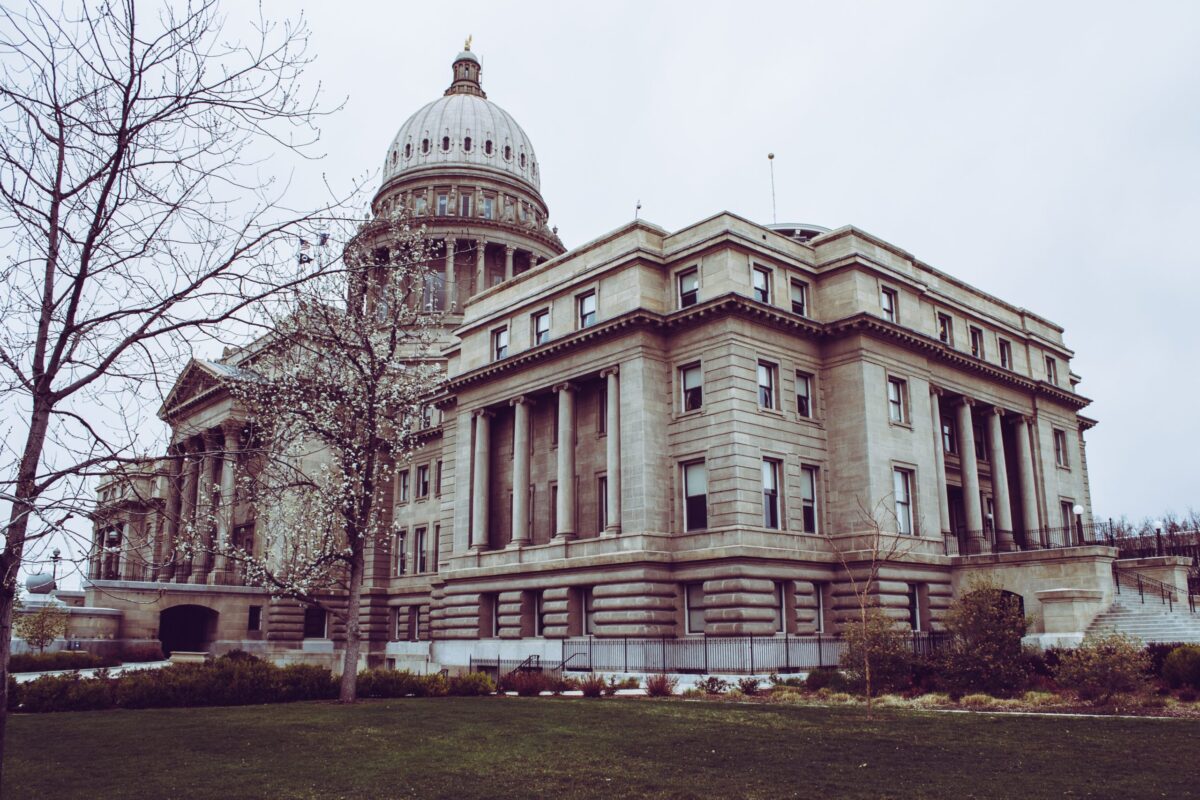

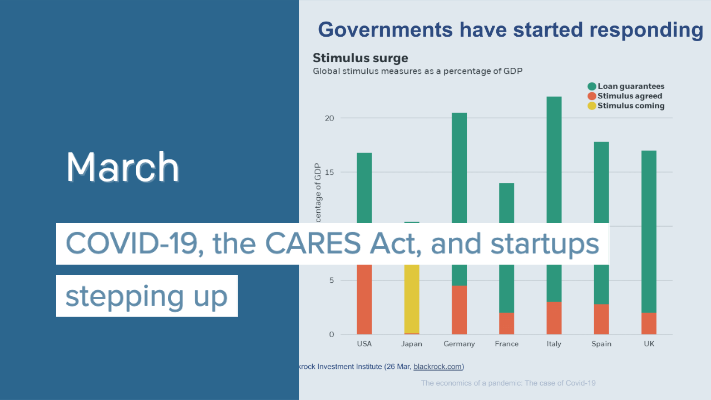

On March 19, 2020, a bill proposing the New Business Preservation Act was submitted to the Senate that seeks to drive economic activity, innovation, and job growth in the wake of the COVID-19 pandemic and the economic downturn. The New Business Preservation Act will provide equity funding for new businesses, with larger allocations directed to areas lacking in capital including the Midwest.

