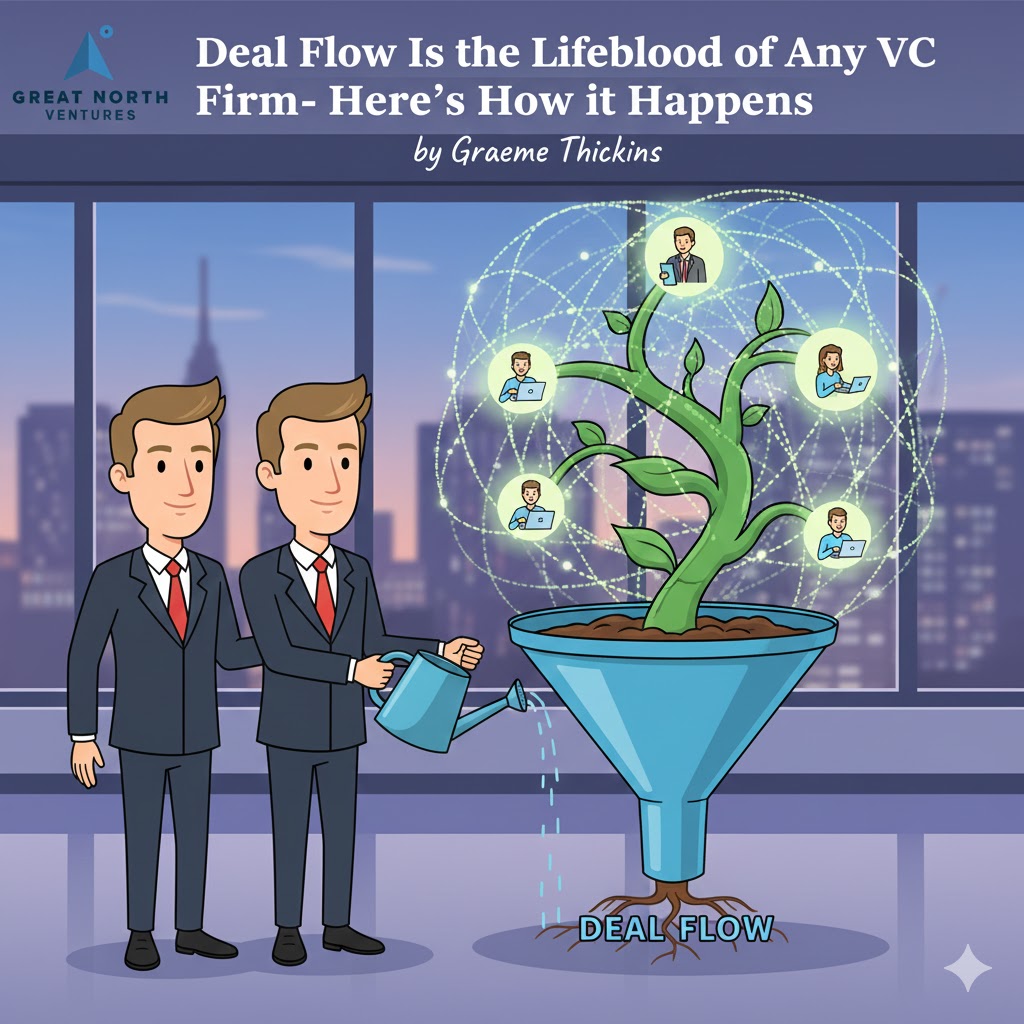

The Q1 2024 NVCA-Pitchbook Venture Monitor reveals activity levels similar to those in Q1 2023. Investors have already poured $36.6 billion into 3,925 deals. Although 38% of venture capitalists withdrew from deal-making in 2023, they still control over $300 billion in uninvested funds. This situation creates an intriguing dynamic with abundant capital but few investments.

What does this mean for startups?

While deal counts have remained consistent, the median pre-money valuation for funded startups slightly increased in Q1 2024. This shows that quality companies are still getting funded. What does “quality” mean in this funding environment? Venture capitalists now advise startups to prioritize profitability over the traditional growth-at-all-costs strategy.

The “Goal Posts” Have Moved

In 2021, the market saw a surge in investments where startups were funded at high valuations despite having relatively low key performance indicators (KPIs). The period has been followed by a correction, where the multiples for valuations have dropped. As a result, startups now face more stringent requirements to attract investors. To secure funding in this new era, companies must demonstrate stronger KPIs, showcasing solid traction, revenue growth, and sustainable business models.

Conclusion

This shift encourages a more disciplined approach to growth, where startups are not just chasing valuation but are building long-term value. I am optimistic about funding levels as startups and VCs respond to the correction in the market.

Source: NVCA-Pitchbook Venture Monitor