities Startup Week

Recessionary times, a record-setting IPO, and Minnesota’s Resilient Startups

Minnesota's Resilient Startups

July 4th, Equitable American Dream-ing, and Robots Diagnosing COVID

Jumpstart, the Startup School, and Branch Wins a Webby!

COVID-19 Trends, the Great North response, and our Founders Survey

Giving in the Time of Coronavirus

COVID-19 Resources for Startups, State-by-State

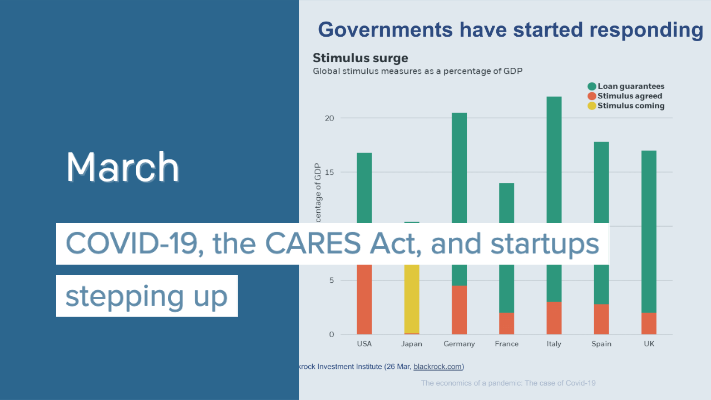

COVID-19, the CARES Act, and startups stepping up

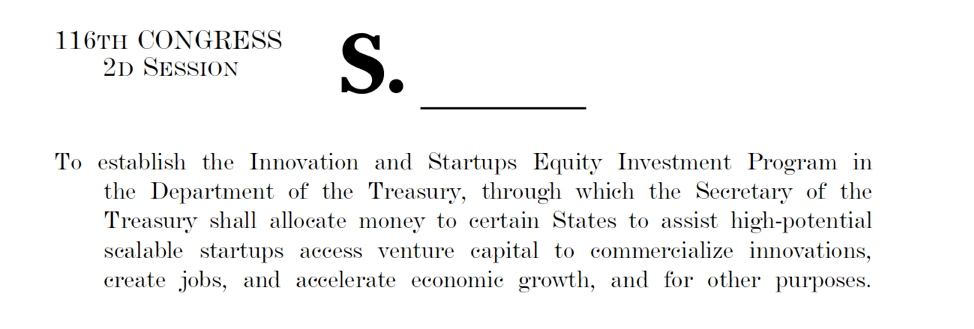

New Business Preservation Act

Digital Future Boardroom, PartySlate, and The Lean Startup School

Great North Labs’s Startup Summit 2020

Great North Labs's Startup Summit 2020

World Economic Forum, NoiseAware, and the Startup School reboot

Great North Labs at the World Economic Forum 2020 in Davos

Top 5 Stories of 2019

Taking the Founders Pledge, Inhabitr, and gBETA Pitch Night

Founders Pledge: Support the Organizations that Support You

BETA Showcase, Greater MN, and Launch MN comes to St. Cloud

7 Places to Spot Us at Startup Week

The Greater MN Meetup, Parallax, and Exponential Medicine

Greater MN at the big show, Neela Mollgaard heads Launch MN, and Misty’s roadtrip.

Talking VC, tech kids, and Forge North’s Horizon

June: Great North Labs’s first fund raised!

May: Innovation Ecosystems, SingularityU Kickoff, and PrintWithMe

April: Minnebar Recap, ZenLord Pro, and Supporting Entrepreneurs

MinneBar 14 Recap

Dispatch and 2ndKitchen claim Tech Madness titles

Minnesota Innovation Collaborative

March: Minnebar, Hockey + Hustlers, and Innovation Workshops

Great North Labs at CES

Dec.-Jan.: Top Posts from 2018, pepr, Glowe, and Misty Robotics

Carried Interest: Top Posts from 2018

Oct.-Nov.: Singularity University, Exponential Tech, and the State of Innovation

Digital Transformation Summit, July 25th in Minneapolis

June: Silicon Lakes, FactoryFix, and the Digital Transformation Summit

Putting the “Silicon” in Silicon Lakes

Digital Manufacturing and Logistics

May: Team Genius, IoT, and the Future of Everything

IoT 3.0

Healthcare Innovation

March: Exponential Tech, the “Goldilocks Zone”, and Minnebar 13

February: Team Expansion, Dispatch, and Startup School Events

Great North Labs Newsletter – December 2017

A Letter To My Younger Self

Great North Labs Newsletter

Great North Labs Featured on Tech.mn

Great North Labs Featured in St Cloud Times

Great North Labs – Featured on BizJournals.com