While the bill was important even earlier, the events of recent weeks add urgency. Dollar for dollar, it represents possibly the most effective grassroots economic stimulus for the mid-to-long term (2-10 years). Even for the immediate months ahead, it can stem job losses among venture-based businesses.

As an early-stage venture fund based in the Midwest, Great North Labs believes this legislation will drive startup activity and value creation in the undercapitalized regions of our country. Entrepreneurship is a proven, capital-efficient way to build economic value and transform regions, and adding capital to our under-capitalized region will bolster existing entrepreneurial ventures and encourage new ones.

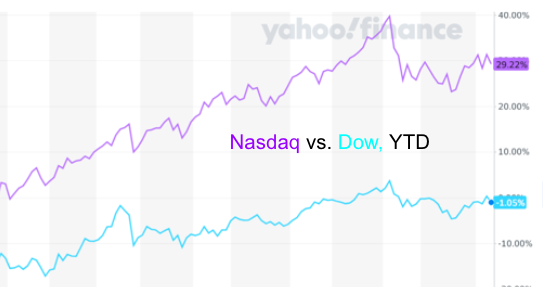

Our support of this legislation is apolitical. As investors, we see the success of this approach every day. Around the world, venture capitalists who pick talent, invest in portfolio companies, and work with their ecosystem (including government) enable grassroots wealth creation. Better than any stimulus or wealth transfer mechanism, the most powerful and durable antidote to economic inequality is new value creation. It is not the CCC or WPA creating jobs for the sake of paying people, or the government distributing wealth, this is grassroots economic growth driven by venture capital. It is not a one-time distribution. It does not depend on daily oscillations of the stock market which cannot possibly reflect true changes in economic value. Rather, it drives true economic value creation through innovation.

“Senator Klobuchar’s bill is a positive step at a critical time. As we look at how to cope with the challenges presented by the coronavirus, we should not lose sight of the critical role new businesses play in creating jobs. The New Business Preservation Act will help level the playing field, by backing entrepreneurs in every state and every zip code, and lead to a more inclusive economy.”

-Steve Case, Chairman and CEO of Revolution (Revolution operates the Rise of the Rest Seed Fund focused on investing in areas outside of traditional VC hubs.)

The Bill

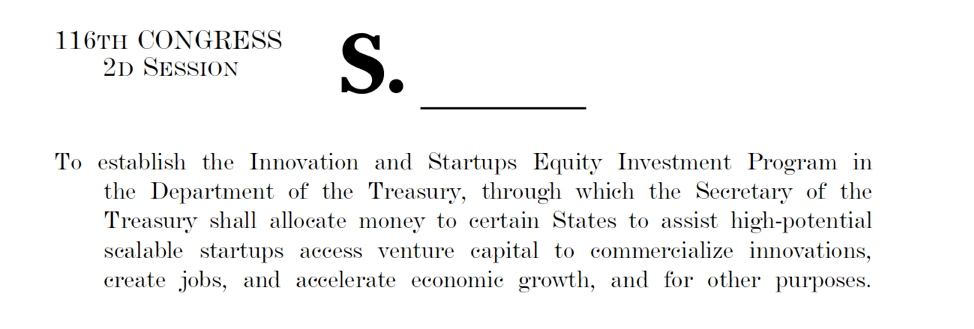

The bill was sponsored by Sen. Amy Klobuchar, and co-sponsored by Sen. Chris Coons, Sen. Angus King, and Sen. Tim Kaine. It seeks to create an Innovation and Startups Equity Investment Program (ISEI) within the Department of the Treasury. The Program will “allocate money to certain States to assist high-potential scalable startups access venture capital to commercialize innovations, create jobs, and accelerate economic growth, and for other purposes.”

The legislation calls for $2B to go to the ISEI, with $1.5B going to initial funding and administrative costs, and a further $500M for follow-on investments. Eighty percent of funds would go to the Midwest, Southeast, and Southwest, with distributions based on population and adjusted for VC money already present, according to Leigh Buchanan at Inc. magazine, and as exits produce returns, they will be “reinvested in the next generation of businesses, creating a sustainable funding resource.”

Feasibility of the approach

Investing in America’s startups by following VC leads into deals is a fiscally responsible approach. As the chart below of VC returns by vintage year shows, even in recessionary years, returns are at an acceptable level for U.S. Treasury purposes.

Startups headquartered in the under-capitalized areas targeted by the bill will likely outperform the national averages because they generally are more capital efficient due to nascent capital markets to support them. It’s not unreasonable to expect a 5%-15% IRR even in recessionary times. This is accomplished because VC is a long-term investment vehicle, which is the perfect counter to a short-term financial crisis.

Small business vs. startup vs. tech startup

While the article and press release talk about “small businesses” and “new businesses”, the bill deals strictly with startups. A “startup” is defined in the bill as a business entity that:

- Has existed less than 10 years

- Has the “intention or

potential to” do ALL of the following:

- significantly scale with respect to revenue and job creation

- develop innovative products or services

- deliver high returns on investment

- Is headquartered in a qualifying area

While there is no mention of the word “technology” in the bill, most people associate startups with tech for good reason. New technologies drive, catalyze, and enable innovations central to new business models, products, and entities. While using a new technology is not required for a startup to put together a winning formula (or to get funding from the ISEI), many of the most innovative and successful companies in the world relied on either new or novel uses to create their businesses.

These companies often require upfront equity investment in order to achieve the scale necessary with their new software or hardware technologies to become viable, high-growth companies. Unlike a services, manufacturing, or industrial business, technology startups rarely have the assets or the initial sales base to obtain traditional bank financing.

The capital gap

Currently, in many of the vast, regional economies outside of VC centers, private investments are reserved for real estate and other traditional vehicles. The need for liquidity in the innovation ecosystem is not met. Because of this, startups in the Midwest and other under-capitalized areas have to work with a capital efficiency not required in more capital-rich areas.

This lean approach can be productive in the early stages of a company’s life by helping to refine products and achieve product-market fit out of necessity. This efficiency is an advantage that Midwestern startups have over coastal startups when capital markets start to freeze up in an economic downturn.

However, once the opportunity for rapid growth and scaling arrive, large amounts of capital are necessary for a startup to reach its potential. Until recently, this meant relocating the operation to Silicon Valley, Boston, or New York. Along with the promising startups goes the jobs created, profits generated, and other ancillary economic benefits. This capital gap is where venture funds such as Drive Capital, Great North Labs, Hyde Park Venture Partners, Rally Ventures, and others that specifically focus on areas underserved by venture capital, work to provide the capital, guidance, and networks required to fuel growth and build long-term value.

June Newsletter

Demystifying Startup HR

Head of Finance & Fund Administration- Venture Capital Firm (Remote)

Demystifying Startup HR

3 Portfolio Companies Make Inc. 5000 + Quicklly & Instacart Expand

3 Portfolio Companies Ranked on The Inc. 5000 List

iraLogix closes $22M + Branch expands with Uber

iraLogix closes $22M Series C

Flywheel lands Gates Foundation grant

Venture Capital Analyst

Orazio Buzza, Founder and CEO of Fooda – on Episode 13, “Execution is King”

$40M Fund II Raised!

Eric Martell, Founder of Pear Commerce: Episode 13, Execution is King

Great North Ventures Raises $40 Million Fund II

Investment Thesis: Fund II Strategy

Investment Theme: Community-Driven Applications

Investment Theme: Digital Transformation Through AI

Investment Theme: Solving Labor Problems

Trends in the Gig Economy + Work in the Metaverse

Portfolio raises $125M + talking fundraising with Branch CEO

Omnia Fishing closes $4M round, joins Great North portfolio!

Atif Siddiqi, Founder/CEO of Branch: Episode 11, Execution is King

Michael Martocci, CEO and Founder of SwagUp: Episode 10, Execution is King

Yardstik new to portfolio, closes $8M Series A

First venture studio startup comes out of stealth!

Insights for founders from a data guru, + FactoryFix raises a Series A!

Una Fox: Episode 9, Execution is King

Start With a Mobile App, Not a Website

2ndKitchen acquired by SoftBank-backed REEF + advice from an early Googler

Joe Sriver, 4giving: Episode 8, Execution is King

2ndKitchen Acquired by REEF

Venture studio startup jobs + advice for founders from founders

Best Advice from the Great North Annual Event: Episode 7, Execution is King

Newsletter: Do you fit our investing themes?

Jonathan Treble, PrintWithMe: Episode 6, Execution is King

Anna Mason, Revolution: Episode 5, Execution is King

Mynul Khan, FieldNation: Episode 4, Execution is King

Nick Moran, New Stack Ventures: Episode 3, Execution is King

Molly Pyle, Center on Rural Innovation (CORI): Episode 2, Execution is King

Justin Kaufenberg, Rally Ventures: Execution is King Episode 1

Newsletter: “Podcast Launched: Execution is King!”

“Execution is King” – the Great North Ventures Podcast

Newsletter: Fund II is open for business!

Unlocking the Potential of Anonymized Commercial Real Estate (CRE) Data

Fund II is open for Business!

Mike Schulte Promoted to Venture Partner

New Name + New Venture Studio

Great North Launches Startup Studio

We Don’t Need No [full-time MBA] Education

How the University of Minnesota is Embracing Startup Culture

Top Stories of 2020, iraLogix, and LaunchMN Calls for Mentors

Building Capacity for Innovation

Seizing Opportunity in a Recession, Allergy Amulet, and Twin Cities Startup Week

Recessionary times, a record-setting IPO, and Minnesota’s Resilient Startups

Minnesota's Resilient Startups

July 4th, Equitable American Dream-ing, and Robots Diagnosing COVID

Jumpstart, the Startup School, and Branch Wins a Webby!

COVID-19 Trends, the Great North response, and our Founders Survey

Giving in the Time of Coronavirus

COVID-19 Resources for Startups, State-by-State

COVID-19, the CARES Act, and startups stepping up

New Business Preservation Act

Digital Future Boardroom, PartySlate, and The Lean Startup School

Great North Labs’s Startup Summit 2020

Great North Labs's Startup Summit 2020

World Economic Forum, NoiseAware, and the Startup School reboot

Great North Labs at the World Economic Forum 2020 in Davos

Top 5 Stories of 2019

Taking the Founders Pledge, Inhabitr, and gBETA Pitch Night

Founders Pledge: Support the Organizations that Support You

BETA Showcase, Greater MN, and Launch MN comes to St. Cloud

7 Places to Spot Us at Startup Week

The Greater MN Meetup, Parallax, and Exponential Medicine

Greater MN at the big show, Neela Mollgaard heads Launch MN, and Misty’s roadtrip.

Talking VC, tech kids, and Forge North’s Horizon

June: Great North Labs’s first fund raised!

May: Innovation Ecosystems, SingularityU Kickoff, and PrintWithMe

April: Minnebar Recap, ZenLord Pro, and Supporting Entrepreneurs

MinneBar 14 Recap

Dispatch and 2ndKitchen claim Tech Madness titles

Minnesota Innovation Collaborative

March: Minnebar, Hockey + Hustlers, and Innovation Workshops

Great North Labs at CES

Dec.-Jan.: Top Posts from 2018, pepr, Glowe, and Misty Robotics

Carried Interest: Top Posts from 2018

Oct.-Nov.: Singularity University, Exponential Tech, and the State of Innovation

July: Pitchly, ForwardFest, and Where to Invest in the Midwest

Digital Transformation Summit, July 25th in Minneapolis

June: Silicon Lakes, FactoryFix, and the Digital Transformation Summit

Putting the “Silicon” in Silicon Lakes

Digital Manufacturing and Logistics

May: Team Genius, IoT, and the Future of Everything

IoT 3.0

Healthcare Innovation

March: Exponential Tech, the “Goldilocks Zone”, and Minnebar 13

February: Team Expansion, Dispatch, and Startup School Events

Great North Labs Newsletter – December 2017

A Letter To My Younger Self

Great North Labs Newsletter

Great North Labs Featured on Tech.mn

Great North Labs Featured in St Cloud Times

Great North Labs – Featured on BizJournals.com